Latest News

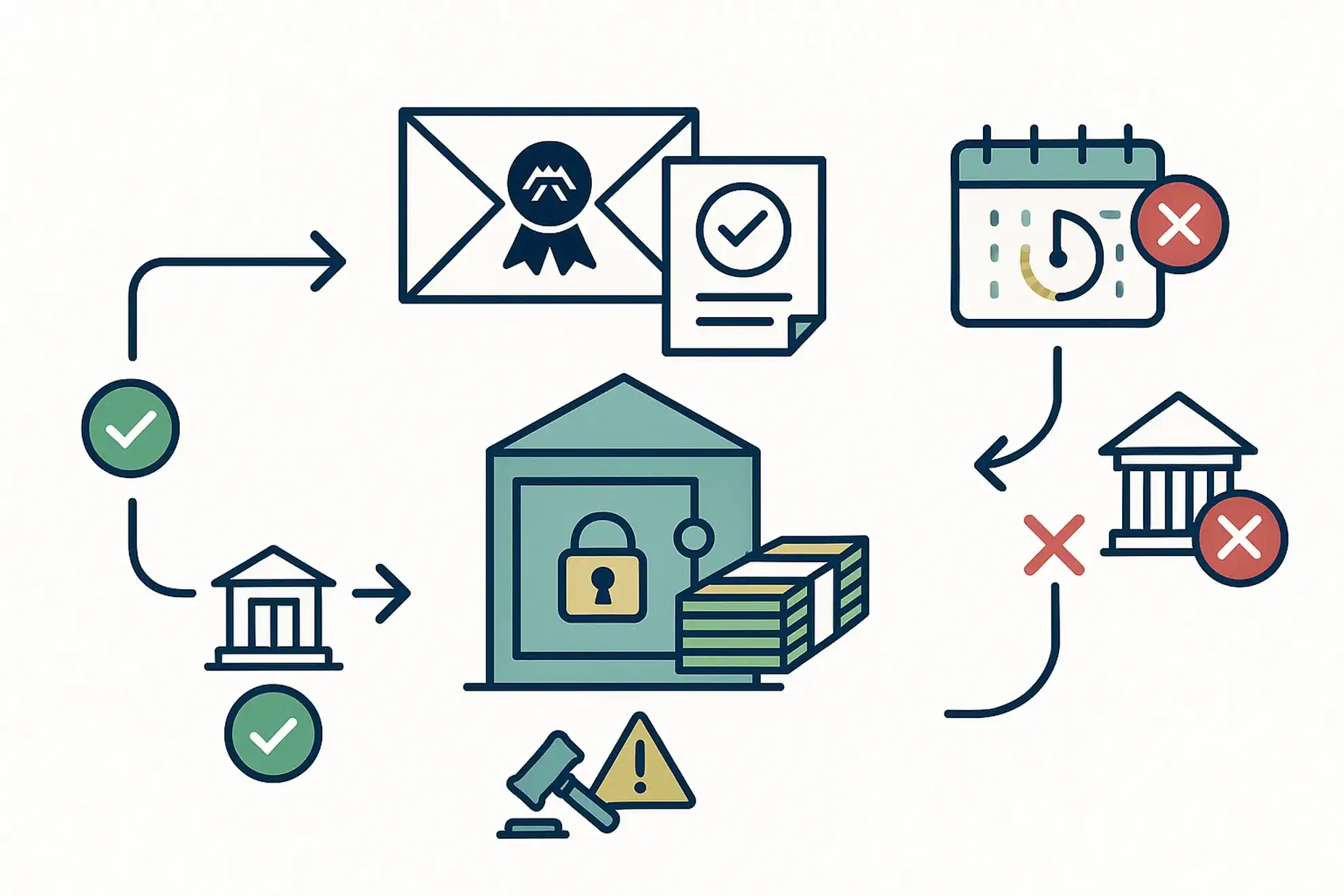

SMSF non-compliance with release authorities

Release authorities are documents issued by the ATO to super funds, authorising the release of money from a member’s super account to pay specific liabilities, including in relation to excess concessional contributions, excess non-concessional contributions, and Division 293 tax assessments. The ATO is seeing a rise in SMSFs that receive a release authority and are […]

New ATO Data-Matching Programs

The ATO acquires and uses data for pre-filling, detecting dishonest or fraudulent behaviour, and identifying areas where it can educate taxpayers to help them understand their tax obligations. When data does not match, the ATO may contact tax agents and their clients to find out why. Rental Income Data-Matching Over the coming months, the ATO […]

ATO’s focus on small business

The ATO is ‘detecting and addressing’ recurring errors in specific industries when businesses have a turnover between $1 million and $10 million. These industries include property and construction (including builders, contractors and tradies), and professional, scientific and technical services (including engineering, design, IT and consulting professionals). In these industries, the ATO continues to see recurring […]

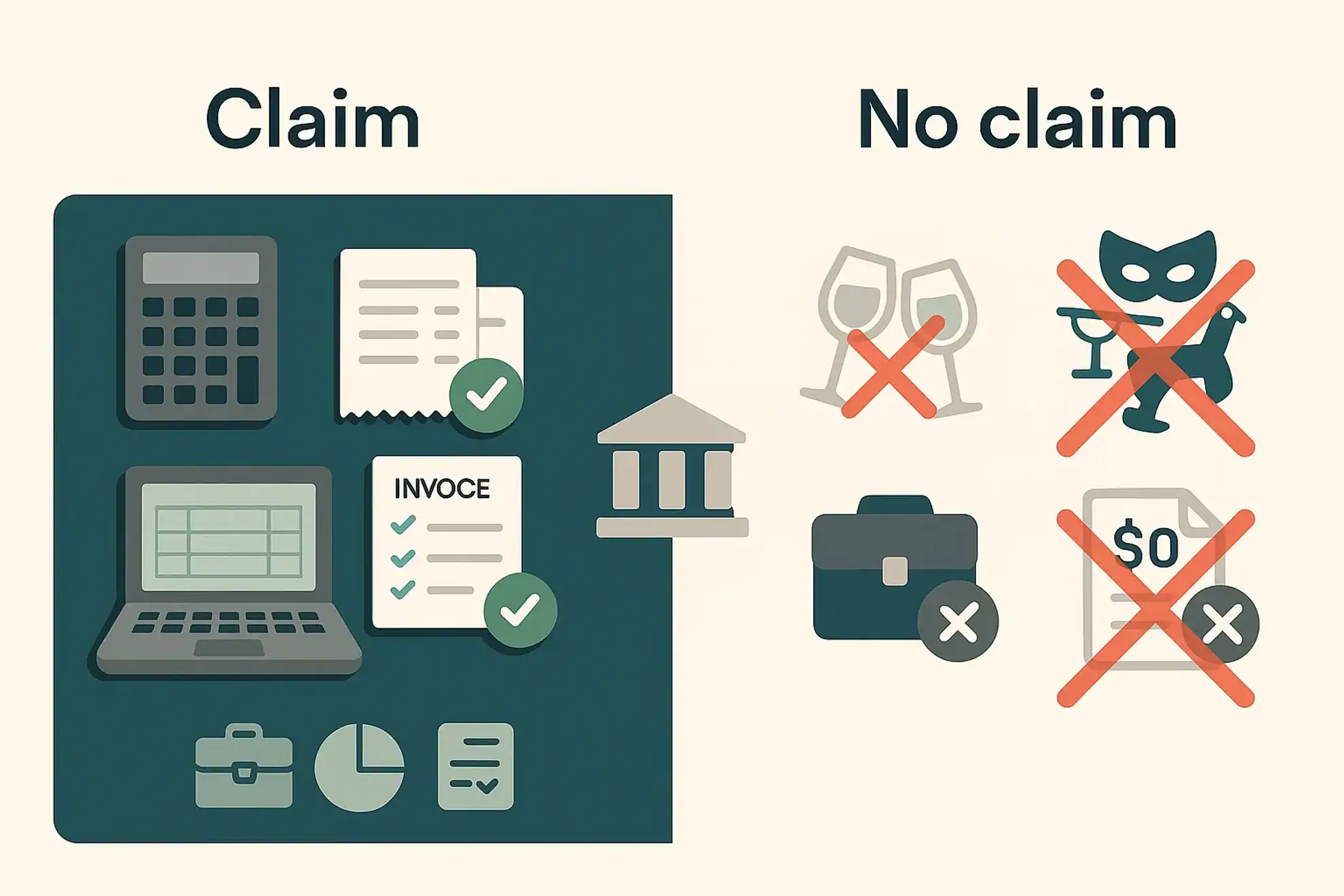

ATO reminder: Business expenses that can (and cannot) be claimed

Taxpayers can claim a tax deduction for most business expenses, provided they meet the ATO’s three ‘golden rules’: The expense must be for business use, not for private use. If the expense is for a mix of business and private use, they can only claim the portion that is used for business. They must have […]

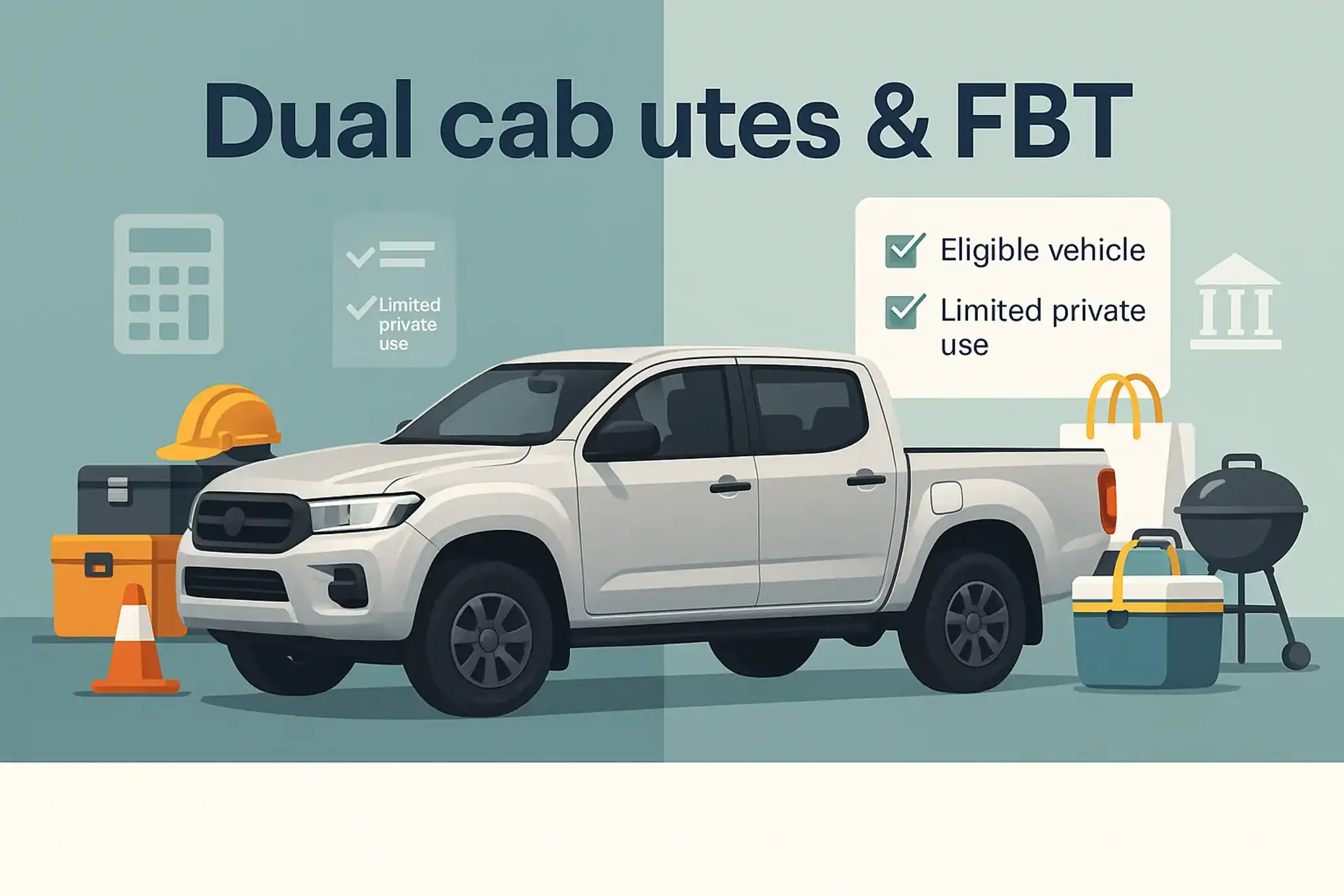

Dual cab utes and FBT

The ATO wishes to dispel the ‘common myth’ that dual cab utes are automatically exempt from fringe benefits tax (‘FBT’). If an employer provides dual cab utes to staff to complete their duties and the vehicle is available for personal use, then the benefit may be subject to FBT. By understanding how their employees use […]

ART dismisses argument that medical expenses were deductible

In a recent decision, the Administrative Review Tribunal (‘ART’) held that a taxpayer could not claim a tax deduction for medical expenses incurred by him in relation to his total and permanent disability pension. The taxpayer had been terminated from his employment due to total and permanent disablement (‘TPD’). For the 2024 income year, his […]

Business or hobby?

You may be unsure whether you’re in business, or your activity is just a hobby. A hobby is a spare-time activity or pastime pursued for pleasure or recreation. Unlike a hobby, a business is run with the intention of making a profit and has basic reporting requirements, such as declaring income and claiming expenses. It’s […]

Renting Out Part Or All Of Your Home

Generally, if you rent out part or all of your home, the rent money you receive is assessable. This means that you must declare your rental income in your income tax return, but you can also claim deductions for any associated expenses. However, be warned. If you rent out part of your home, such as […]

Gumboots? Check, Akubra? Check. Tax Status? …

Hobby farming is a lifestyle choice that has been around for years and looks like an option that, if anything, is on the increase. It can be easy to poke fun at the typical hobby farmer (like the old joke about their skills at growing blackberries and rabbits). For many the choice to embrace the […]

I’m a volunteer. Any taxing issues?

From sporting clubs or environmental groups to many charity associations, volunteers are an indispensible workforce and support network for many organisations. For most, if not all, having volunteers ready to lend a hand is pivotal in them being able to function or survive. Given that there are many hundreds of volunteers propping up all sorts of […]

What types of legal expenses are allowable as tax deductions?

When a legal expense is incurred in relation to the operation of a business for the purpose of producing assessable income, it is generally allowable as a deduction. Exceptions are when the legal fee is capital, domestic or private in nature, if it is specifically excluded by another section of income tax legislation, or is […]

When is refinancing loan interest deductible to a partnership?

About General Law and Tax Law Partnerships A general law partnership is formed when two or more people (and up to, but no more than, 20 people) go into business together. Partnerships are generally set up so that all partners are equally responsible for the management of the business, but each also has liability for […]