The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes.

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes.

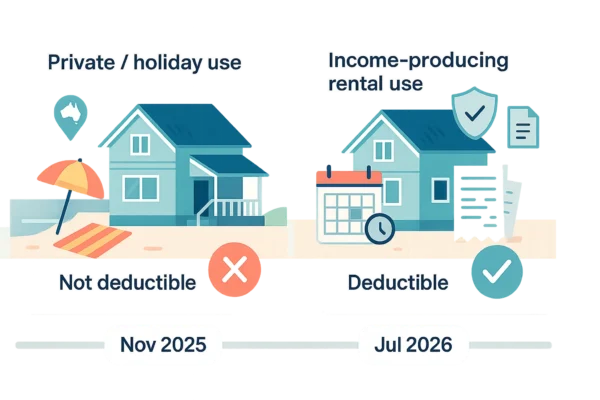

Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather than being apportioned).

Holiday home expenses relating to ownership and use of the holiday home (e.g., interest, rates and maintenance) will not be deductible, unless the holiday home is ‘mainly’ used to produce assessable income.

Whether a holiday home is used ‘mainly’ to produce assessable income will be determined based on a consideration of a number of factors.

However, this will generally not apply to expenses incurred in relation to holiday homes that are rental properties before 1 July 2026, if those expenses are incurred under an arrangement entered into prior to 12 November 2025.

Editor: Please contact our office if you want more information regarding this new development.

For personalised guidance on year‑end entertainment and gifting rules, please contact Taxwise Australia and review practitioner registration details via the Tax Practitioners Board.