Latest News

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

ASIC warning about pushy sales tactics urging quick super switches

ASIC is warning Australians to be on ‘red alert’ for high-pressure sales tactics, click bait advertising and promises of unrealistic returns which encourage people to switch superannuation into risky investments. The warning comes amid increasing concerns from ASIC that people are being enticed to invest their retirement savings in complex and risky schemes. ASIC Deputy […]

ATO warns of common Division 7A errors

The ATO reminds shareholders of private companies that understanding how Division 7A of the tax legislation applies is crucial to avoiding costly tax consequences when accessing the company’s money or other benefits. When Division 7A applies, the recipient of a payment, loan or other benefit can be deemed to have been paid an unfranked dividend […]

Taxpayers who need to lodge a TPAR

Taxpayers may need to lodge a Taxable payments annual report (‘TPAR’) online by 28 August if they have paid contractors to provide any of the following services on their behalf: building and construction; cleaning; courier and road freight; information technology; or security, investigation or surveillance. If the ATO is expecting a TPAR from a taxpayer […]

Changes to tax return amendment period for business

Businesses with an annual aggregated turnover of less than $50 million now have up to four years from the date of their tax return assessment to request amendments (increased from two years). This applies to assessments for the 2024/25 and later income years. If businesses make a mistake on a tax return amendment, they should […]

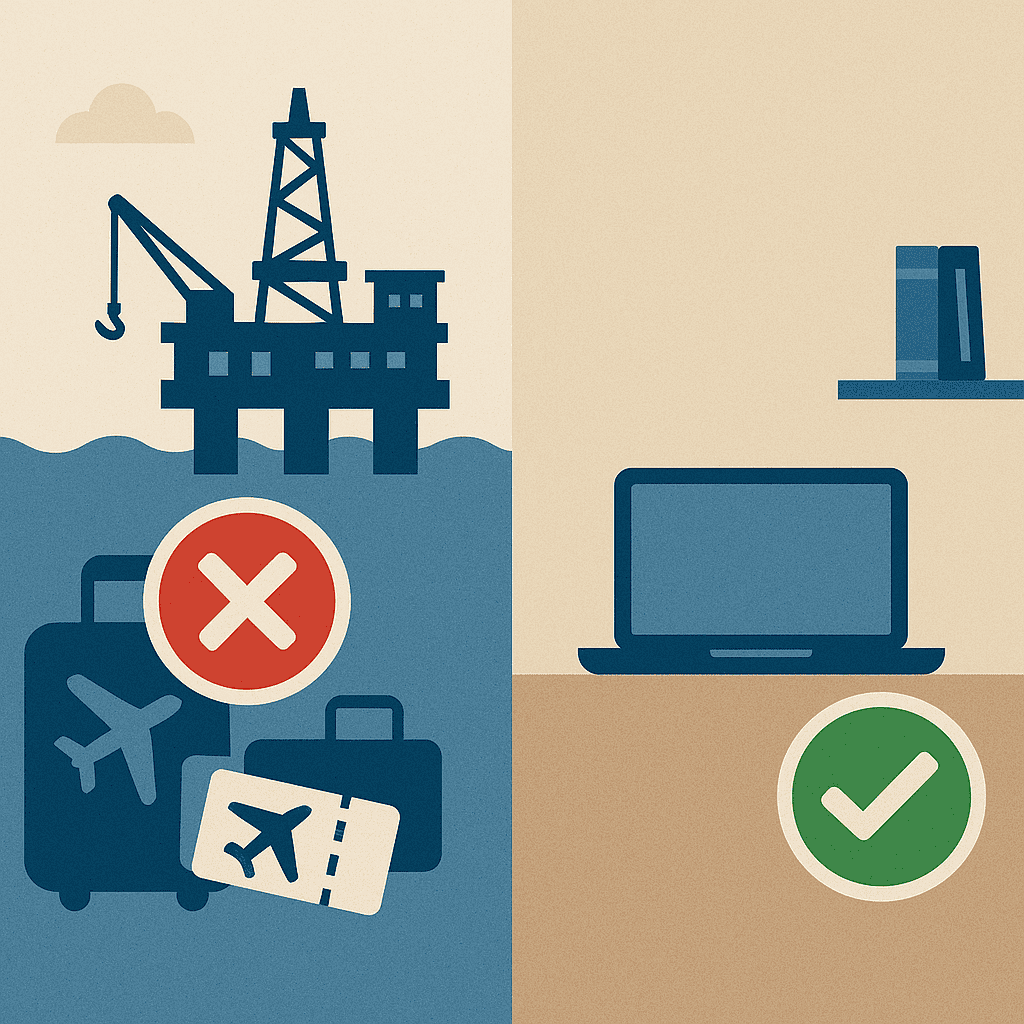

Taxpayer’s claim for travel expenses denied

In a recent decision, the Administrative Review Tribunal (‘ART’) denied an offshore worker’s claim for work-related travel expenses, although it did allow his claim for home office expenses. During the relevant period, the taxpayer resided in Queensland with his family, while his employment as an engineer was primarily based at an offshore facility located off […]

ATO to include tax ‘debts on hold’ in taxpayer account balances

From August 2025, the ATO is progressively including ‘debts on hold’ in relevant taxpayer ATO account balances. Editor: A ‘debt on hold’ is an outstanding tax debt where the ATO has previously paused debt collection actions. Tax debts will generally be placed on hold where the ATO decides it is not cost effective to collect […]