Latest News

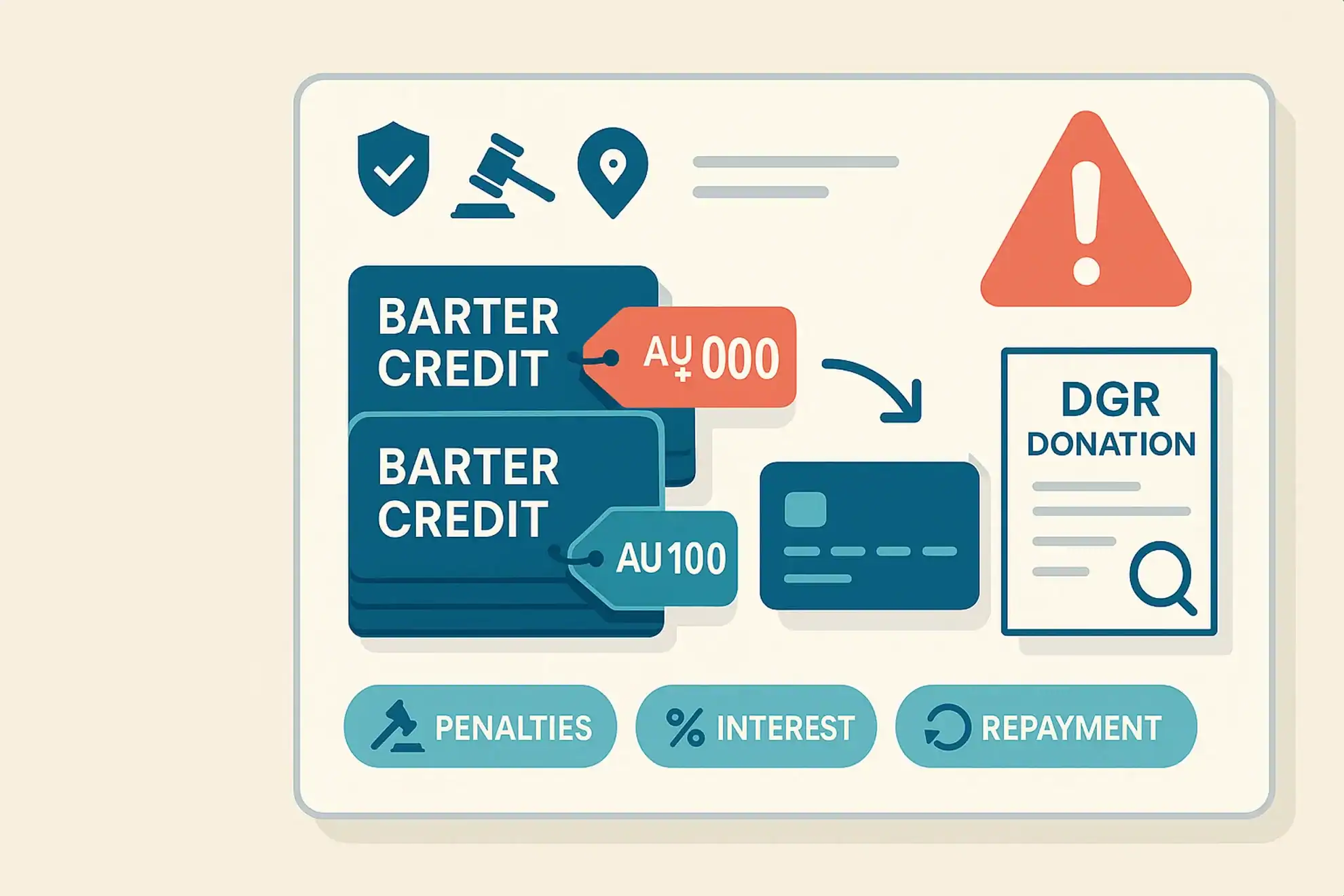

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

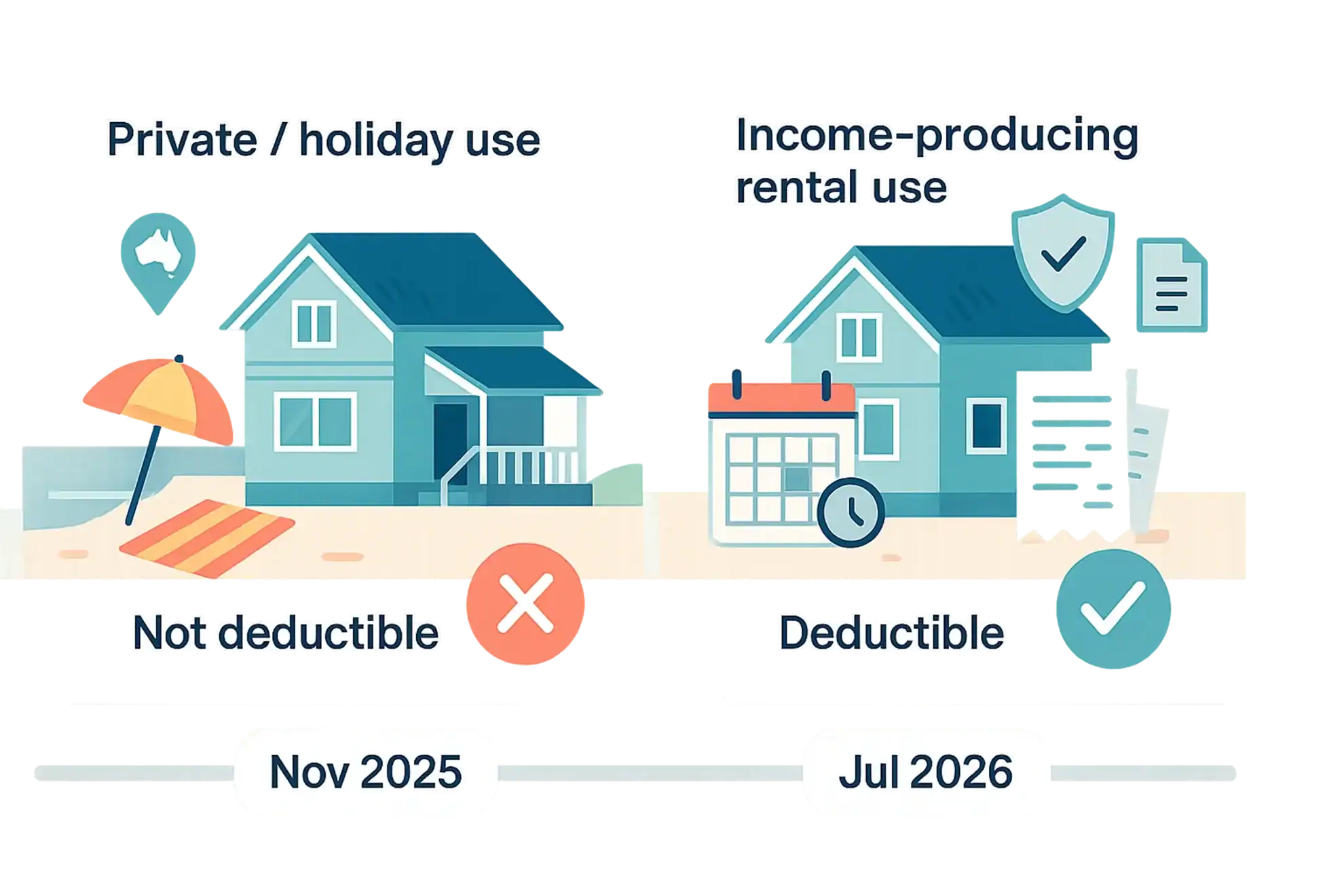

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

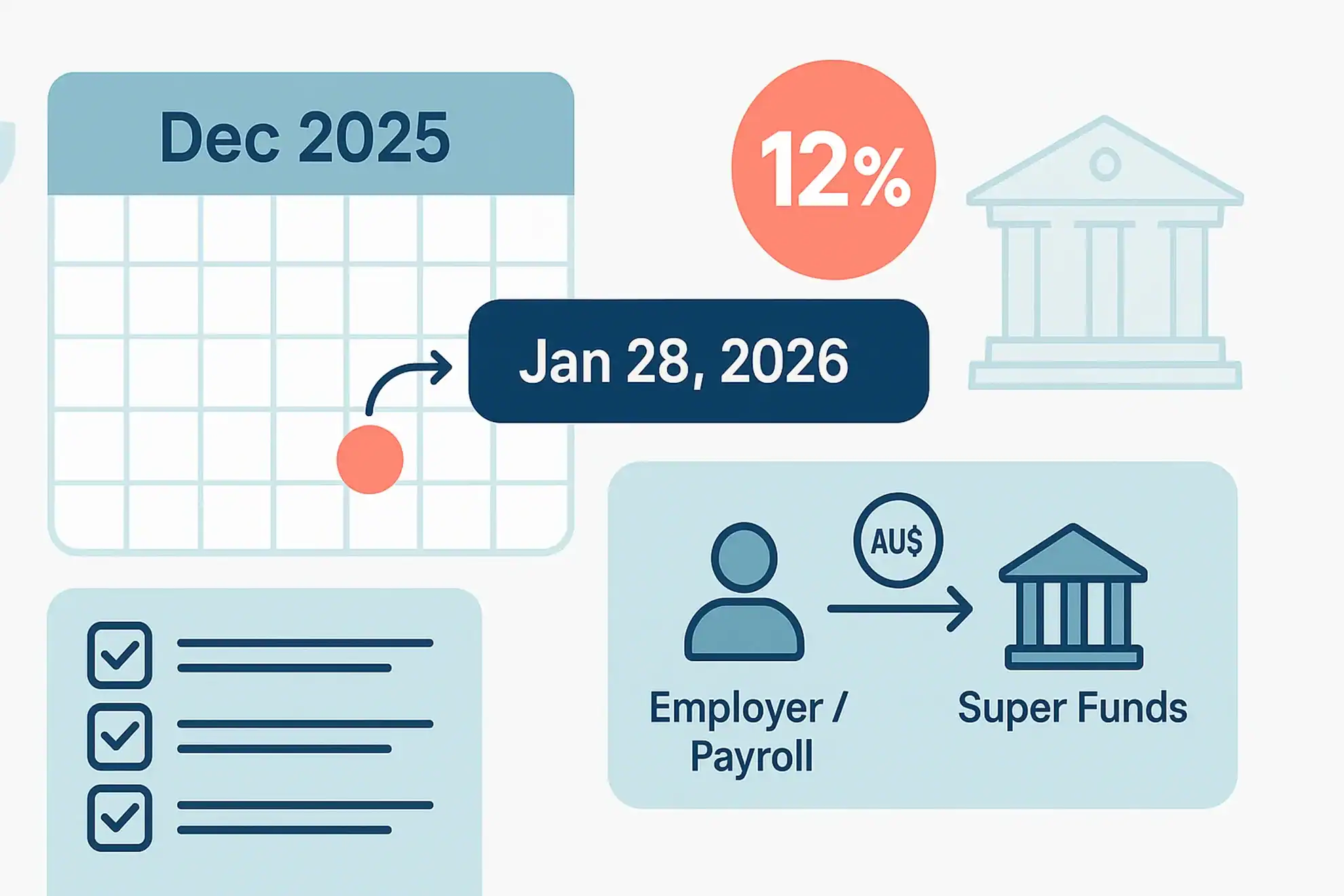

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

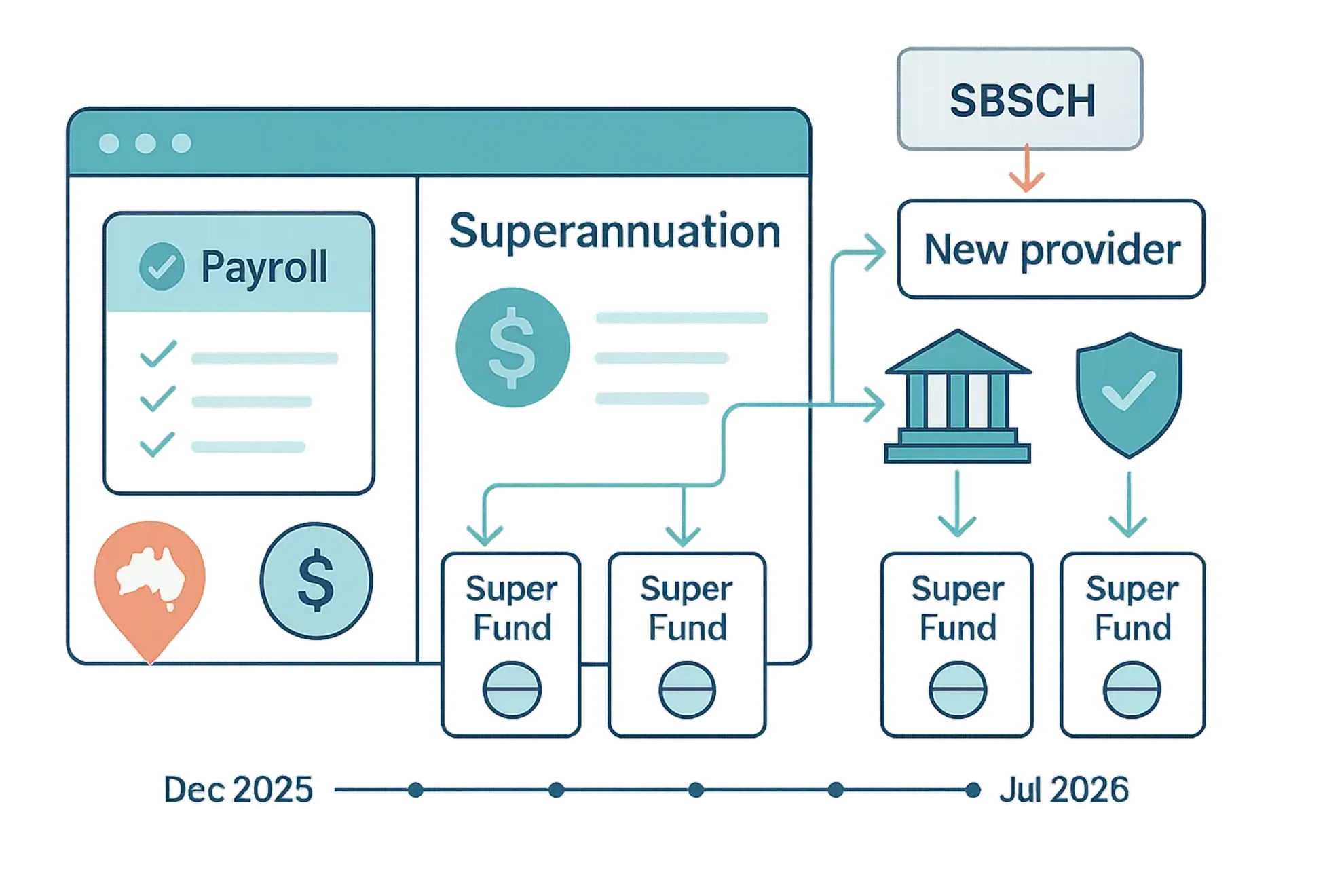

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Identifying a good investment property

Most of us have heard the saying ‘Location, location, location’, but have we thought about what it actually means? Is it the only factor when considering buying an investment property? Location, location, location There is no doubt that location is one of the most important factors in determining a good investment property. It influences your […]

Gumtree sourced assets, and the realities of making a claim

A recent case before the Administrative Appeals Tribunal (AAT) brought into focus a growing phenomenon that you should keep in mind for work-related or business expense deduction claims, especially where the acquisition of claimable assets is made in a certain way. THE ENGINEER AND HIS “INVOICE” The AAT case involved a taxpayer’s attempt to make […]

The CGT Implications of Subdividing and Building on the Family Property

Given the state of the property market in Australia these days, a not-uncommon situation can arise where a residential propefty owner seeks to demolish and subdivide the block containing the family home and build residential units. lf you have the available land of course, the above is a solid strategy. However it can cause headaches from a tax perspective – and in […]

Are Personal Carer Travel Costs Claimable? It Depends …

A recent Administrative Appeals Tribunal decision has ramifications for taxpayers with disabilities, and who are in need of a personal carer. The decision centres around what is or is not acceptable as a tax deduction in relation to the costs that arise with regard to that carer under certain conditions. The circumstances of the taxpayer concerned in the case are particularly relevant, […]

Company Tax Franking Implications

The recent cut to the tax rate for incorporated businesses that turnover less than S50 million a year, while generally welcomed, can bring with it some important considerations when it comes to distributing franked dividends. The rate change 1o 27.5% is to be staggered, starting with companies that turnover up to $10 million a year, with retrospective effect from July […]

End-of-Year Tax Planning Tips For Business

The general rule is that you can claim deductions for expenses your business incurs in its task of generating assessable income. Many of these deductions are obvious – rent, materials, supplies and so on — but there are also some less obvious options left available just before the end of the income year, should your circumstances […]