Latest News

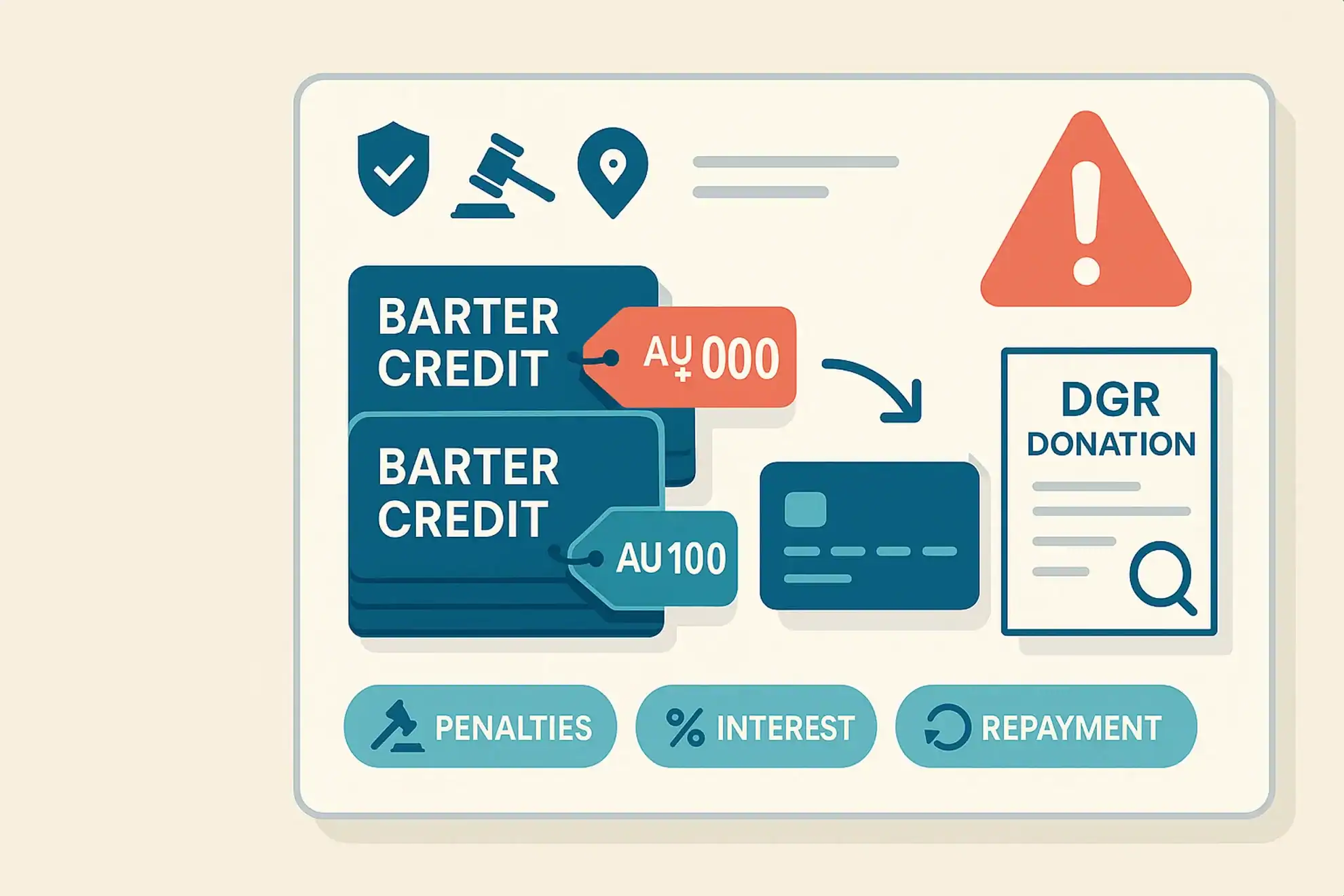

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

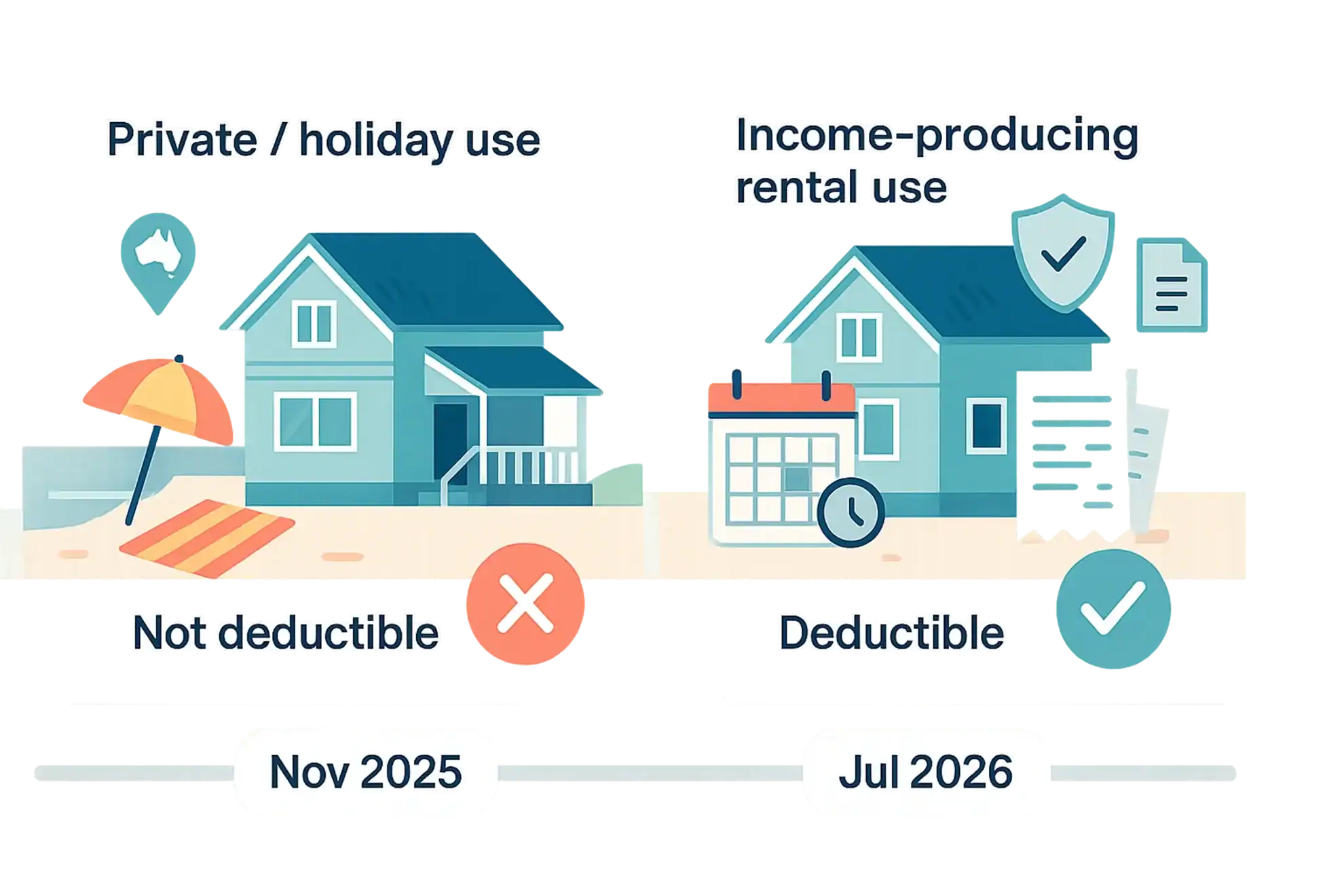

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

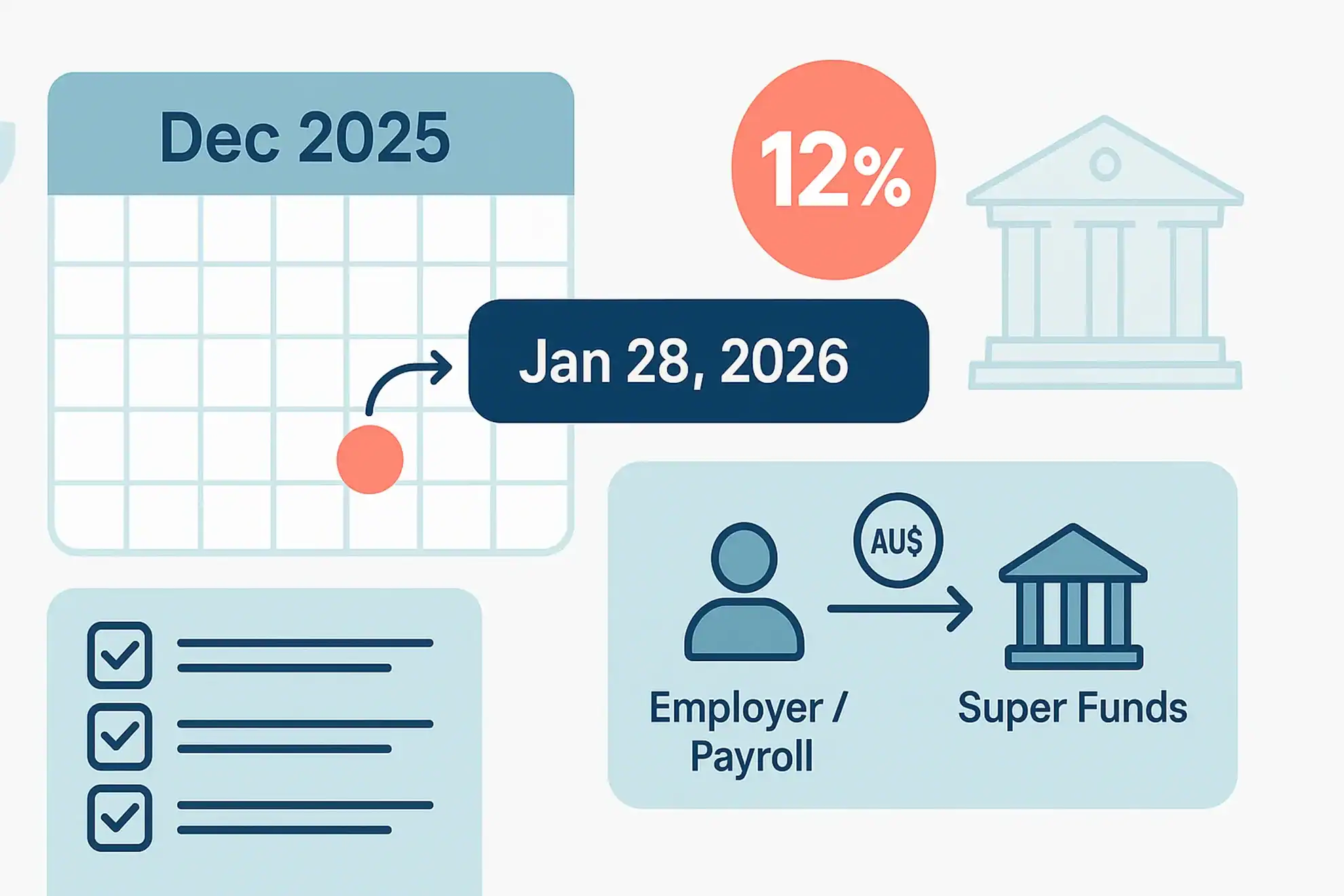

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

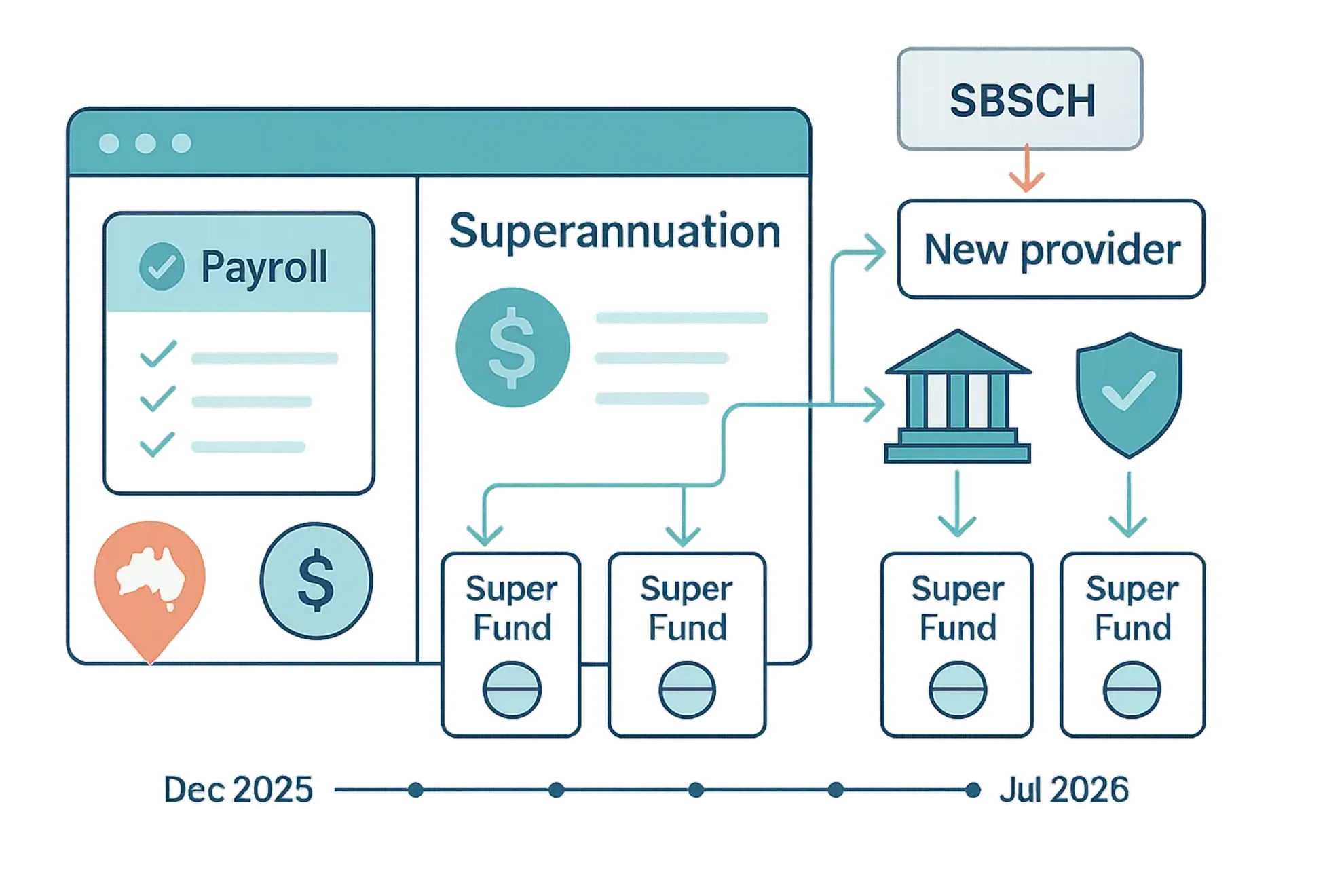

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

ATO Recommends You Update Your ABN Details For Disastrous Reasons

The ATO has provided a novel, though important, reason for businesses to update their ABN details: to help businesses to manage the coming disaster season. ABN details are used by emergency services and government agencies to help identify and contact businesses during times of emergency and potential disaster. Therefore, to make sure they don’t miss […]

Measuring The Integrity Of The ABR

From September, the Australian Business Register (‘ABR’) will contact a random sample of ABN holders across all entity types to: confirm their business information; discuss how they use the ABN, and check their understanding of how ABNs are used; find out about their registration experience and ask for suggestions for how they can improve it; […]

Using The Cents Per Kilometre Method

The ‘cents per kilometre’ method broadly allows an individual taxpayer to claim up to a maximum of 5,000 business kilometres per car, per year without the need to keep any written evidence (e.g., receipts) of car expenses. Importantly, taxpayers making a ‘cents per kilometre’ claim are required to demonstrate that they worked out the number […]

Deductions For A Company Or Trust Home-Based Business

The ATO has reminded taxpayers that, if they run their home-based business as a company or trust, their business should have a genuine, market-rate rental contract (or similar agreement) with the owner of the property. The agreement will determine which expenses the business pays for and can claim as a deduction. If there isn’t a […]

Super Guarantee Opt-Out For High Income Earners Now Law

From 1 January 2020, eligible individuals with multiple employers can apply to opt out of receiving super guarantee (‘SG’) from some of their employers, to help them avoid unintentionally going over the concessional contributions cap. If appropriate for them, they should submit the relevant ATO form to apply for an SG employer shortfall exemption certificate, […]

Federal Court Provides Clarification On The PSI Rules

The Federal Court recently handed down two decisions relating to the personal services income (‘PSI’) rules. Income is classified as PSI when more than 50% of the income received under a contract is for a taxpayer’s labour, skills or expertise. The PSI rules are integrity provisions which ensure individuals cannot reduce or defer their income […]