Latest News

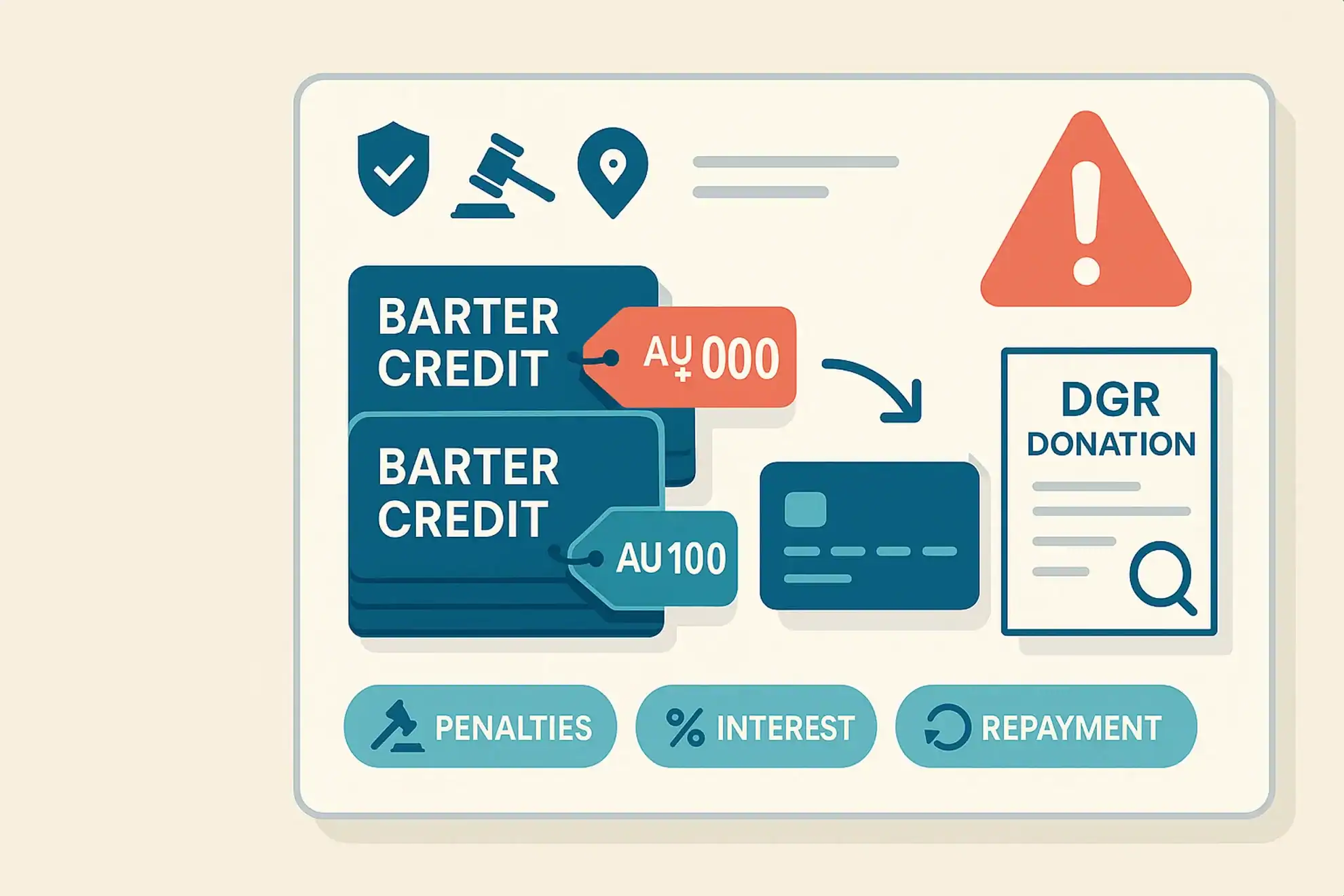

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

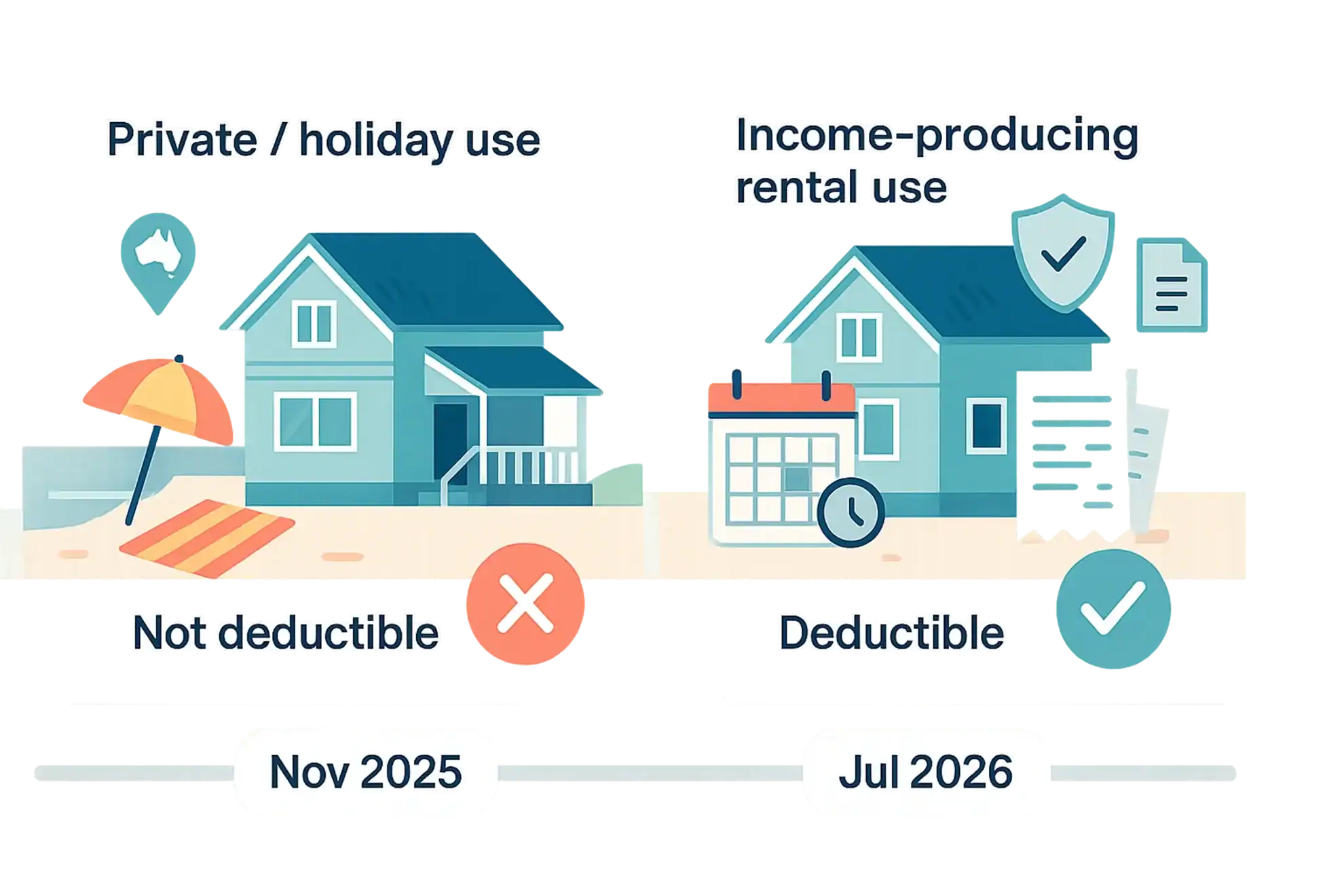

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

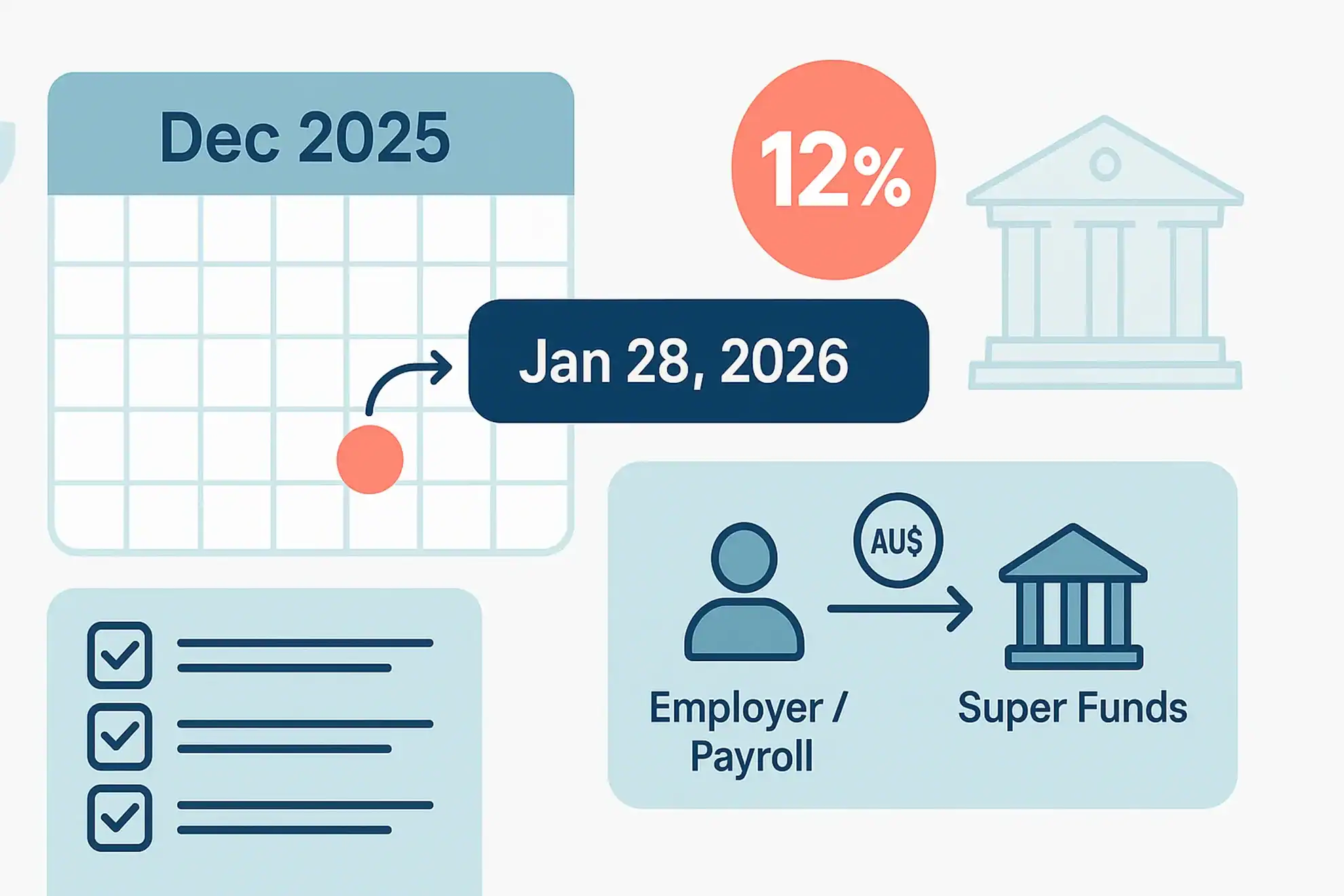

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

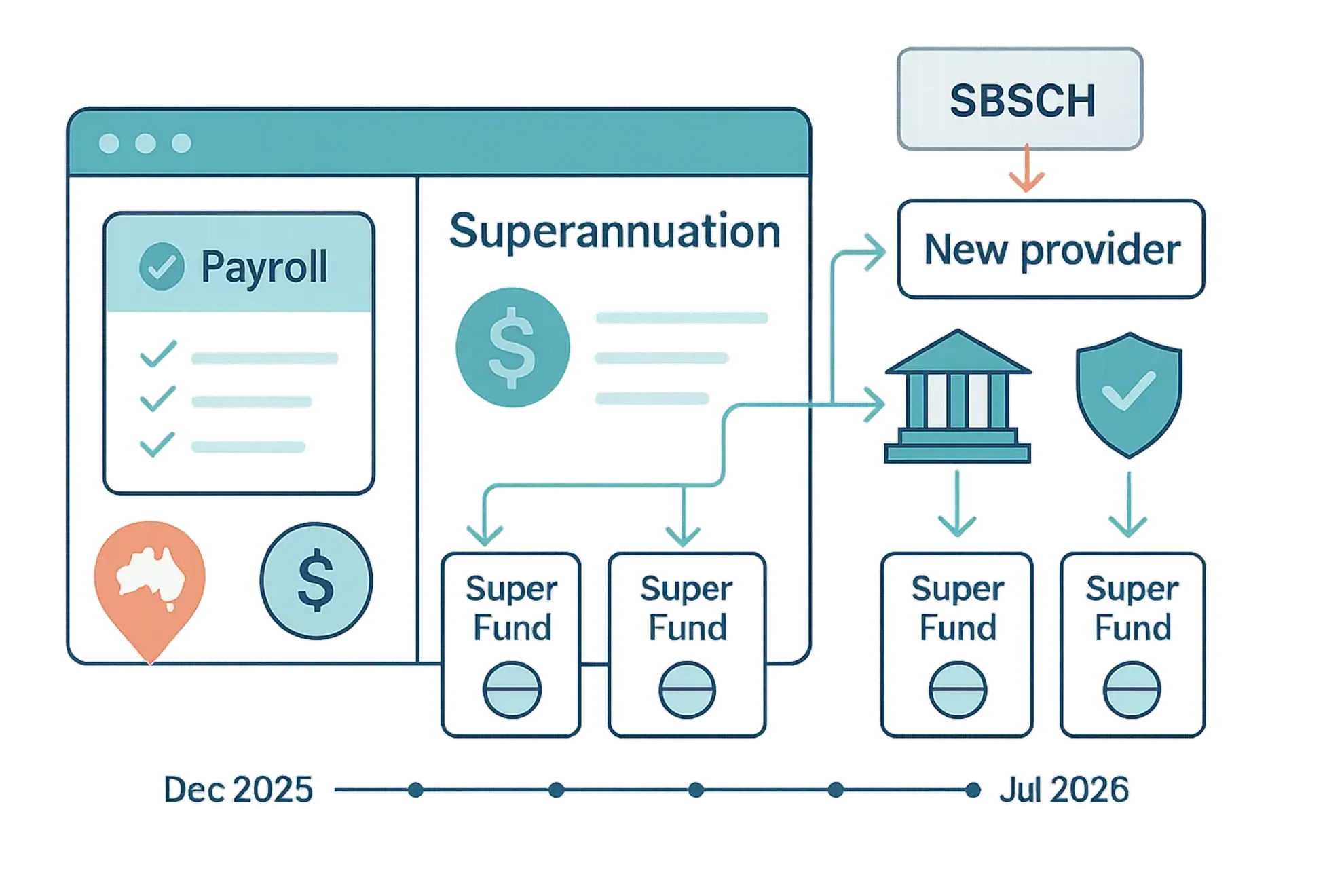

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

FBT And Cars: A Perennial Head-Scratcher

The provision of cars by employers to employees remains an issue that continues to create confusion for some business taxpayers. A not-uncommon situation is where the employer fails to identify that a car fringe benefit has been provided. This is typically found in family companies or trusts where a car bought by the business is […]

Recent Changes to the Assets Test For Pensioners

From January 1, 2017, the assets test free area and taper rate for pensions increased. The assets test works by reducing a person’s age pension payment for every dollar of assets owned over a certain value. The test takes into account most assets, including any property (except your primary home) or possessions owned, or partly owned, in […]

Controversial super change scrapped: but other proposals need to be watched.

At the time of writing, the new Parliament released the first batch of proposed changes to the superannuation regime, and among these was the announcement that the proposed $500,000 lifetime non-concessional cap is to be scrapped. These proposed changes are still in exposure draft form and may be subject to further tweaking. The government also […]

HELP Debt Changes

The Australian Government has introduced changes which mean if you have moved overseas and have a Higher Education Loan Program (HELP) or Trade Support Loan (TSL) debt, you now have the same repayment obligations as those who live in Australia. This applies if you already live or intend to move overseas for a total of […]

Planning To Retire

When you’re planning to retire you need to understand how any lump sum payments you receive from your employer might be taxed and, if you’re part of an Employee Share Scheme, consider whether the ‘good leaver’ conditions apply to you. Alternatively, if you’re selling your business, you’ll want to know whether or not the retirement […]

Records you need to keep

During the financial year you’ll receive documents that are important for doing your tax, such as payment summaries, receipts, invoices and contracts. Generally, you need to keep these for 5 years from when you lodge your tax return in case we ask you to substantiate your claims. Records you need to keep include: Payment summaries […]