Latest News

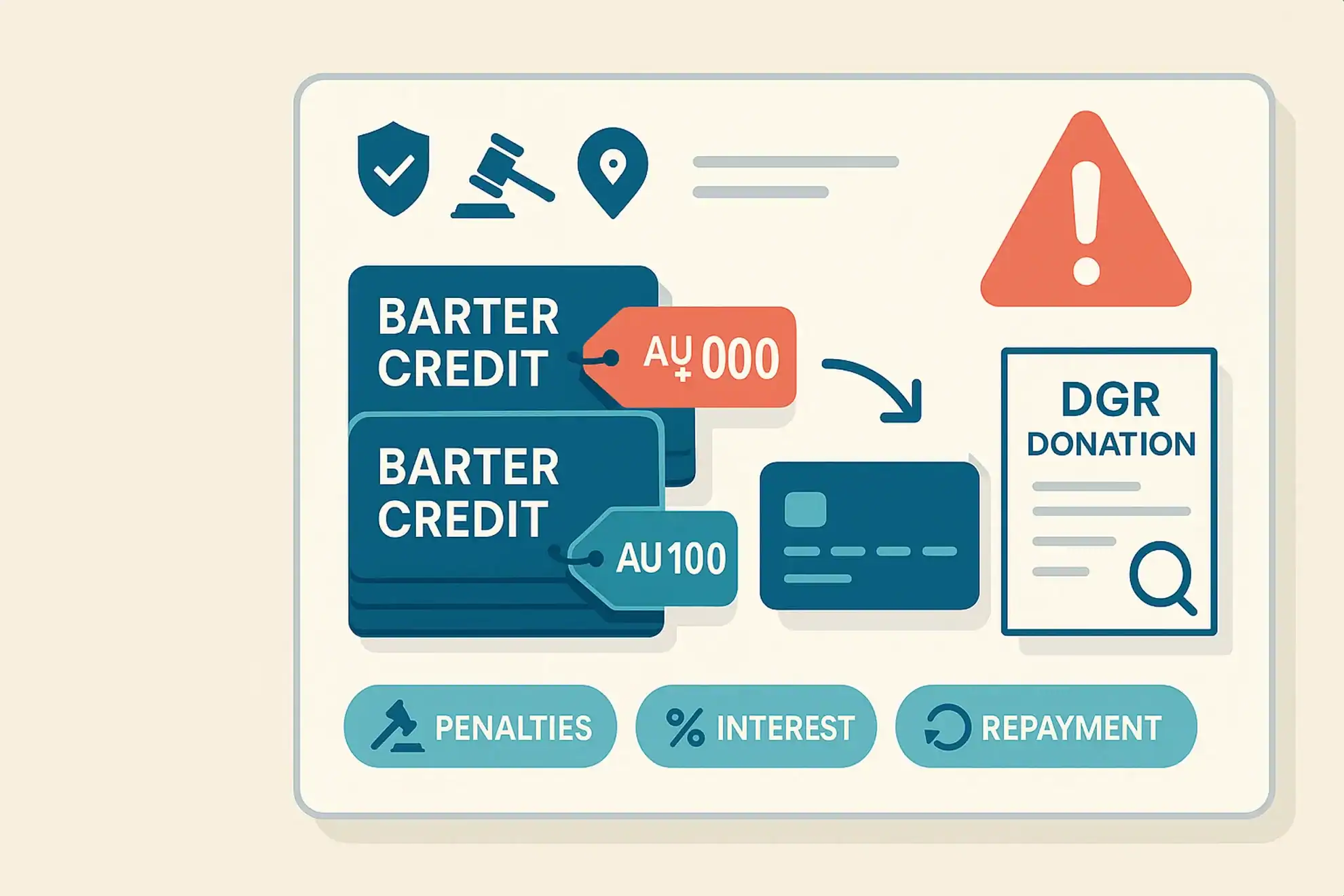

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

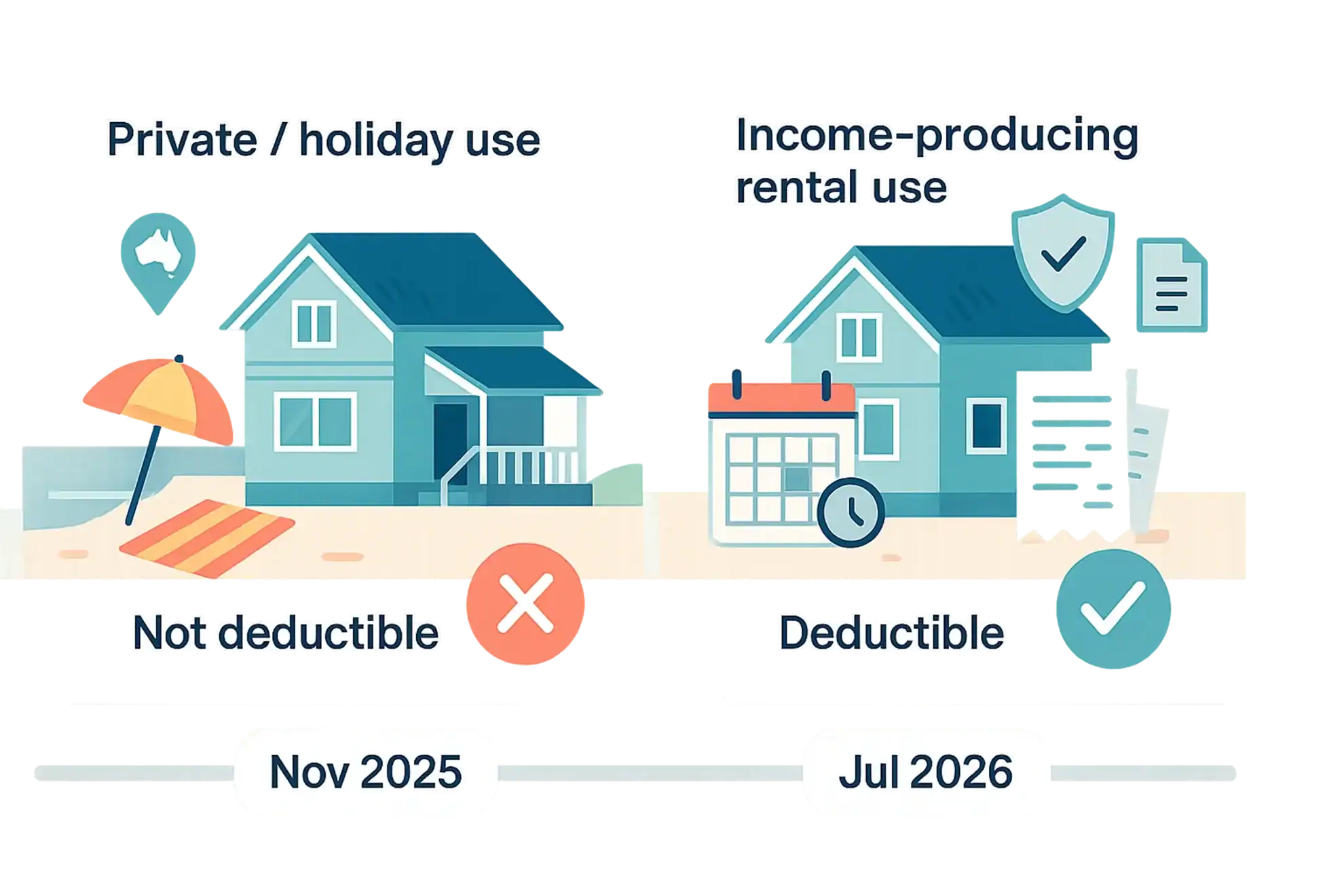

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

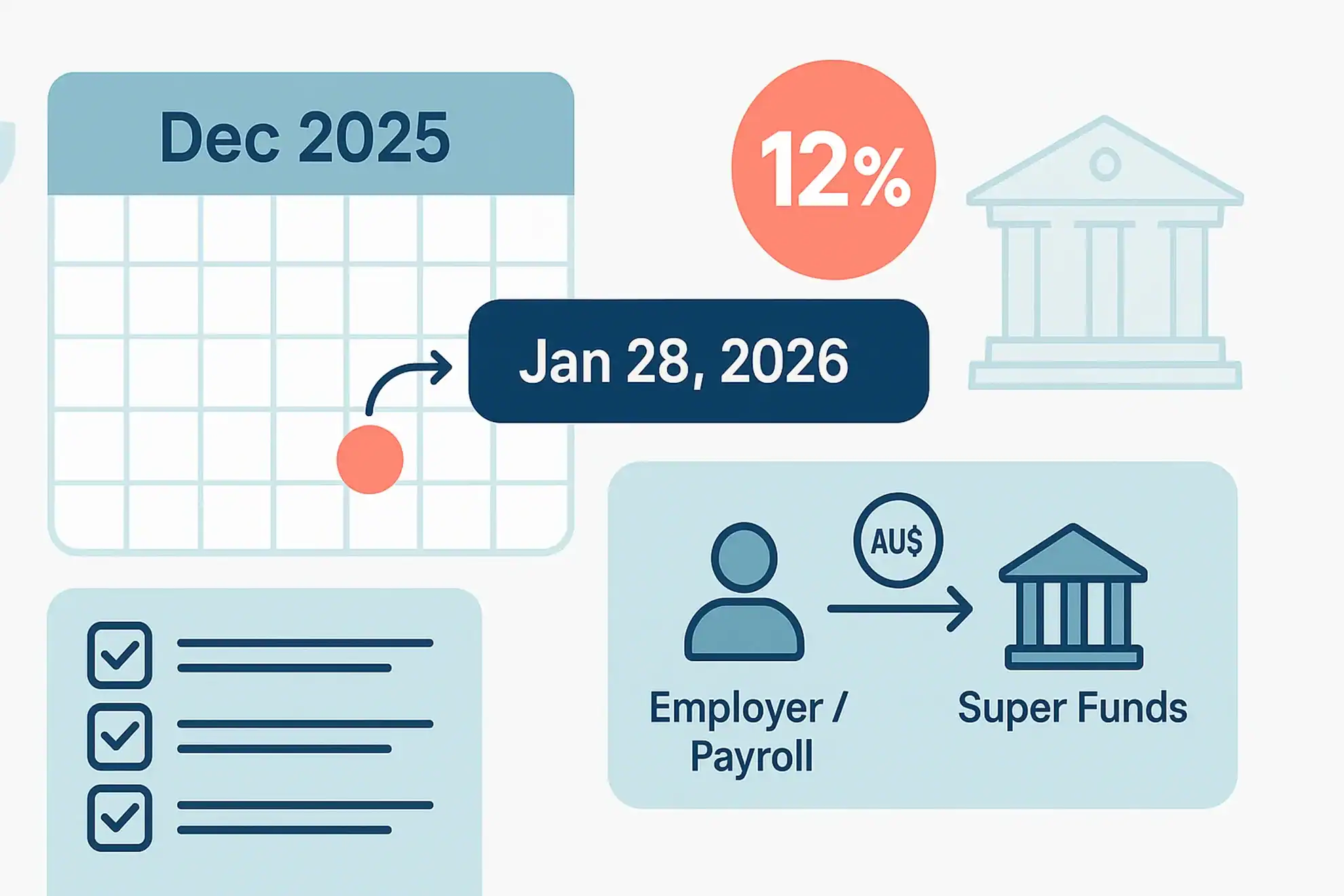

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

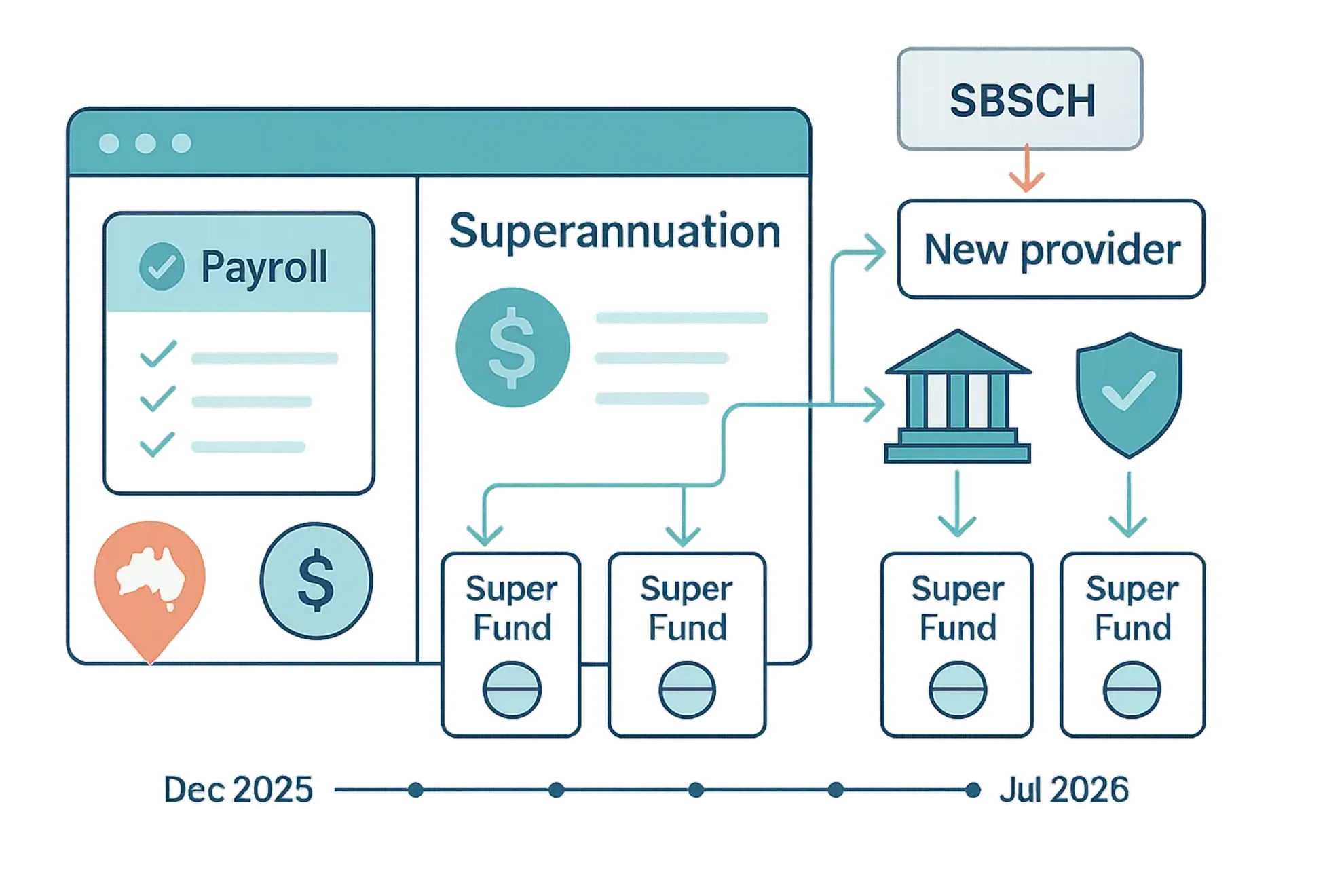

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Government Payments Data-Matching Program

| | | The ATO’s government data matching for payments will acquire government payments data from government entities who administer government programs for 2017/18 to 2022/23 financial years. The data items include: service provider identification details (names, addresses, phone numbers, email, dates of birth, service type, ABN, ACN); and payment details (service provider ID, name […]

Preparing For The New Director ID Regime

| | | As part of its Digital Business Plan, the Government announced the full implementation of the ‘Modernising Business Registers’ program. This included recently enacted legislation introducing the new director identification number (‘director ID’) regime. The director ID is a unique identifier that a director will need to apply for once and will keep […]

Do You Use the Small Business Superannuation Clearing House?

| | | The ATO has advised employers intending to claim a tax deduction for super payments that they make for employees in the 2020/21 income year that any such payments must be accepted by the Small Business Superannuation Clearing House (‘SBSCH’) on or before 23 June 2021. This allows processing time for the […]

Family Assistance Payments

| | | The ATO has reminded individuals receiving Child Care Subsidy and Family Tax Benefit payments from Services Australia that they and their partners must lodge their 2019/20 Individual tax returns by 30 June 2021. Lodgement deferrals with the ATO do not alter this requirement. Services Australia needs such individuals’ income details to […]

Car Parking Threshold For 2022 FBT Year

| | | The car parking threshold for the FBT year commencing on 1 April 2021 is $9.25. This replaces the amount of $9.15 that applied in the previous FBT year commencing 1 April 2020.

Temporary Reduction in Pension Minimum Drawdown Rates Extended

| | | The Government has announced an extension of the temporary reduction in superannuation minimum drawdown rates for a further year to 30 June 2022. As part of the response to the coronavirus pandemic (and the negative effect on the account balance of superannuation pensions), the Government reduced the superannuation minimum drawdown rates […]