Latest News

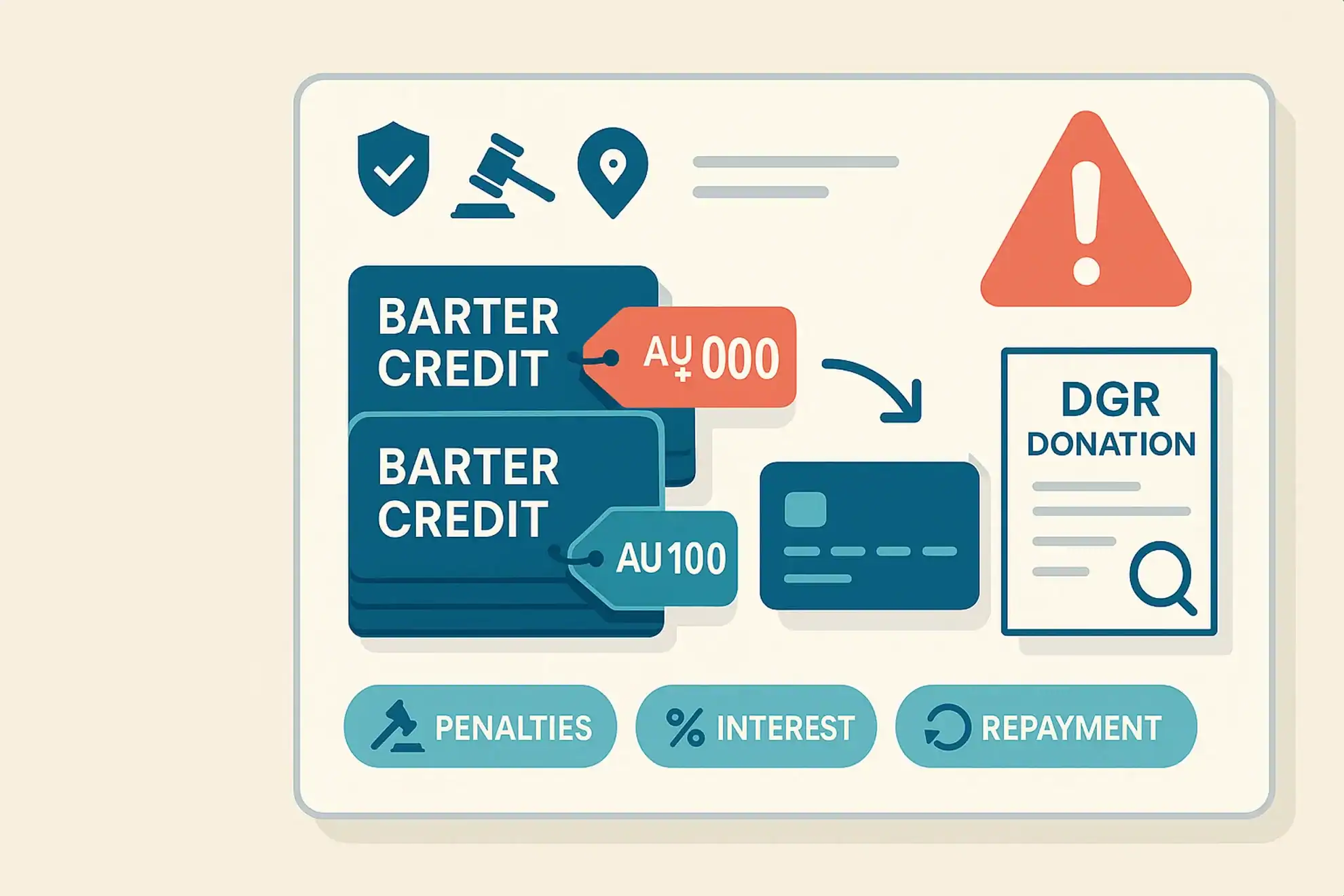

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

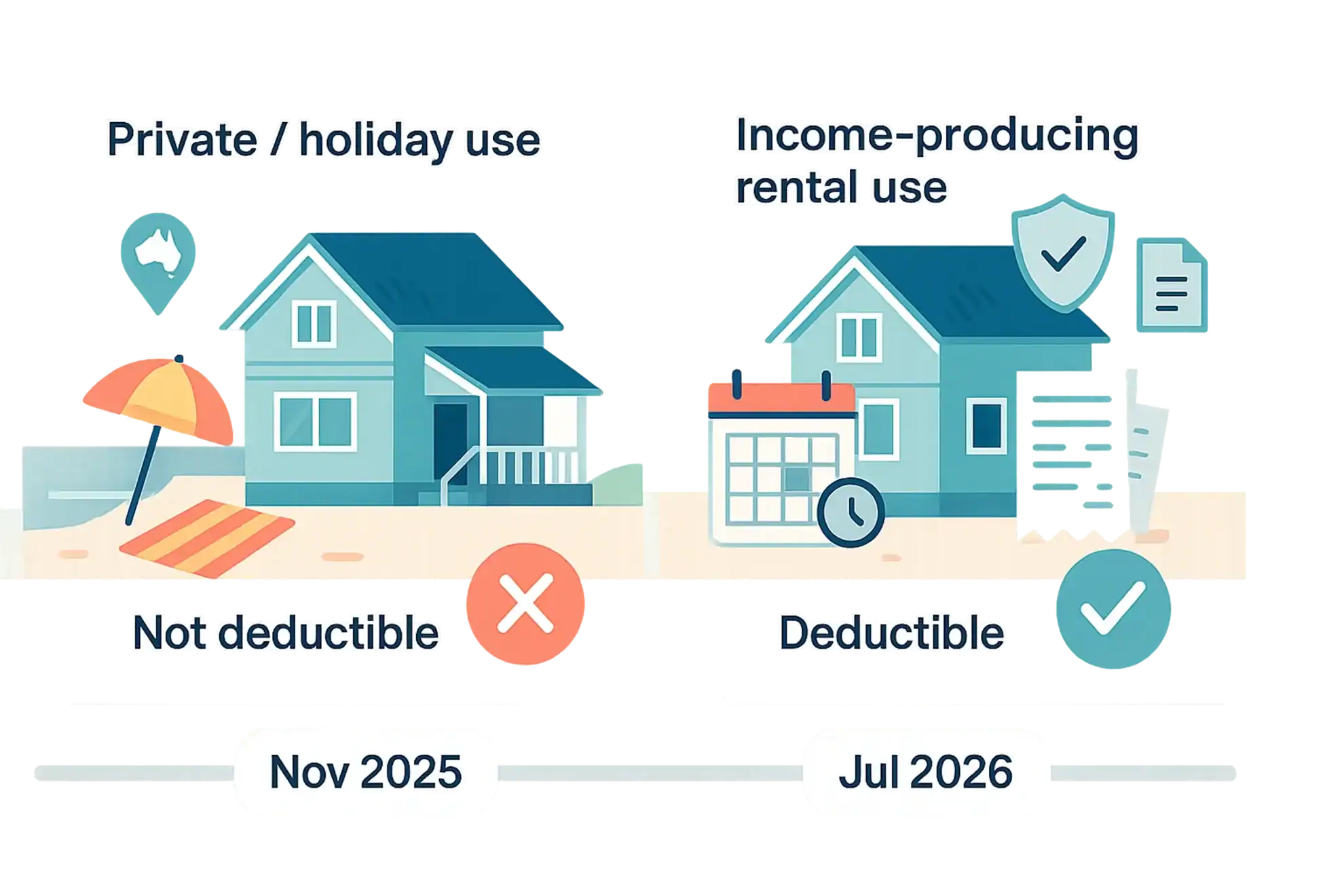

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

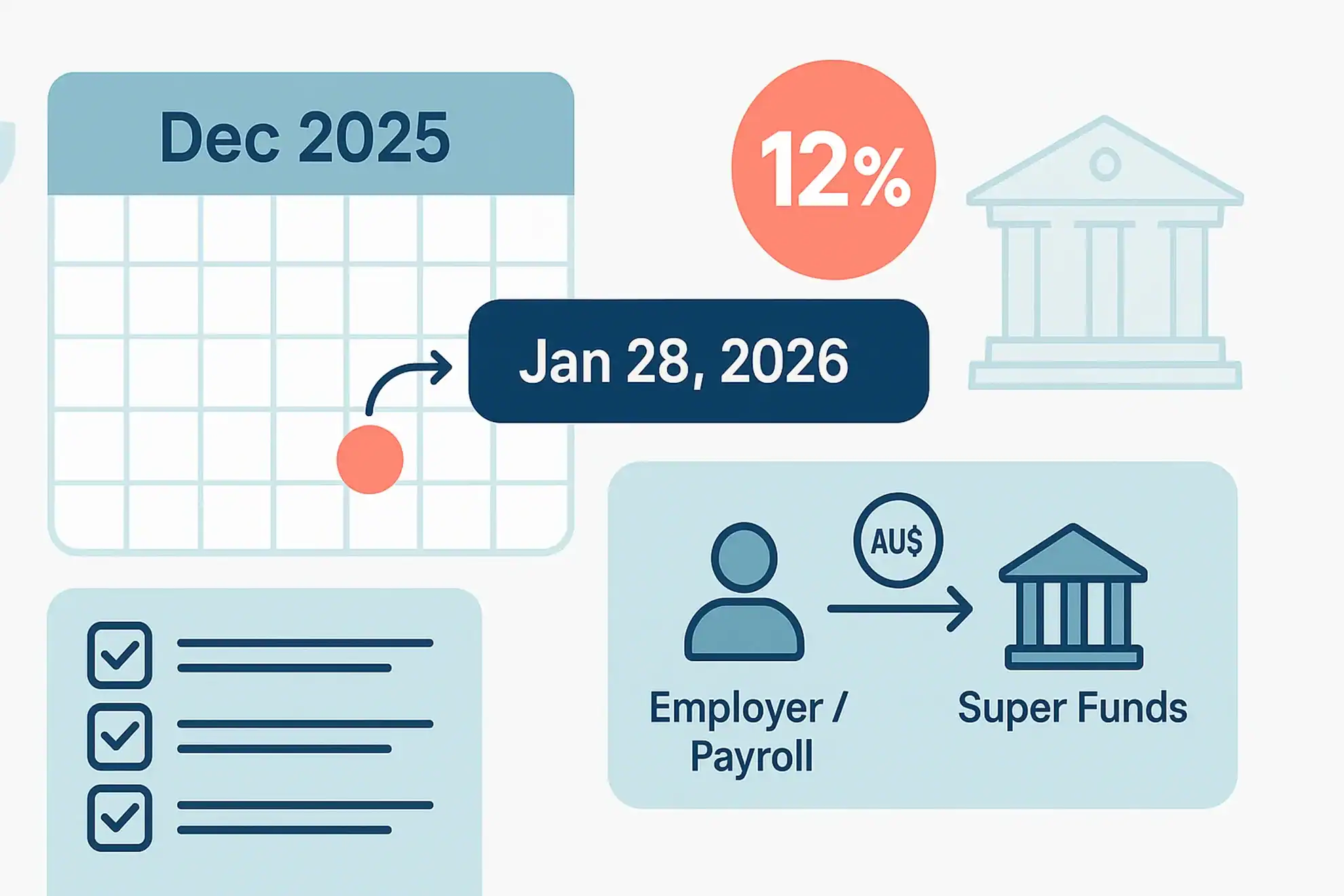

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

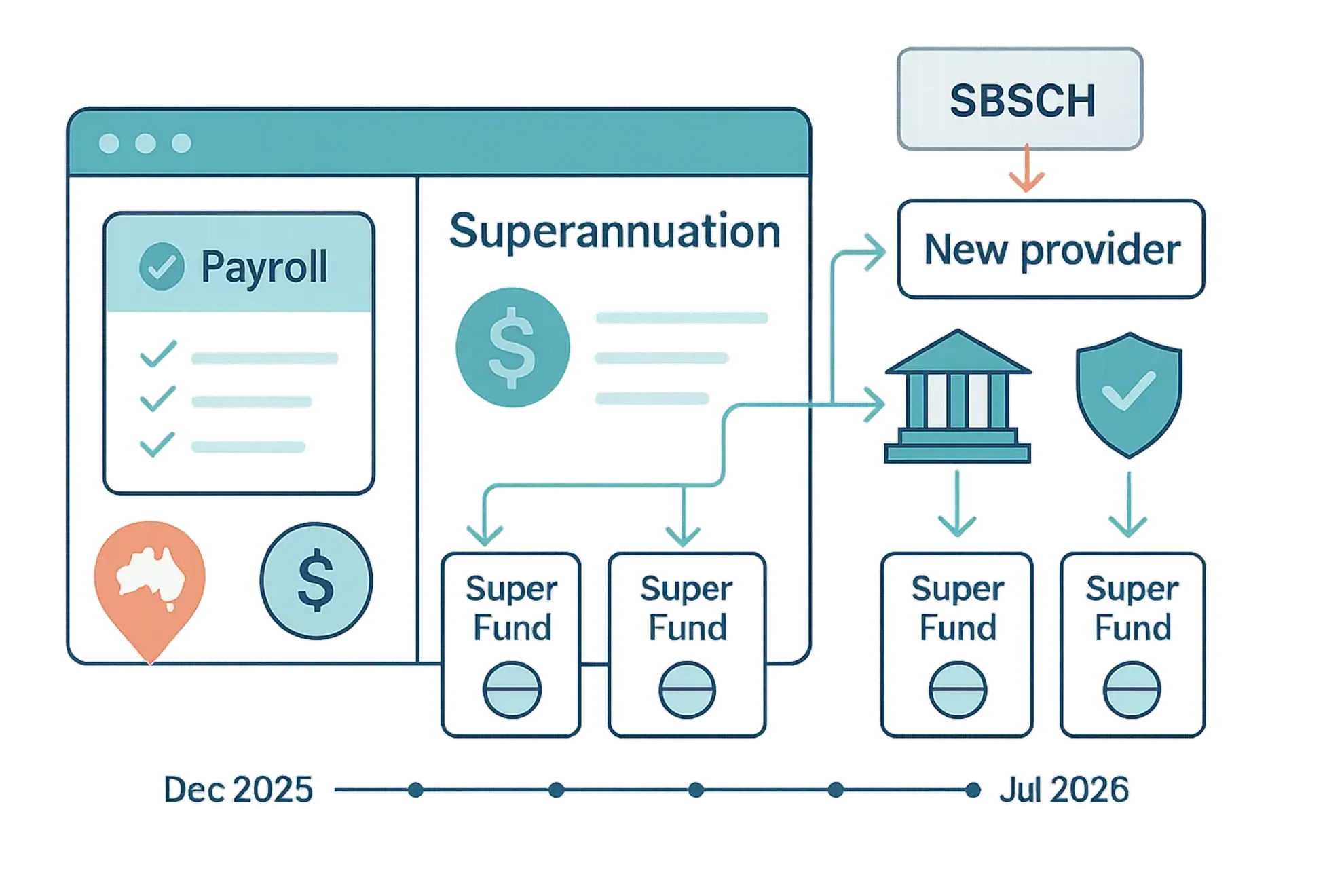

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

New Measures Applying From 1 January 2021

| | | The Government has provided an update of a number of new measures which came into effect from 1 January 2021, including (among others): The most significant changes to Australia’s insolvency framework in 30 years, which are intended to reduce costs, cut red tape and help more small businesses recover from the […]

ATO Reminder For Employers – Finalise STP Data For 2020

| | | The ATO has issued a reminder to employers who report through Single Touch Payroll (‘STP’) – which should be all employers, unless an exemption or deferral applies – that they will need to finalise payroll information for the 2020 income year by making a declaration. The due date for making finalisation […]

Steps to Successful Property Investment

Property has been considered a popular path to wealth for Australians for many years. It has the potential to generate capital growth (an increase in the value of your asset) as well as rental income. There are also tax advantages associated with negative gearing. However, when buying an investment property, it is wise to remember that you are making […]

Beware Of Scams

| | | Scamwatch is warning that scams cost Australian consumers, businesses and the economy hundreds of millions of dollars each year and cause serious emotional harm to victims and their families. Cryptocurrency scams are the most ‘popular’ type of investment scams, representing over 50% of losses. Often the initial investment amount is low (between […]

Sitting on the Fence?

Why people DO it Around 20% of Australians invest in property for: Potential capital growth Rental income Tax benefits. They tend to consider property one of the more solid, less volatile forms of investment because you can actually touch bricks and mortar. They like the feeling of getting ahead financially. They don’t want to be […]

JobMaker Hiring Credit Scheme: Claims Open From 1 February 2021

| | | The JobMaker Hiring Credit is being administered by the ATO and provides a wage subsidy payment directly to employers as an incentive to employ additional job seekers aged 16 to 35 years. Registrations for the JobMaker Hiring Credit scheme opened on 7 December 2020, and claims for the first JobMaker period […]