Latest News

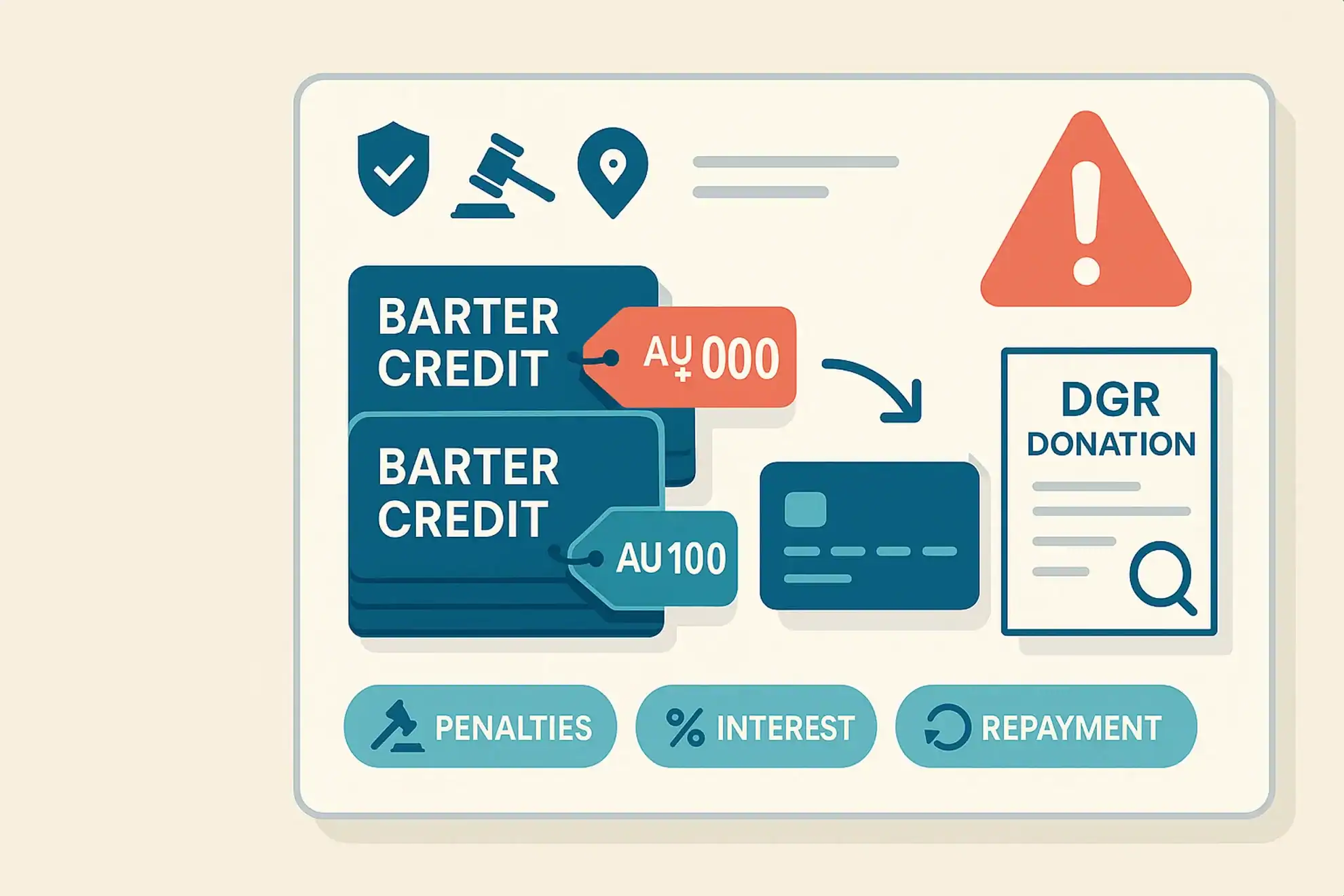

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

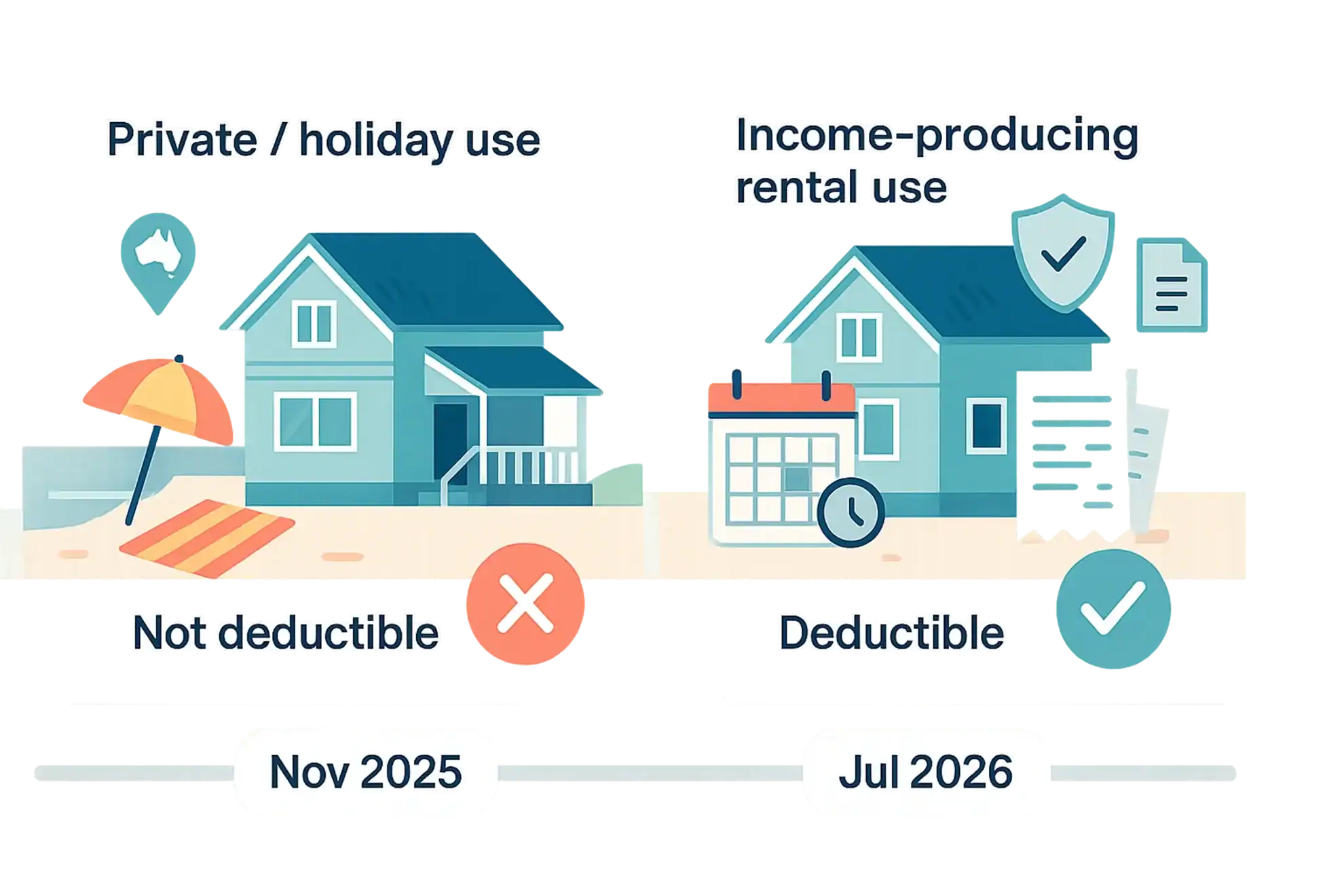

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

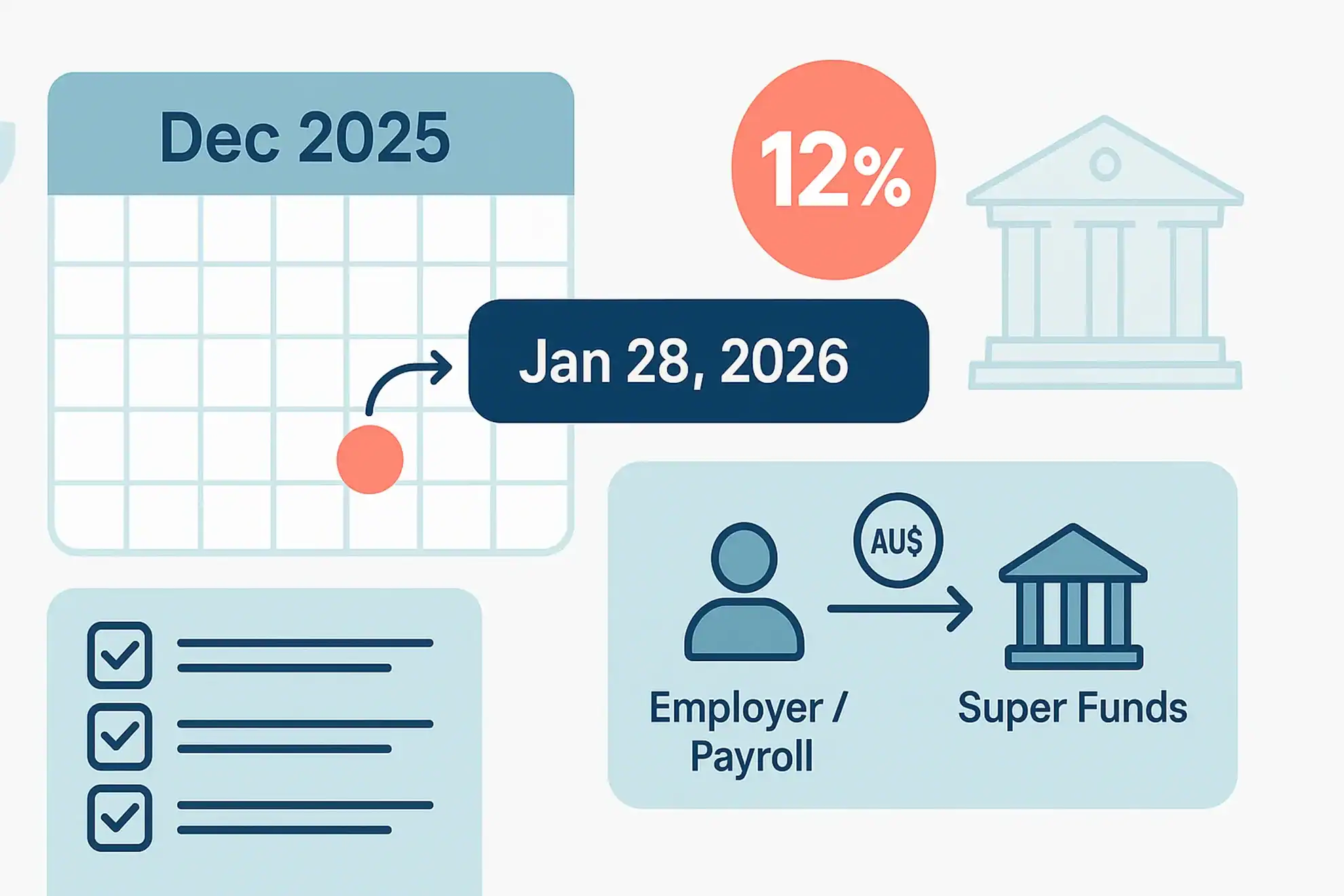

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

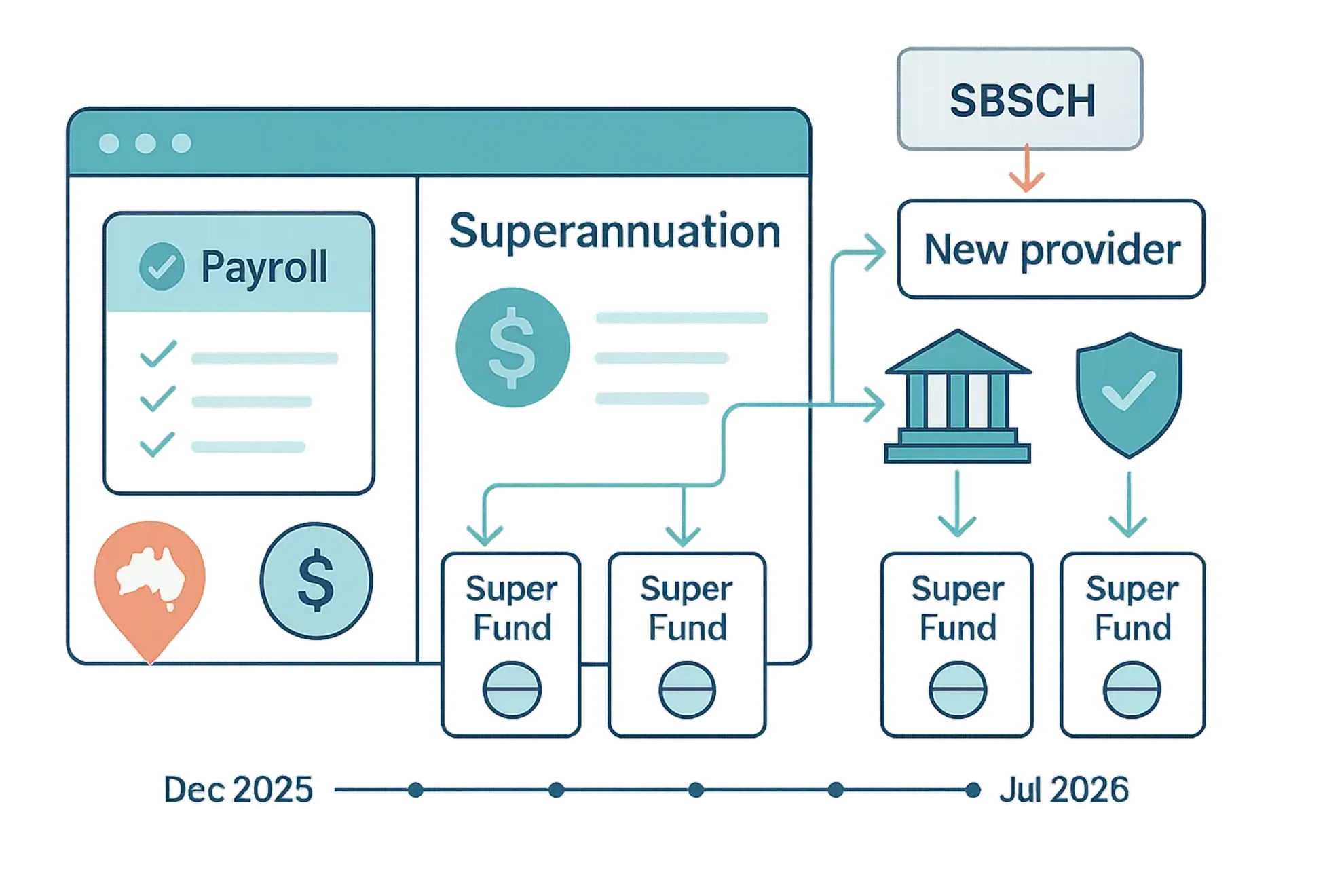

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

ATO advice regarding year-end trustee resolutions

The ATO has advised that, in the lead up to 30 June, trustee clients who wish to make beneficiaries presently entitled to trust income for the 2023 income year should ensure their trustee resolutions are effective. This includes where trustees may want to make beneficiaries ‘specifically entitled’ to franked dividends and capital gains included in […]

‘Side hustles’ in the ATO’s sights

Editor: A recent ATO article highlights the fact that it is increasingly trying to bring more modern techniques of money-making into its tax net . . . ‘Side hustles’ have really grown over the past few years — everything from the gig economy and drop shippers, to content creators and influencers. The ATO recognises that […]

ATO ride sourcing data-matching program

The ATO will acquire ride sourcing data relating to approximately 200,000 individuals to identify individuals that may be engaged in providing ride sourcing services during the 2022/23 financial year. The data items include: identification details (driver identifier, ABN, driver name, birth date, mobile phone number, email address and address); and transaction details (bank account details, […]

In the ATO’s sights this Tax Time

The ATO has announced its three key focus areas for this Tax Time: rental property deductions; work-related expenses; and capital gains tax ATO Assistant Commissioner Tim Loh said the ATO is continuing to prioritise areas where they often see mistakes being made: “Within these areas, we have identified common mistakes, and are particularly focused on […]

Court penalises AMP $24 million for charging deceased customers

The Federal Court has found that four companies that are or were part of the AMP Group breached the law when charging life insurance premiums and advice fees from the superannuation accounts of more than 2,000 deceased customers. The Federal Court ordered two of these AMP companies to pay a combined penalty of $24 million […]

The super guarantee rate is increasing

Businesses that have employees, or hire eligible contractors, will need to ensure that their payroll and accounting systems are updated to reflect the new super guarantee rate of 11% for payments of salary and wages that are made from 1 July 2023. Businesses need to calculate super contributions at 11% for their eligible workers for […]