Latest News

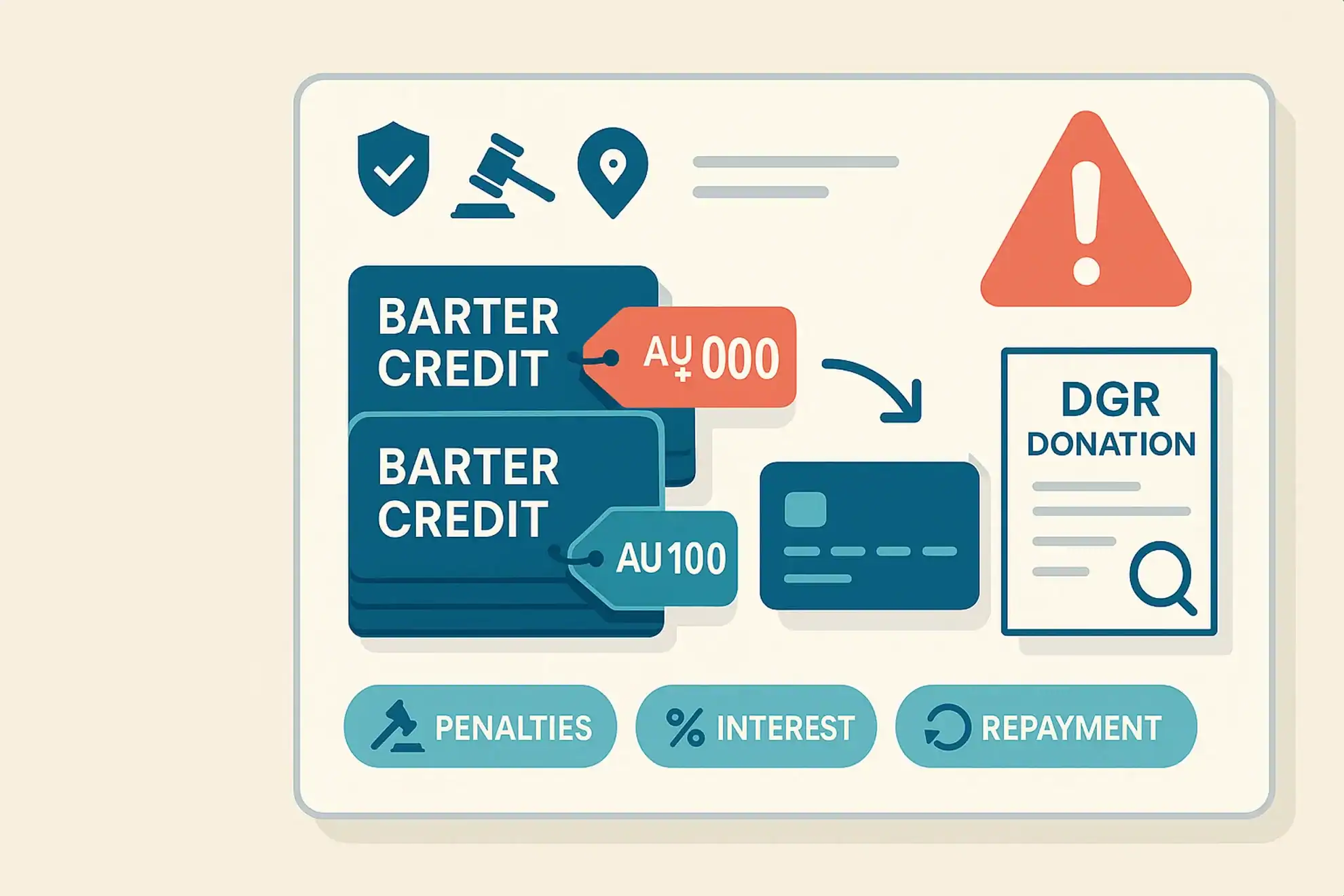

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

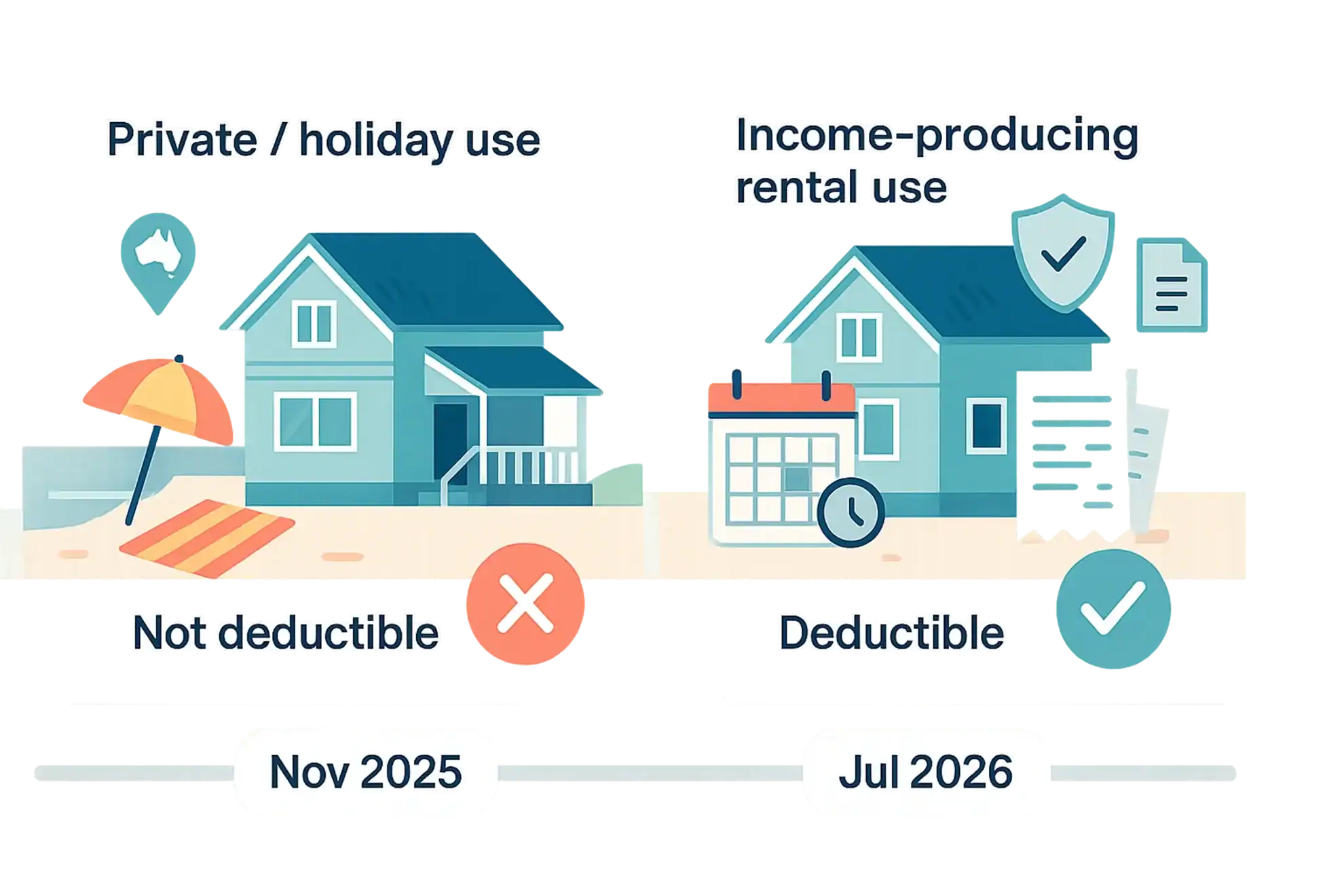

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

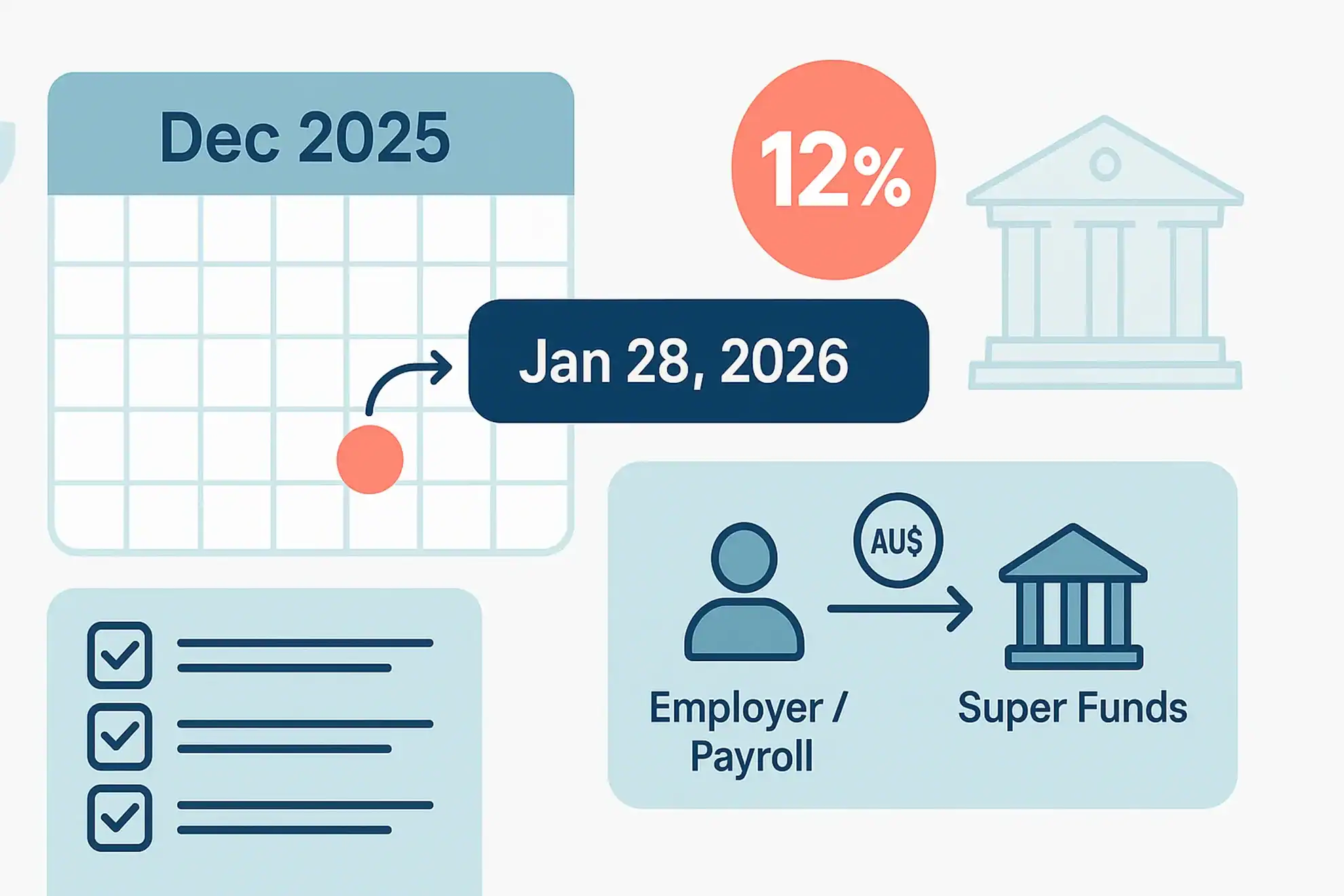

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

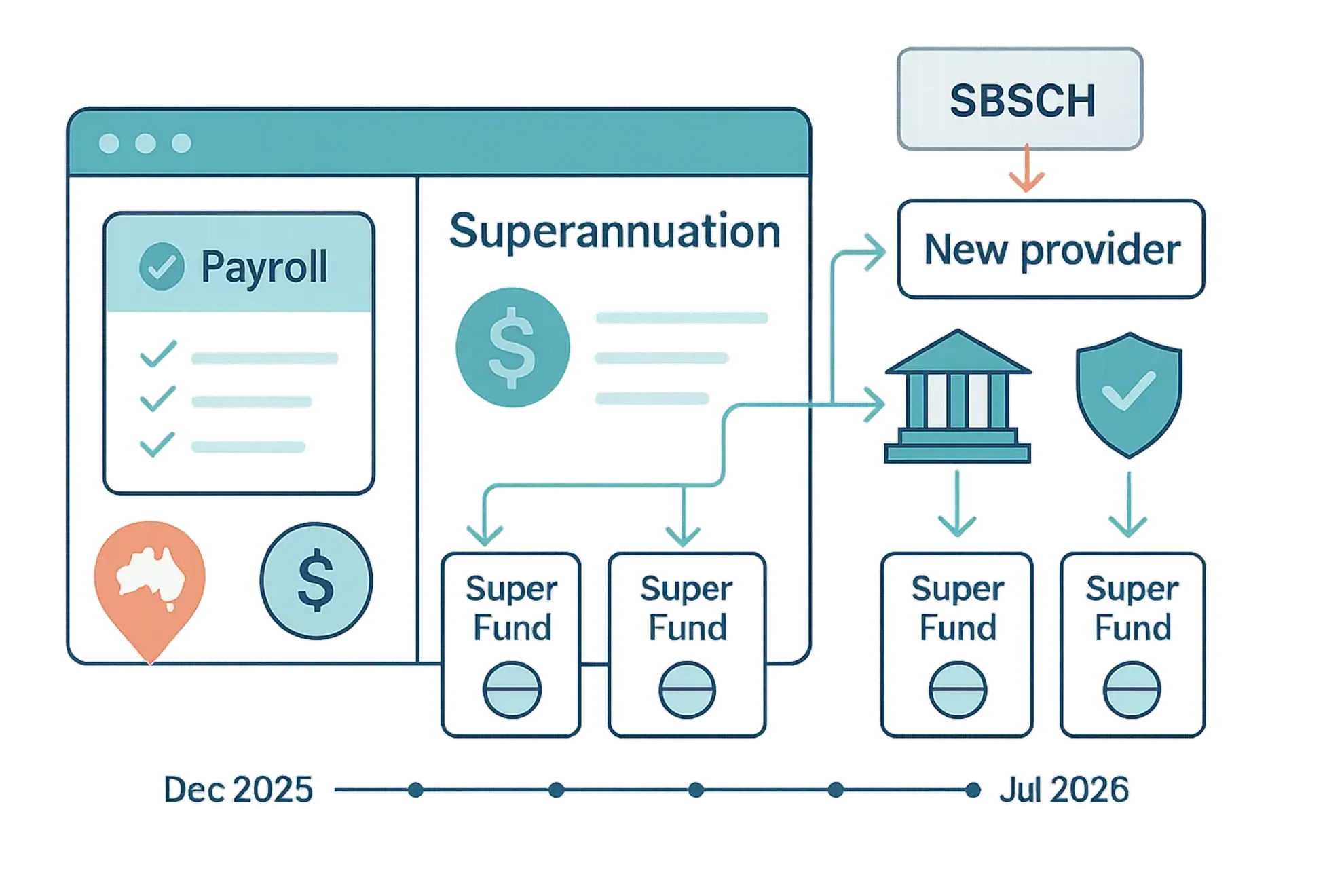

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Bitcoin: Its place in your wallet or SMSF portfolio

While bitcoin may be the most well-known cryptocurrency, there are nearly 1,500 in existence. In its simplest form, a cryptocurrency is a “peer-to-peer electronic cash system”, which means that the currency is not in a physical form like cash but sits in an electronic register. What makes bitcoin work, where previous attempts at electronic cash […]

SMSF Commutation Requests – How to get the green light from the ATO

The ATO has issued guidance on its approach to commutation requests, which is an essential piece of information for SMSF trustees because it explains which commutation requests will not be subject to an ATO review. With recently introduced superannuation rules now in effect (from 1 July 2017), superannuation members with income streams that are valued […]

Dealing With Tax and Renting Via Airbnb

Airbnb is one of many examples of the “sharing economy” — connecting buyers (users) and sellers (providers) through a facilitator that usually operates an app or a website. Airbnb acts as this facilitator by allowing individuals, referred to as “hosts”, to rent out a room of their house or their whole house for a short-time […]

Rental Property Owners Lose Some Deductions

Legislation that came into law in the last half of 2017 makes a reality, measures first announced with the 2017 Federal Budget. The “housing tax integrity” bill solidifies the government’s intention to deny all travel deductions relating to inspecting, maintaining, or collecting rent for a residential investment property. As well, second-hand plant and equipment […]

Duties and Taxes When You Buy Online From Overseas

Items that you buy over the internet from an overseas source are generally required to abide by the same rules and screening processes that apply to any other “import”. Also the usual duties or taxes should apply. Customs duties are regulated by the Department of Home Affairs (a recently formed body from December 2017, which […]

Federal Budget 2018 – 2019

Federal Budget Summary The item that may receive the most analysis from the whole of this year’s federal budget will be the incnrease of the 32.5% tax bracket, and an expansion of the Low Income Tax Offset. A win for small businesses in this year’s budget sees the retention of the $2o,000 instant asset write-off […]