Latest News

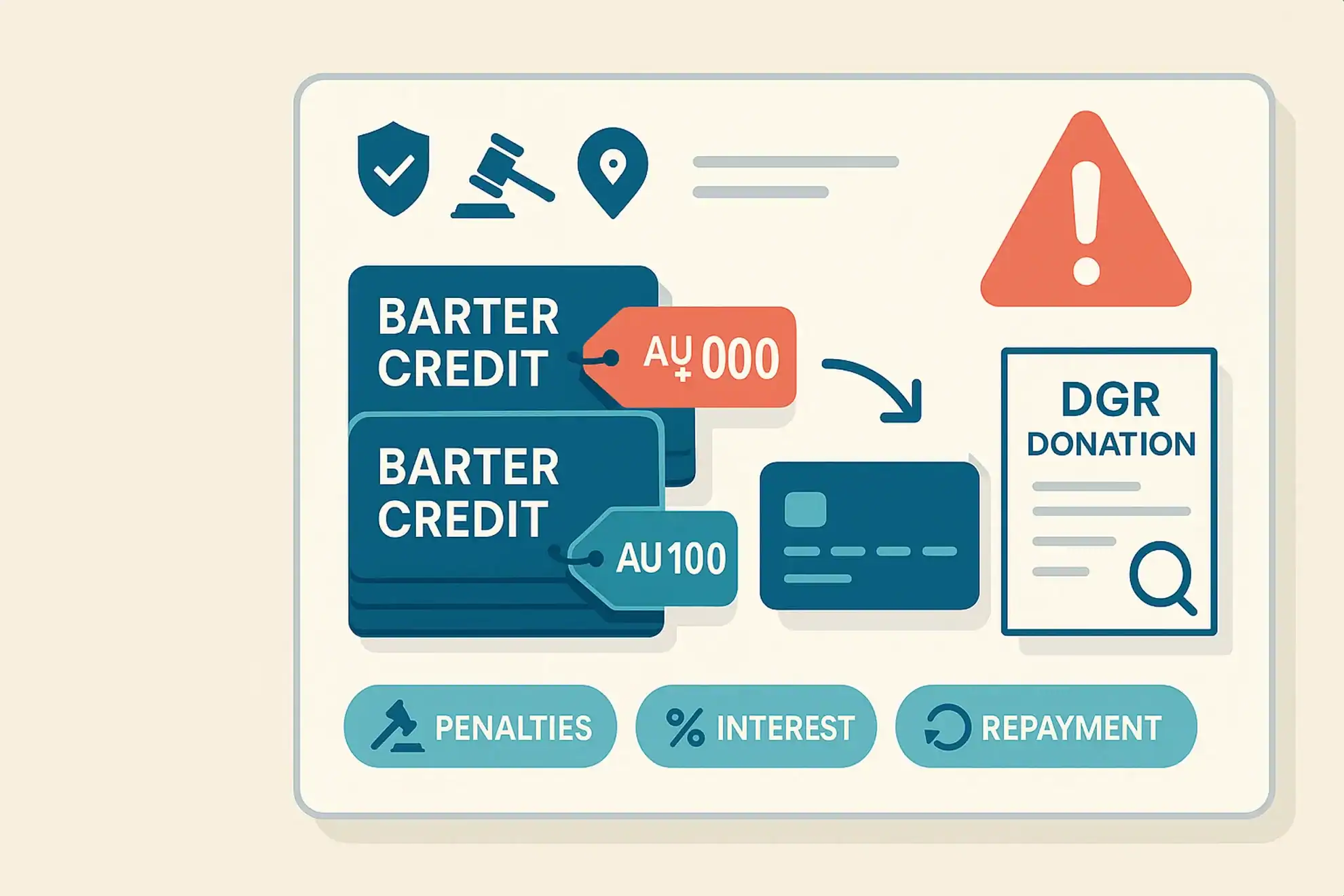

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

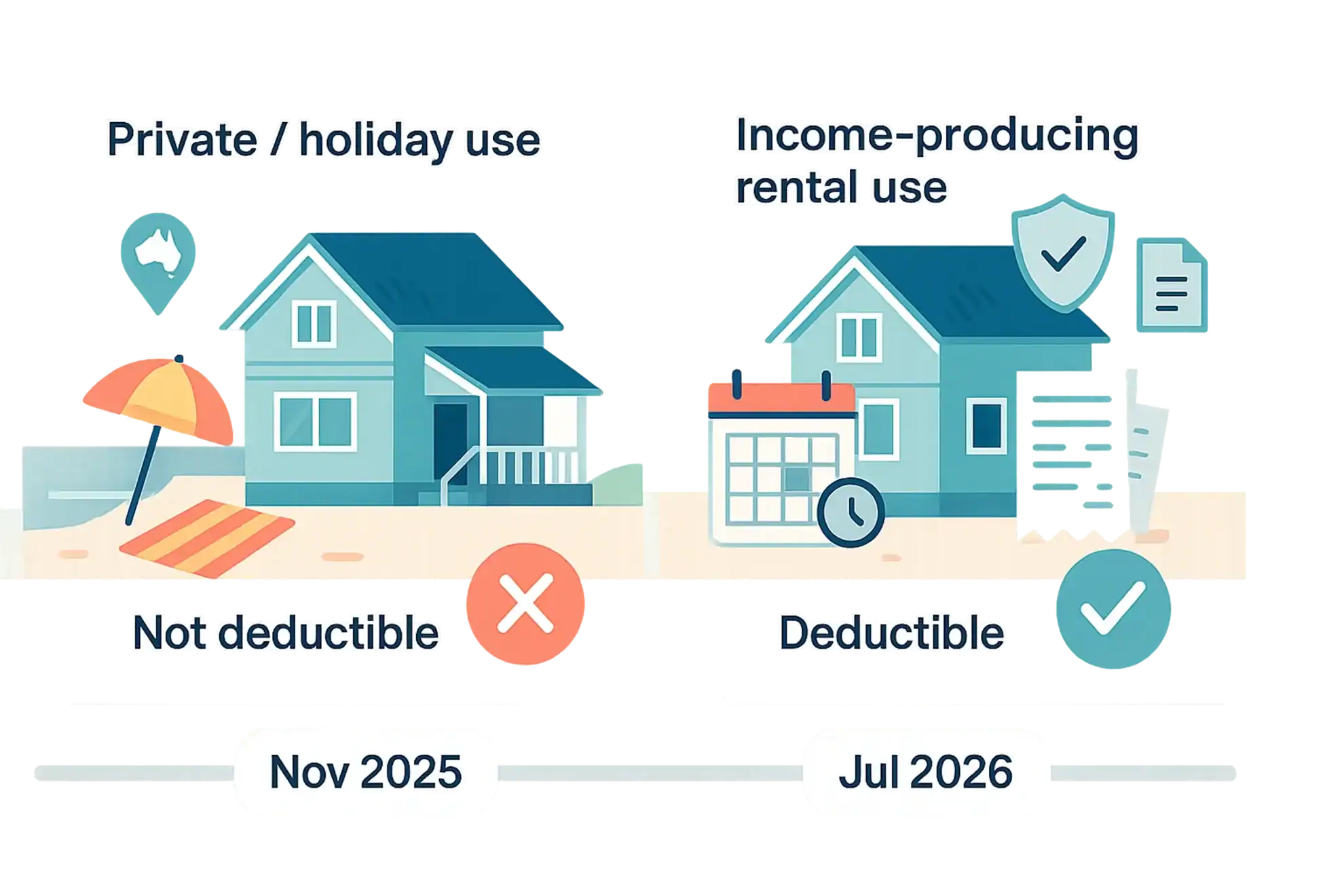

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

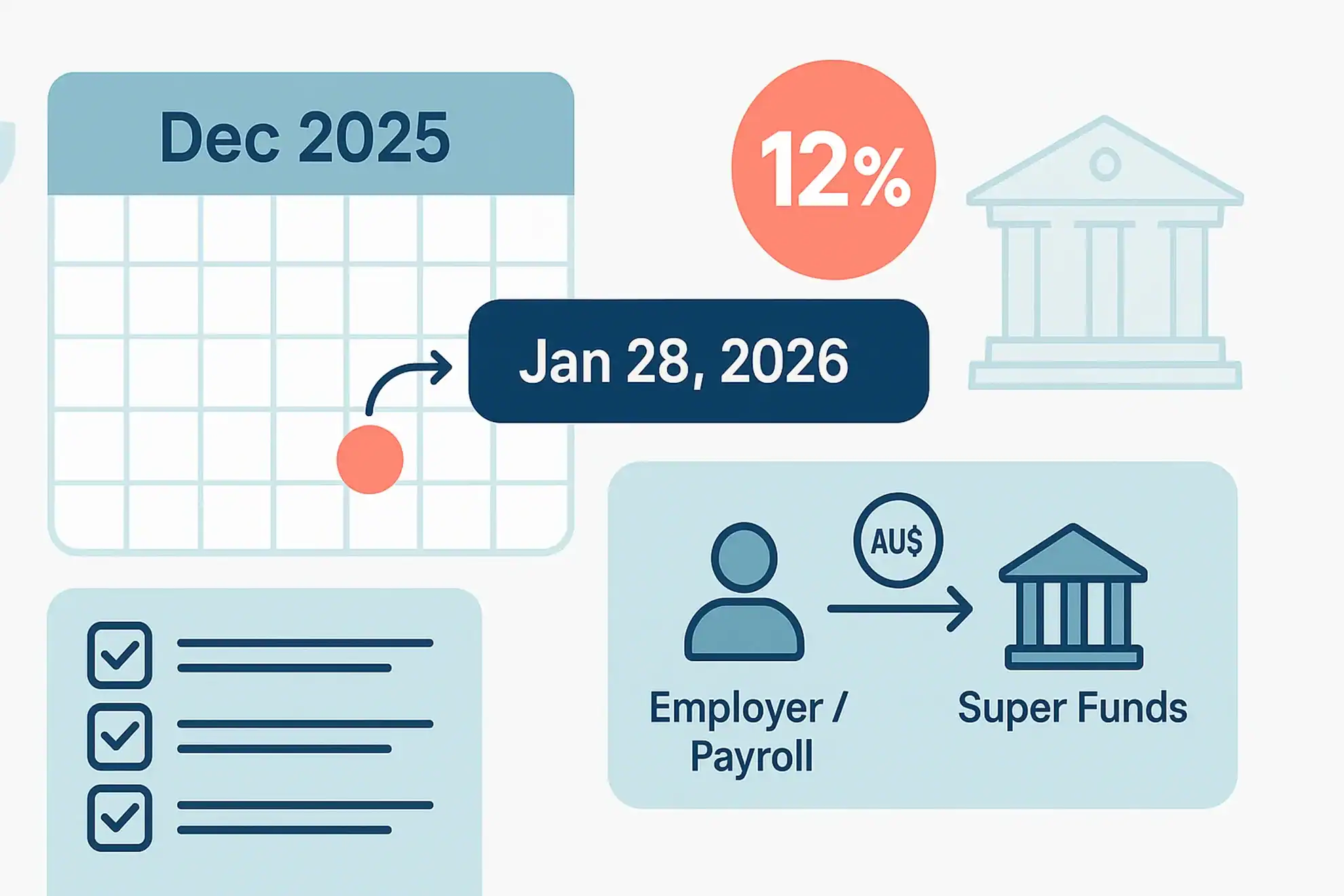

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

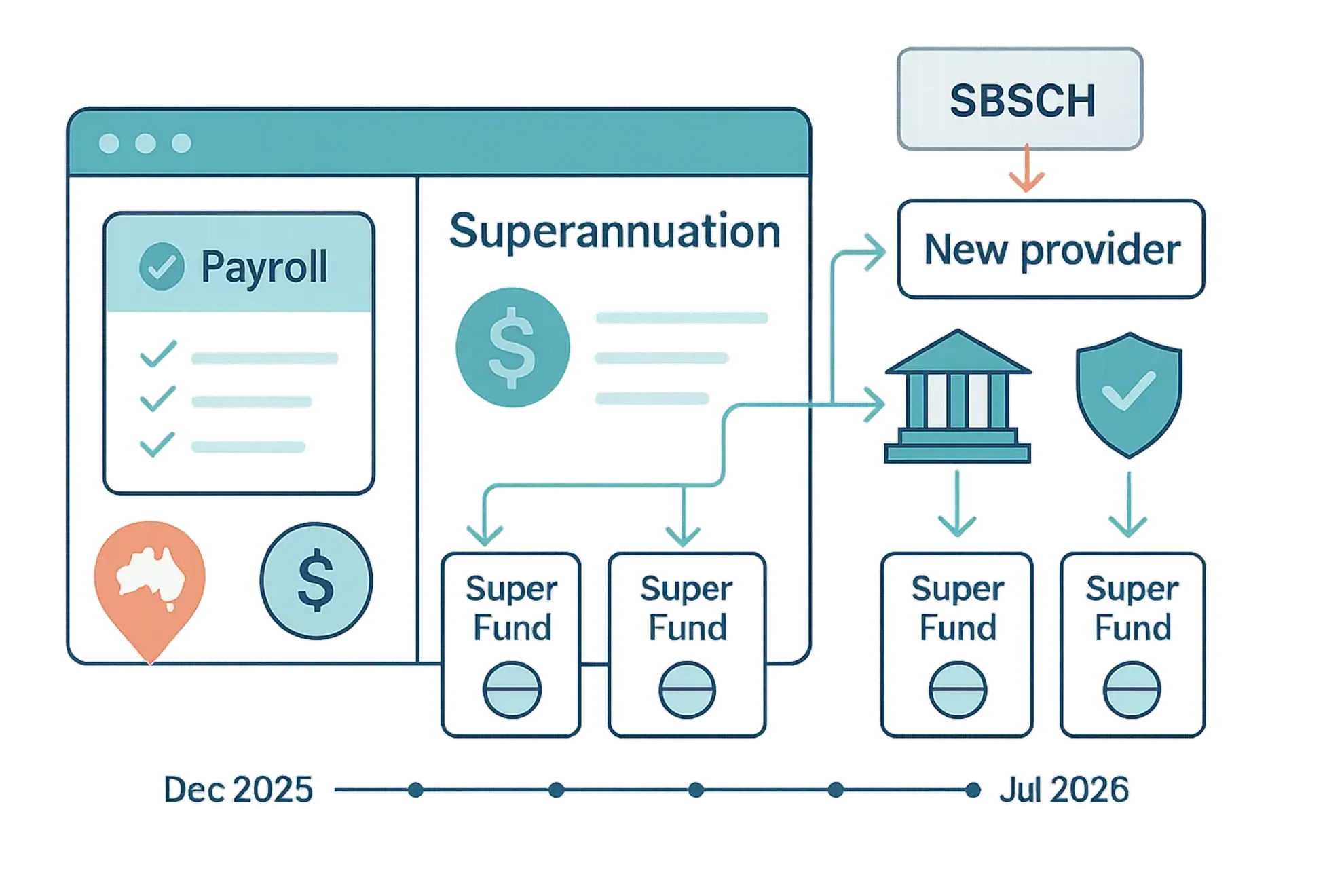

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Car Parking Threshold For 2020 FBT Year

The car parking threshold for the FBT year commencing on 1 April 2019 is $8.95 (replacing the amount of $8.83 that applied in the previous year commencing 1 April 2018).

Trustee Obligations On The ATO’s Radar: TFN Reports

The ATO is currently reviewing adherence to certain trustee obligations, including the lodgment of Tax File Number (‘TFN’) reports for TFN withholding for closely held trusts. Beneficiaries are required to quote their TFN to trustees to avoid having tax withheld from payments or unpaid present entitlements, and trustees must lodge a TFN report for any […]

ATO Assets Crackdown – Lifestyle Assets Data Matching Program

The ATO has released details of their “Lifestyle assets 2013-14 and 2014-15 financial years data matching program protocol”. They will obtain information on insurance policies for certain classes of assets, including marine vessels, enthusiast motor vehicles, thoroughbred races horse, fine art and aircraft to improve their profiling of taxpayers and provide a more comprehensive view […]

False Laundry Claims ATO Targets This Tax Time

The ATO will target false clothing and laundry work-related expense claims this Tax Time. In 2018, around six million people claimed work-related clothing and laundry expenses totalling nearly $1.5 billion. Assistant Commissioner Karen Foat said although many Australians can claim clothing and laundry expenses, it’s unlikely that half of all taxpayers are required to wear […]

Making a Division 293 Election

The ATO is reminding taxpayers and tax practitioners that the process to release money from super fund accounts to pay additional tax on concessional contributions (referred to as ‘Division 293’) changed on 1 July 2018. Since then, practitioners or their clients must send the Division 293 election form to the ATO, not to the super […]

Uber Drivers Not Employees

The Fair Work Ombudsman has completed its investigation relating to Uber Australia Pty Ltd and its engagement of drivers, concluding that the relationship between Uber Australia and the drivers is not an employment relationship. The investigation found that Uber drivers are not subject to any formal or operational obligation to perform work. Instead, Uber drivers […]