Latest News

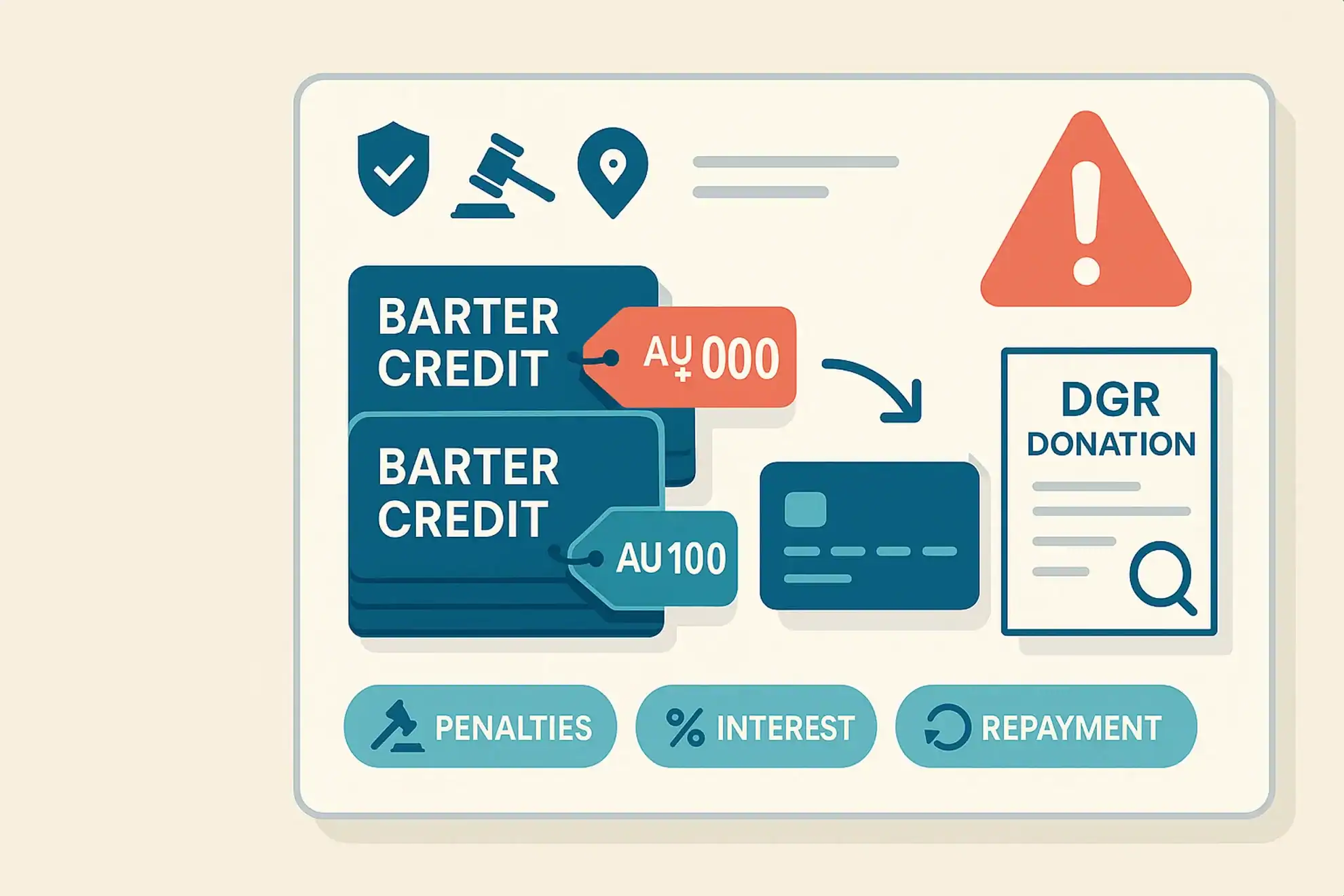

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

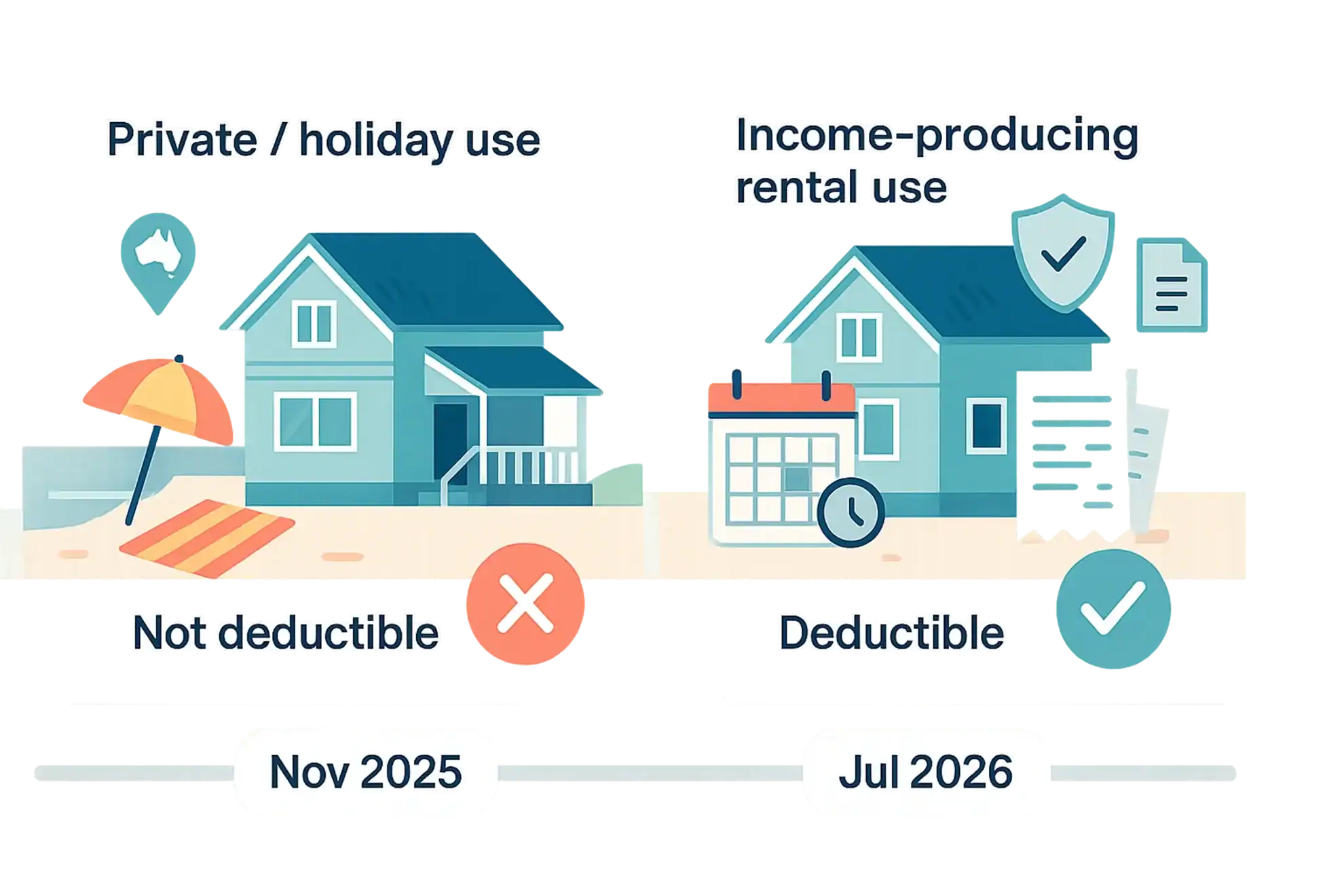

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

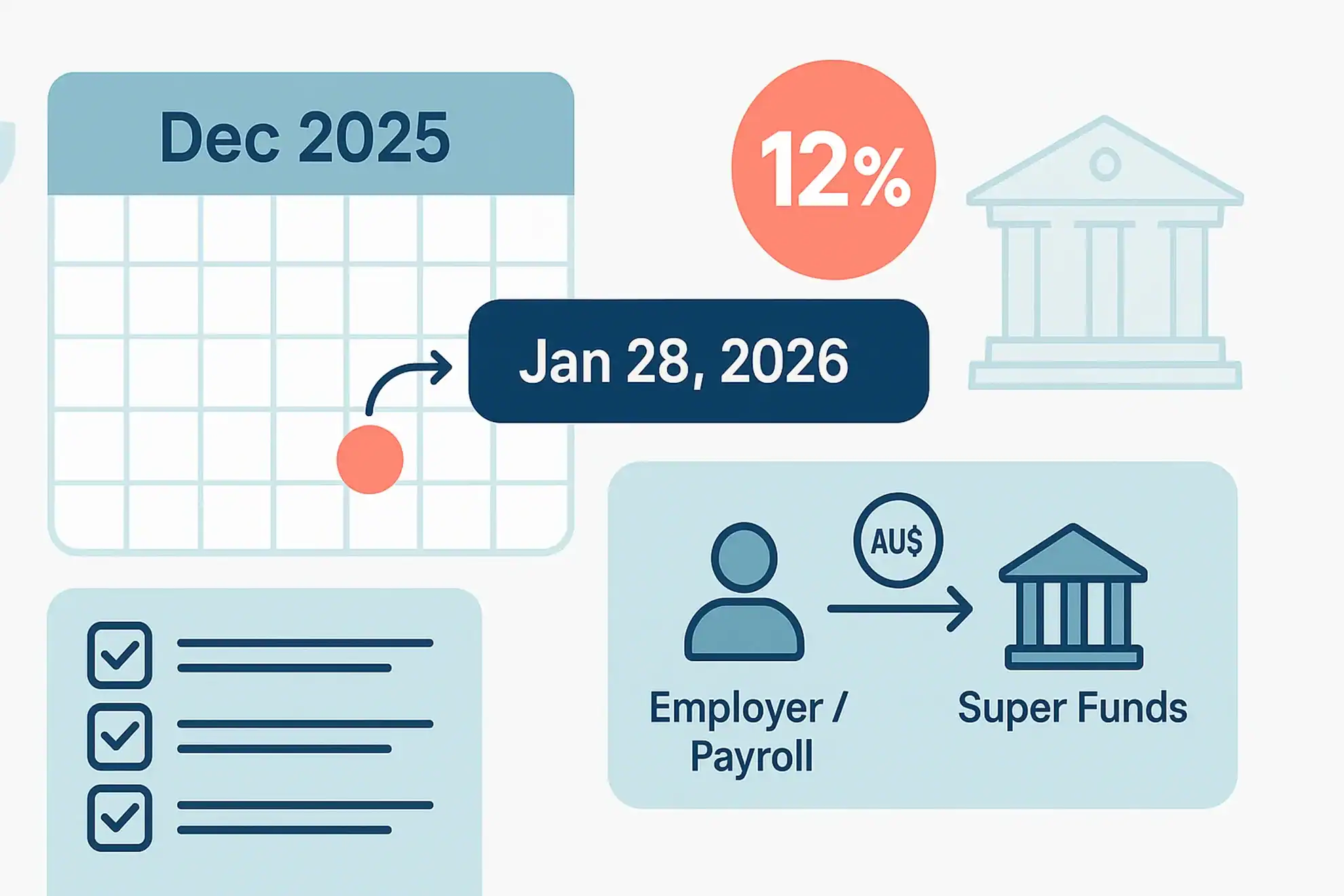

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

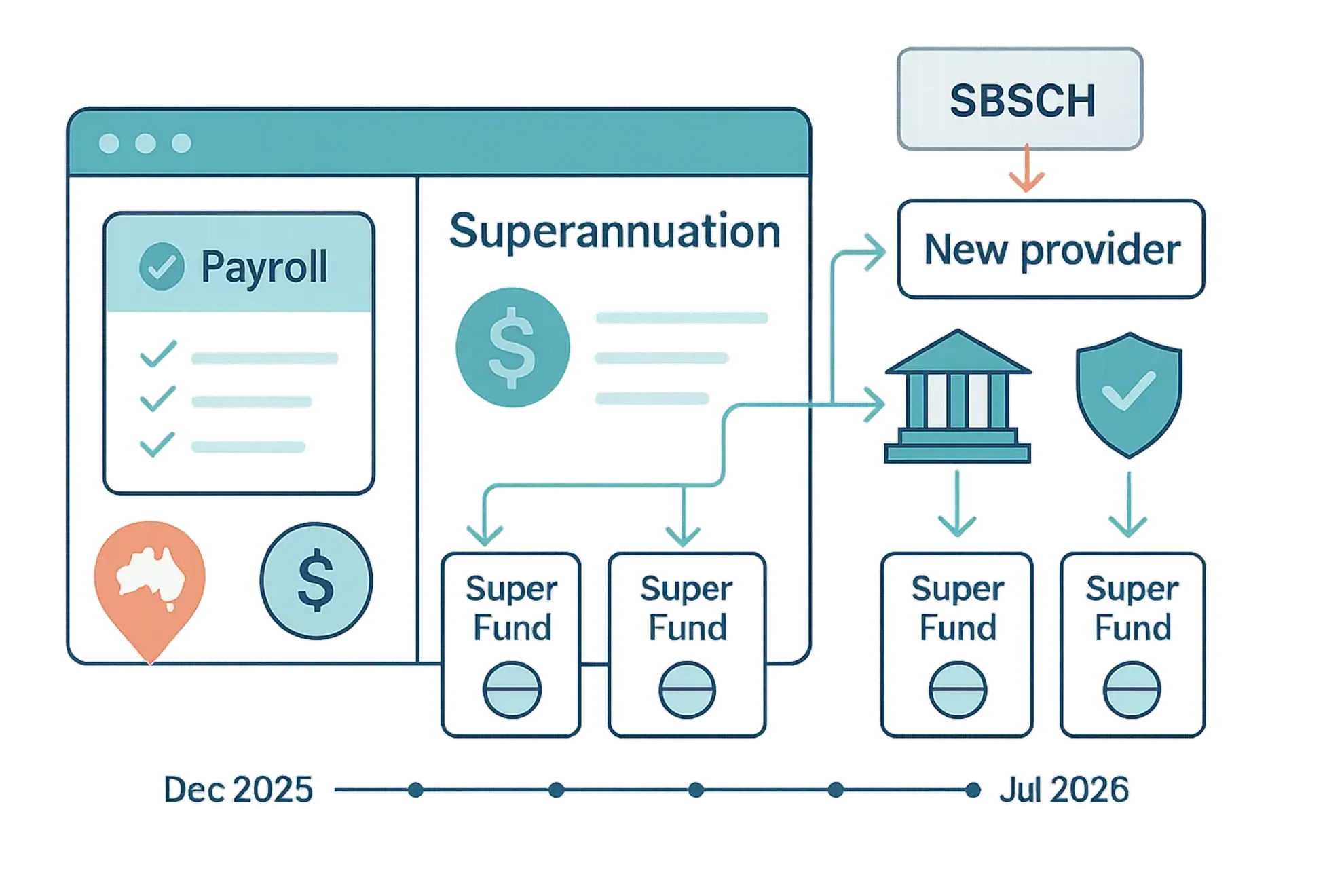

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

New FBT Retraining and Reskilling Exemption Available

Recent legislative amendments mean that employers who provide training or education to redundant (or soon to be redundant employees) may now be exempt from fringe benefits tax (‘FBT’). The ATO has reminded eligible employers that they can apply the exemption to retraining and reskilling benefits provided on or after 2 October 2020. There are […]

Avoiding Disqualification From SG Amnesty

The superannuation guarantee (‘SG’) amnesty ended on 7 September 2020. Employers who disclosed unpaid SG amounts and qualified for the amnesty are reminded that they must either pay in full any outstanding amounts they owe, or set up a payment plan and meet each ongoing instalment amount so as to avoid being disqualified and […]

Further STP Developments

In an indication of the far-reaching changes that Single Touch Payroll (‘STP’) will be bringing, Treasury has recently finished consulting on draft legislation that expands the data that may be collected through STP by the ATO (as announced in the 2019/20 Budget). The legislation, if enacted, will broaden the amounts that employers can voluntarily […]

COVID-19 And Tax Depreciation Reports – Are Physical Inspections Necessary?

Property investors and businesses will often engage a specialist quantity surveyor to prepare a tax report on capital works and depreciation deductions available to them under the tax law in respect of their income-producing properties – for example, a rental property, office building or factory. A thorough physical inspection of the property by a quantity […]

Extending Administrative Relief For Companies To Use Technology

The Government has passed legislation renewing the temporary relief that allows companies to use technology to meet regulatory requirements under the Corporations Act 2001. These temporary relief measures will allow companies to hold virtual meetings and use electronic communications to send meeting-materials and execute documents until 31 March 2022. This should ensure that companies can […]

Backpacker Tax May Not Apply To Some Backpackers

The High Court has held that the ‘working holiday maker tax’ (also known as the ‘backpackers tax’) did not apply to a taxpayer on a working holiday visa from the United Kingdom who was also an Australian tax resident, due to the application of the Double Tax Agreement between Australia and the United Kingdom. The […]