Latest News

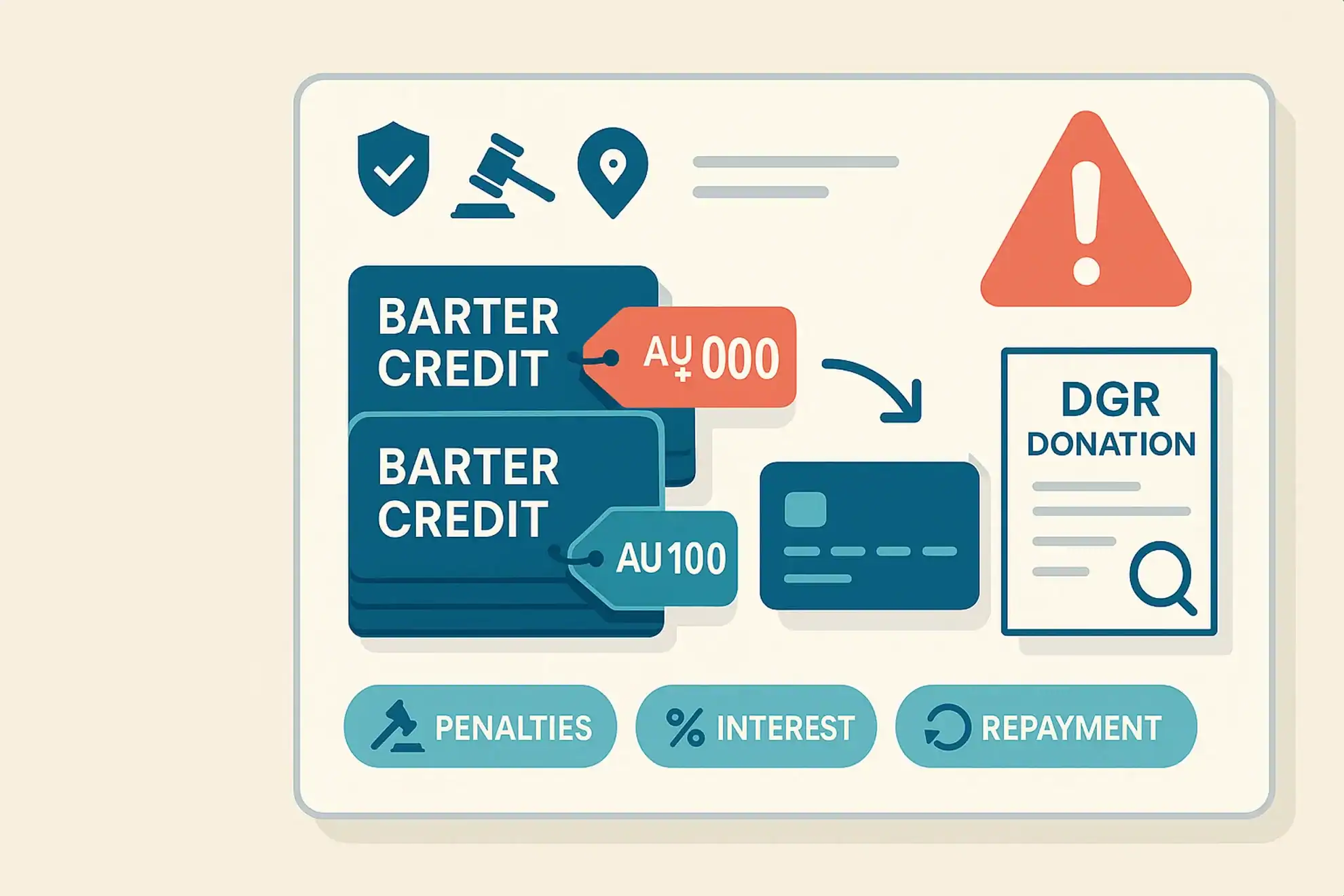

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

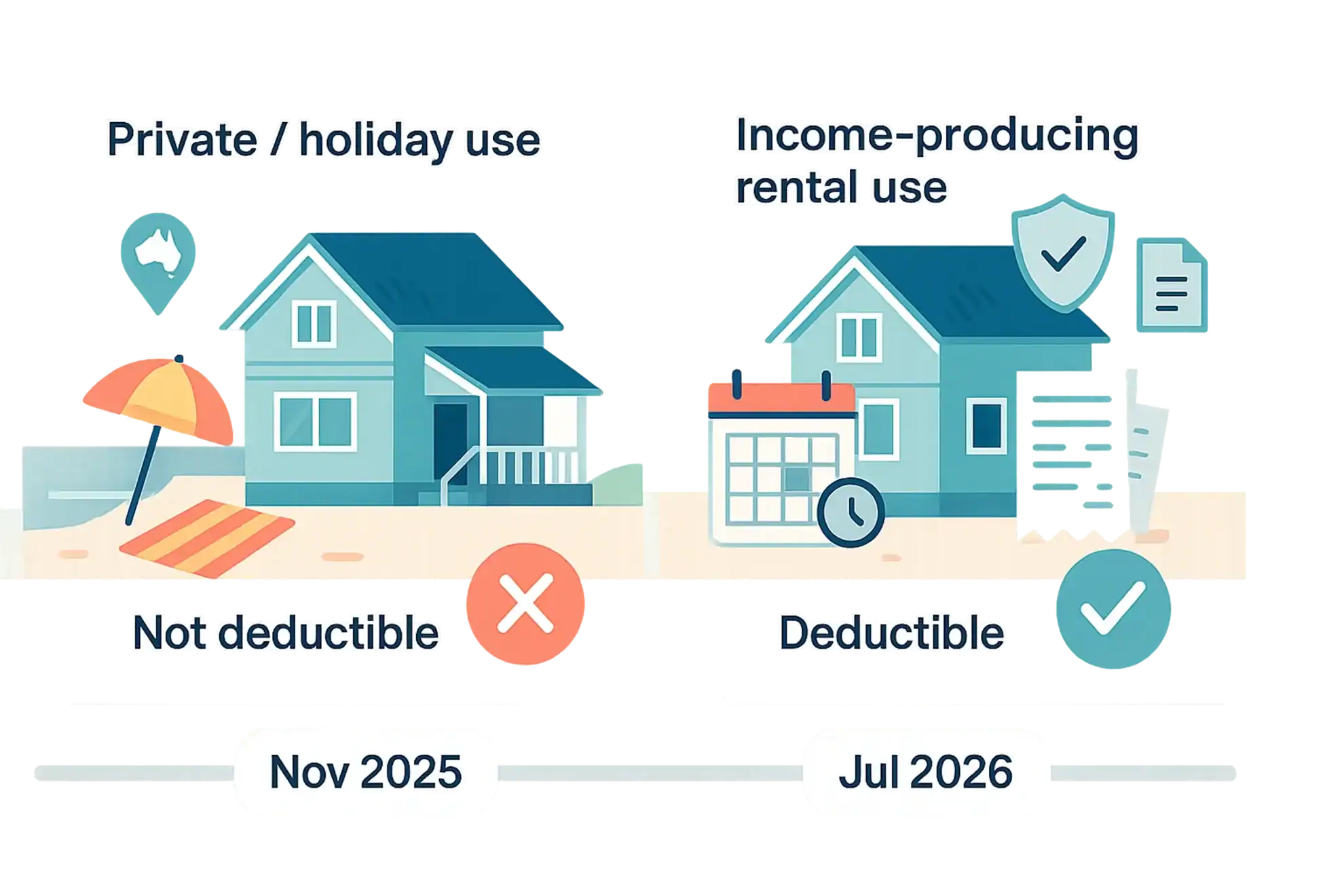

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

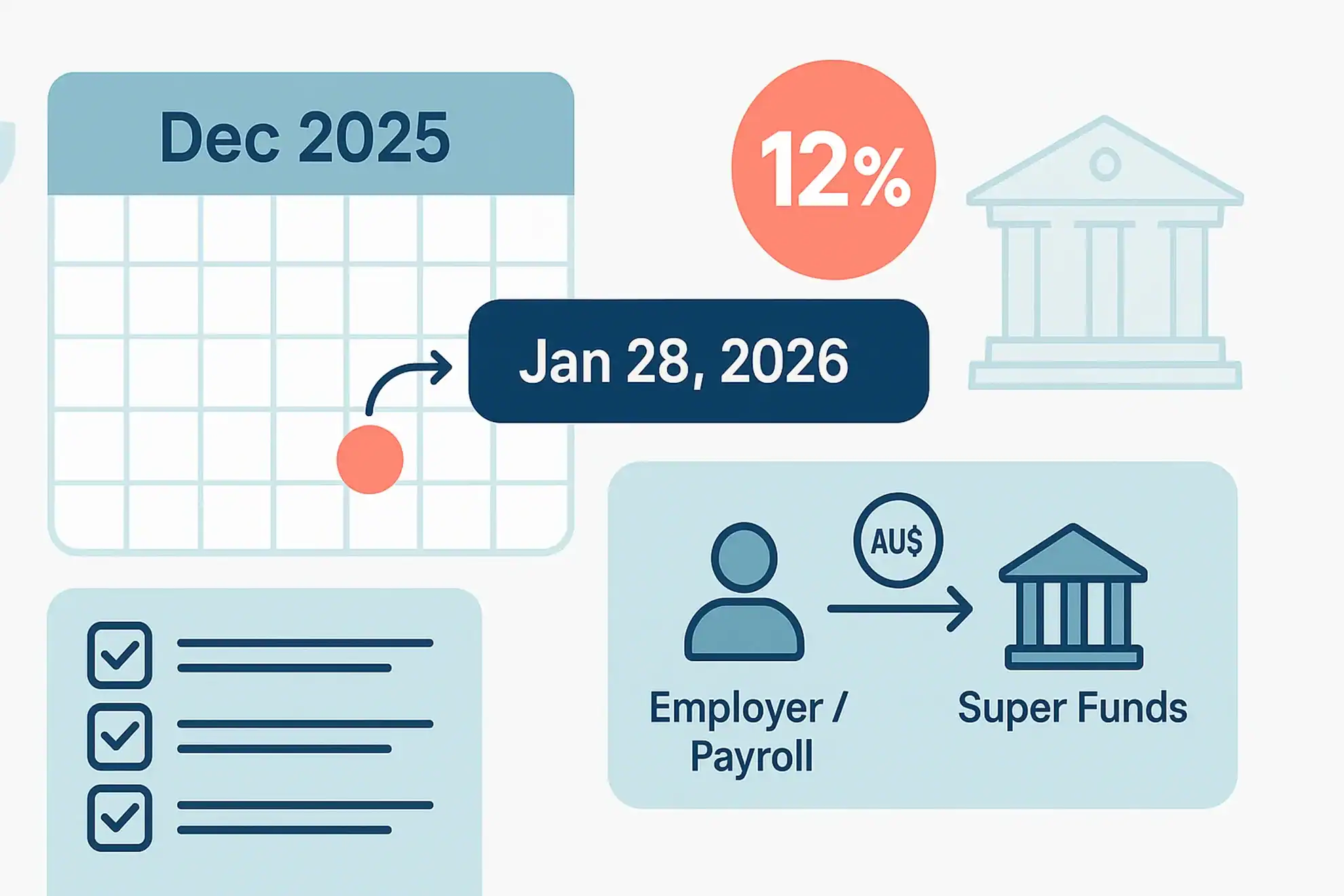

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

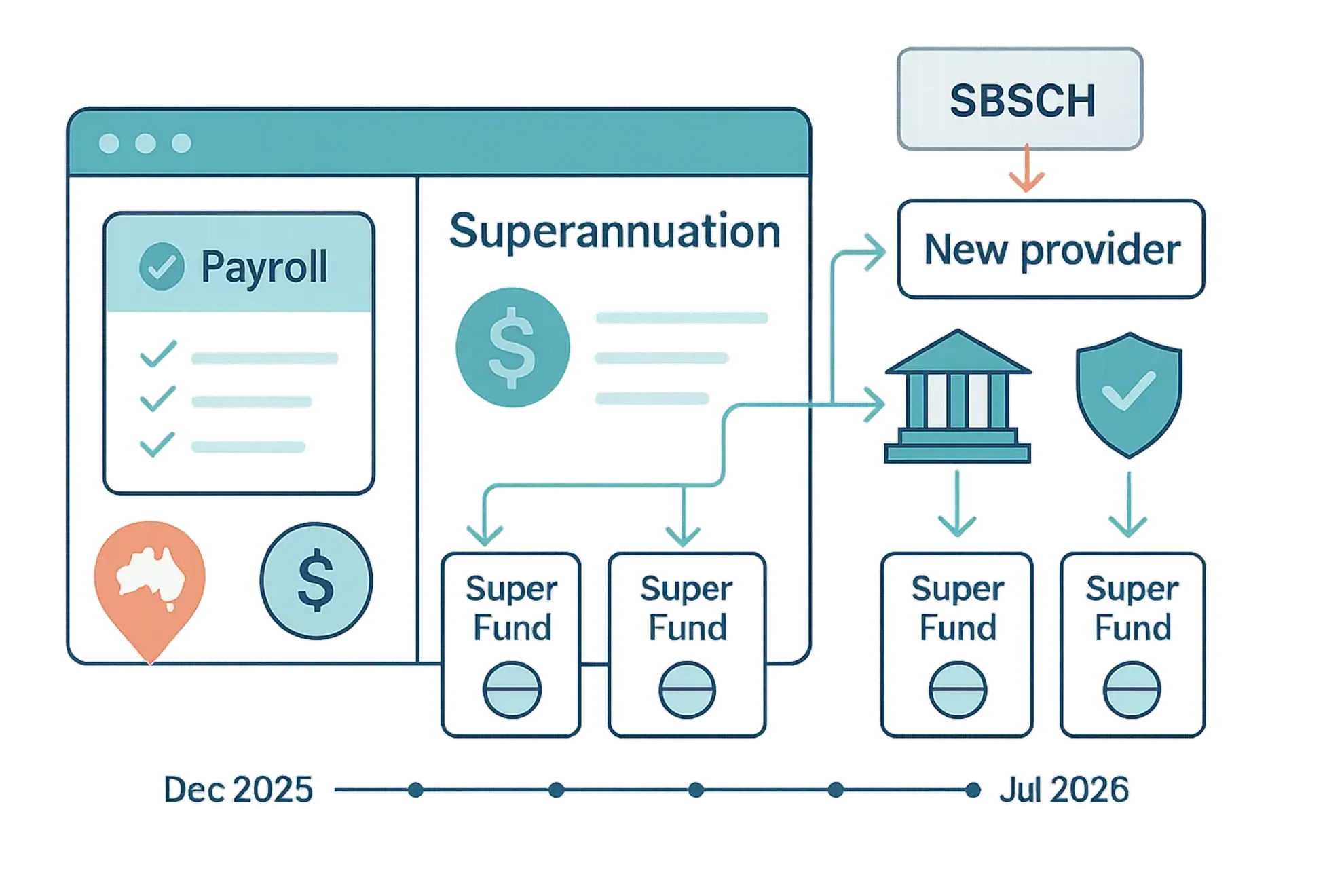

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

You don’t need to be wealthy to invest … but you do need to invest to be wealthy.

If you think you have to be wealthy to invest in property you might be mistaken! In fact, the skills and experience you’ve gained managing a budget on a lower income could make you a better property investor than some big spending high income earners. We often meet people who are hooked on the […]

The Ins and Outs of Entertainment Business Deductions

As a tax concept, “entertainment” can be relevant not only to fringe benefits tax (FBT), but also to income tax and even goods and services tax (GST). For a business, whether a business expense is “entertainment” will generally also determine whether the cost is deductible. If the expenditure can be shown to be directly connected […]

Ten Tips for Rental Property Owners to Avoid Common Tax Mistakes

Below is a list of tips from the Australian Taxation Office (ATO) that should help rental property owners avoid what it has found are the 10 most common tax errors made by rental property investors. The ATO says that avoiding these tax mistakes will save many taxpayers both time and money. Replacing an entire part […]

Stay Alert For Scams and Fraud

The Australian Taxation Office (ATO) is committed to educating taxpayers on how to protect themselves against tax scams and identity theft. It says that up to the end of last financial year, S2.7 million was handed over to fraudsters, with about 2,500 individuals providing some sort of personal information to scammers, including tax file numbers. […]

Understanding Novated Leases, FBT and Claims for Work-Related Car Expenses

A novated lease is a popular way for employers to reward and incentivise their staff. Through a salary sacrifice arrangement that includes a novated lease, employees are provided with a vehicle and can also reduce their personal tax liability. However, employees should understand how fringe benefits tax (FBT) might apply to their arrangement and what […]

Forced to Unwind Your Limited Recourse Borrowing Arrangements?

Limited recourse borrowing arrangements (LRBAs) were once all the rage in SMS land, However, with the tightening of banking rules this frenzy has begun to abate somewhat over the last few years. LRBAs are great in a growing market as they allow an SMSF to grow the value of assets it holds in the expectation […]