Latest News

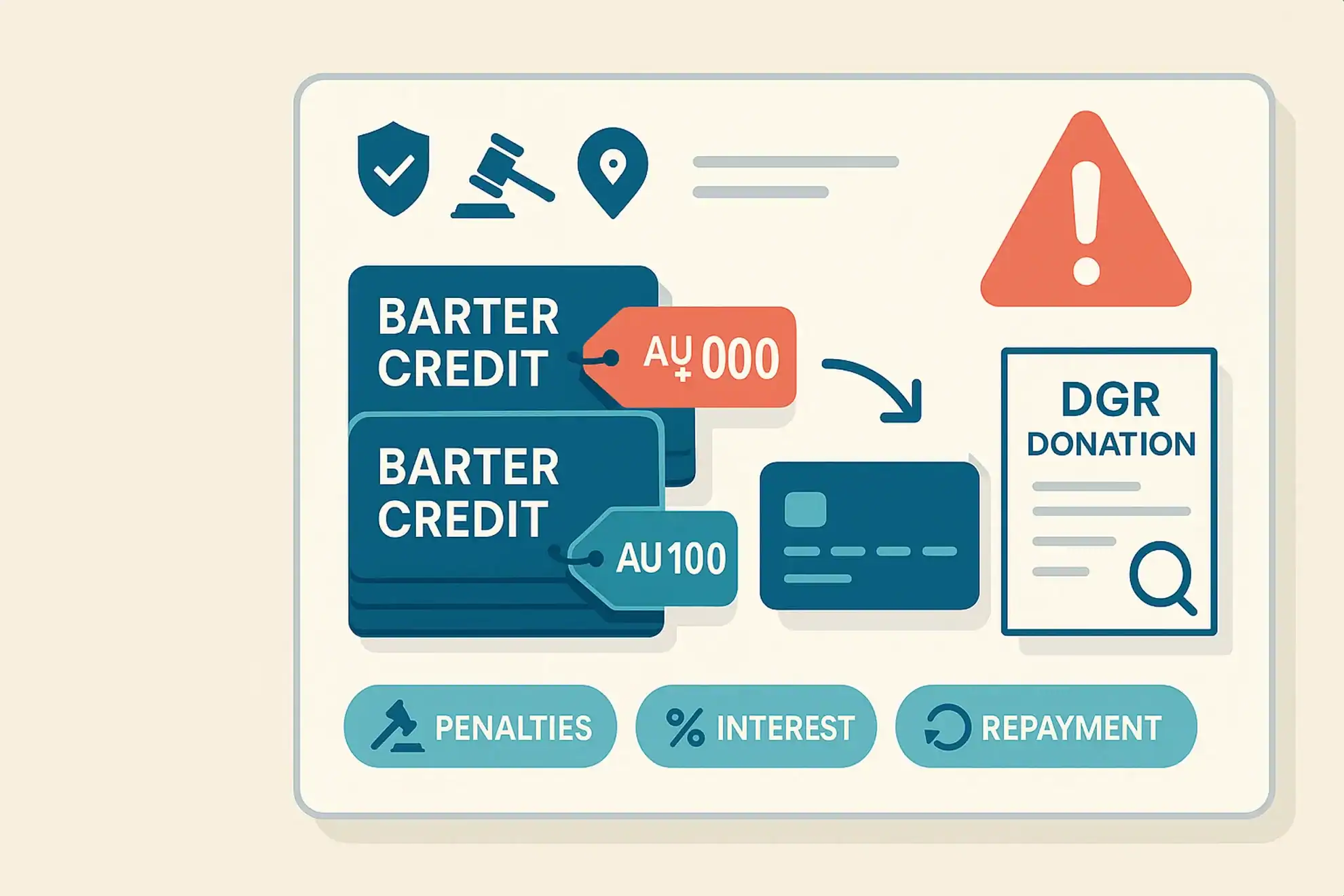

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

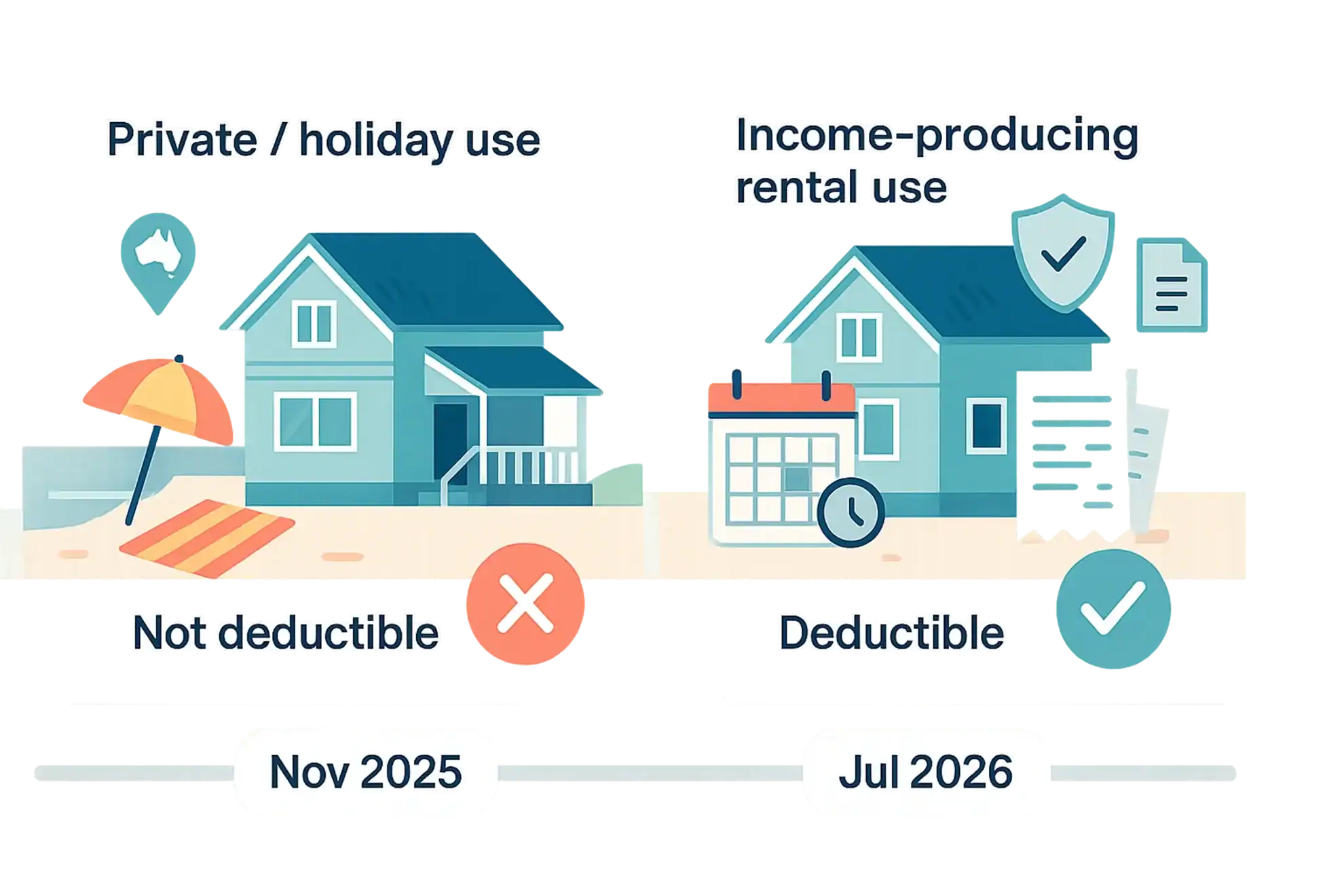

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

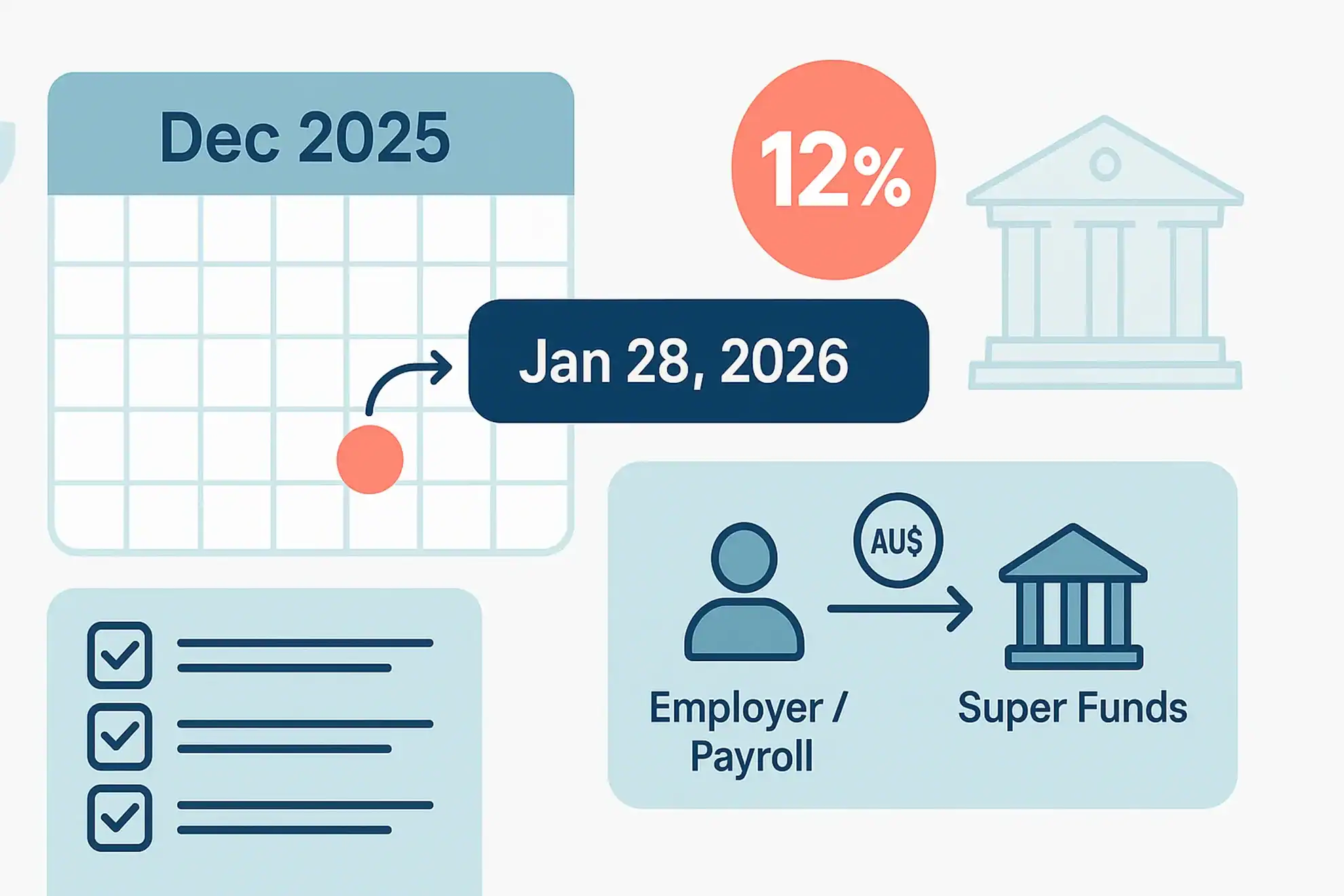

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

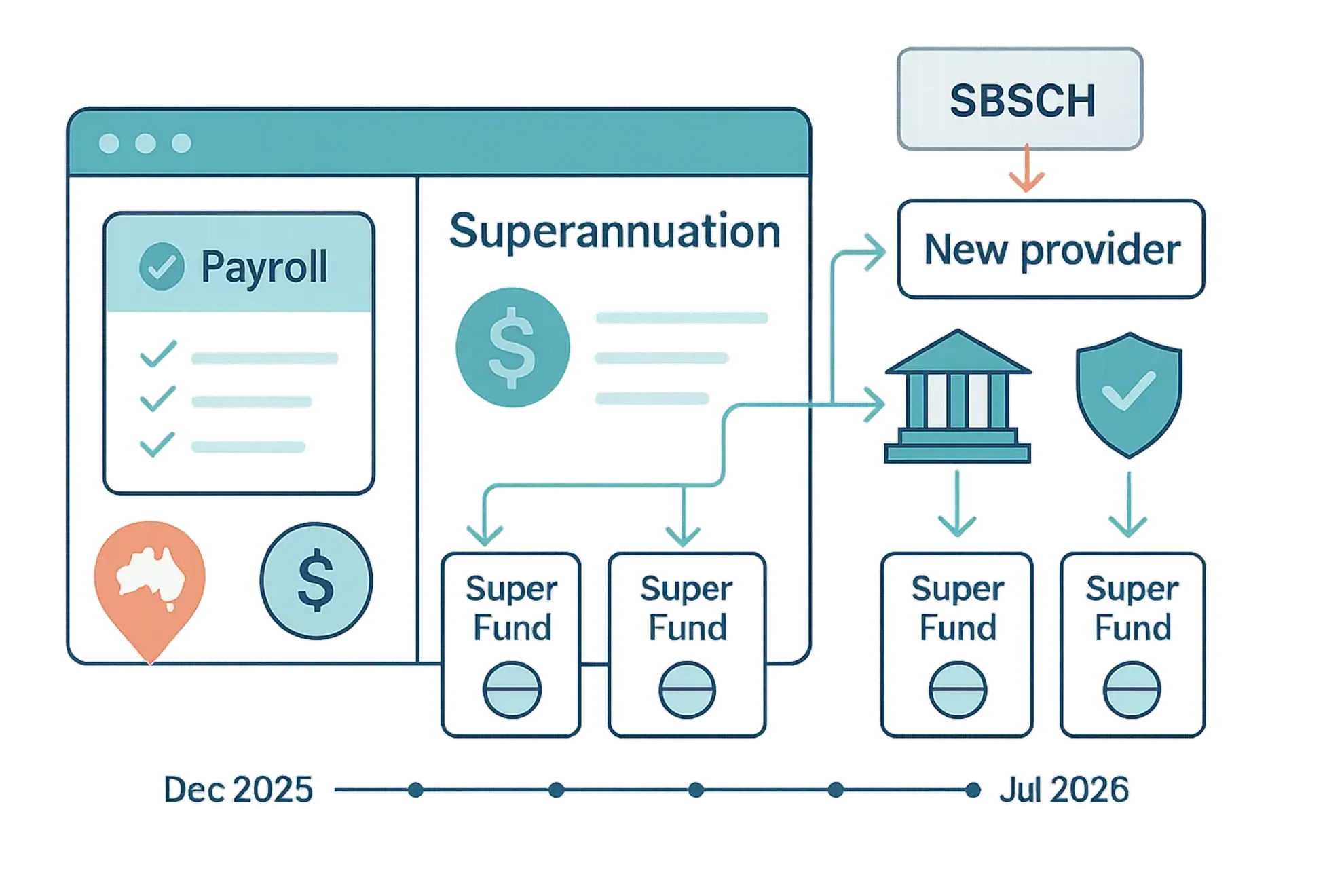

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

ATO SMSF Statistics 2020 Overview Of Lodgments Published

As of 30 June 2021, SMSFs have been reported as making up 25% of all super assets (i.e., $822 billion as of 30 June 2021). At the same time, there were approximately 598,000 SMSFs with almost 1.115 million individual members. Furthermore, as of 30 June 2020, on average, each SMSF has assets of just over […]

SMSF Recordkeeping

Trustees of SMSFs have been put on notice by the ATO that keeping and maintaining good records is one of their key responsibilities and legal obligations. Good record keeping ensures trustees can ensure accurate and timely SMSF accounts, audits and income tax return lodgments. As a result, the ATO has recently confirmed that even where […]

12-Month Extension Of The Temporary Loss Carry Back Tax Offset

As announced in the 2020/2021 Federal Budget, legislation has now passed to allow eligible corporate entities (i.e., with, amongst other things, an aggregated turnover of less than $5 billion) a 12-month extension to claim a loss carry-back tax offset in the 2023 income year. The temporary loss carry-back rules were initially implemented in 2020 to […]

Super Changes And Full Expensing 12-Month Extension Now Law

A plethora of superannuation law tweaks has recently been made (via recent legislative reforms) which include: Removing the $450 monthly super guarantee threshold. Reducing the eligibility age for making downsizer contributions from 65 to 60. Changes to facilitate the removal of the work test for those aged between 67 and 75 regarding non-concessional and salary […]

Tax Deductibility Of COVID-19 Test Expenses

After much speculation, the Government announced that COVID-19 tests, including Polymerase Chain Reaction (‘PCR’) and Rapid Antigen Tests (‘RATs’), will be both: tax-deductible; and exempt from FBT; broadly where they are purchased for work-related purposes. This will require the introduction of new specific legislation (i.e., to clarify that work-related COVID- 19 test expenses incurred by […]

Covid Test Costs To Be Tax Deductible

The Australian government announced on 7 February 2022 that legislation will be changed to ensure covid test costs will be tax deductible for the 2022 financial year. The deduction will apply both when an individual is required to attend the workplace or has the option to work remotely. What testing expenses will you be able […]