Latest News

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Significant change to claiming working from home expenses

Before 1 July 2022, an individual taxpayer that incurred additional deductible expenses as a result of working from home, had a choice of three methods around claiming working from home expenses. These choices were: The shortcut method – which was available from 1 March 2020 to 30 June 2022; The fixed-rate method – which was […]

Transfer balance cap indexation

An individual’s transfer balance cap (‘TBC’) determines the maximum amount they can commit to a retirement phase interest in their super fund, such as an account-based pension, without being subject to penal taxation. When the TBC concept was introduced with effect from 1 July 2017, it was initially $1,600,000. It was increased by $100,000 as […]

ATO and AFP crackdown on GST fraud promoters

A raft of enforcement activity has been undertaken across the country by the ATO-led Serious Financial Crime Taskforce, including the execution of search warrants and issuing of warning letters. On 31 December 2022, the ATO took compliance action on more than 53,000 clients and stopped approximately $2.5 billion in fraudulent GST refunds from being paid […]

New 15% super tax to apply from 1 July 2025

The Government recently announced it will be imposing a 15% additional tax on individuals that have more than $3 million in superannuation. The new measure is expected to commence from 1 July 2025 (i.e., the start of the 2026 income year). The main takeaways from the information provided thus far include the following: The additional […]

Start thinking about your FBT obligations

The 2023 FBT year ended on 31 March, so it is now time for employers to get ready to lodge their 2023 FBT returns, where they have provided benefits to their employees (or their associates) between 1 April 2022 and 31 March 2023. If you have provided fringe benefits to employees during the year, we […]

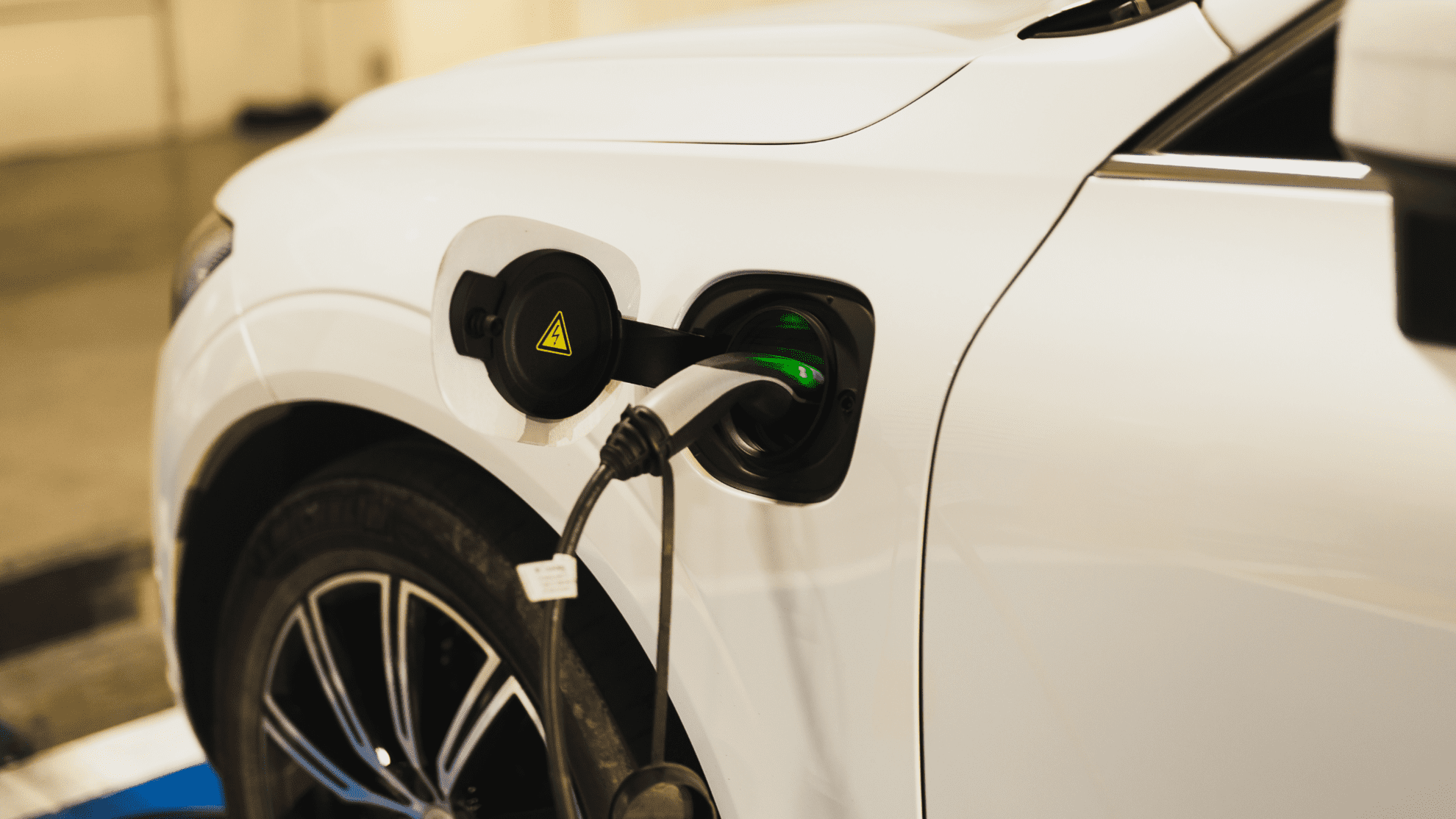

FBT exemption for electric cars

Until recently, the FBT consequences for providing electric cars to employees were effectively the same as any other car. However, from 1 July 2022, FBT is no longer payable on benefits provided for eligible electric cars and associated expenses. Practically, this exemption will be relevant for the first time in the 2023 FBT year. Broadly, […]