Latest News

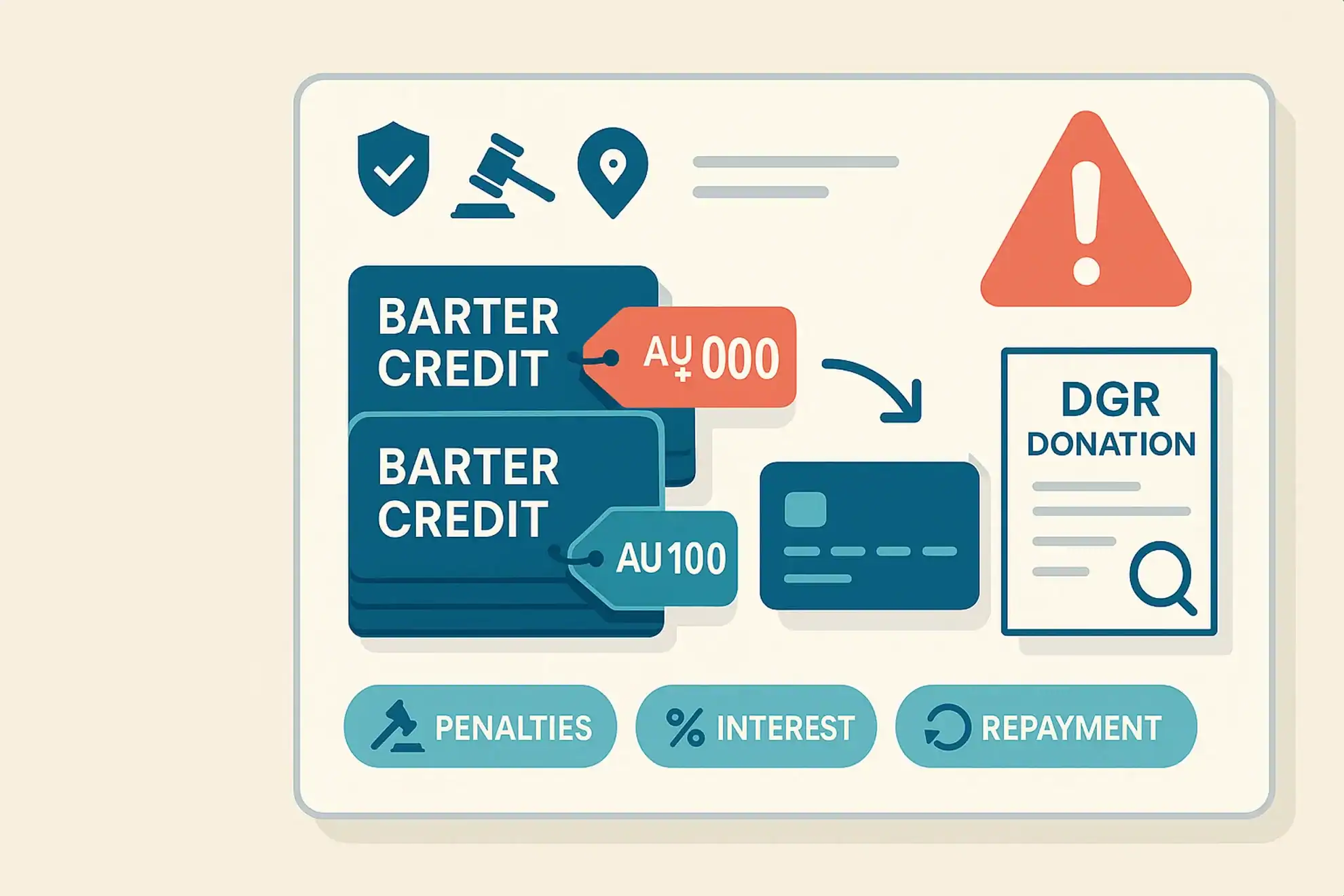

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

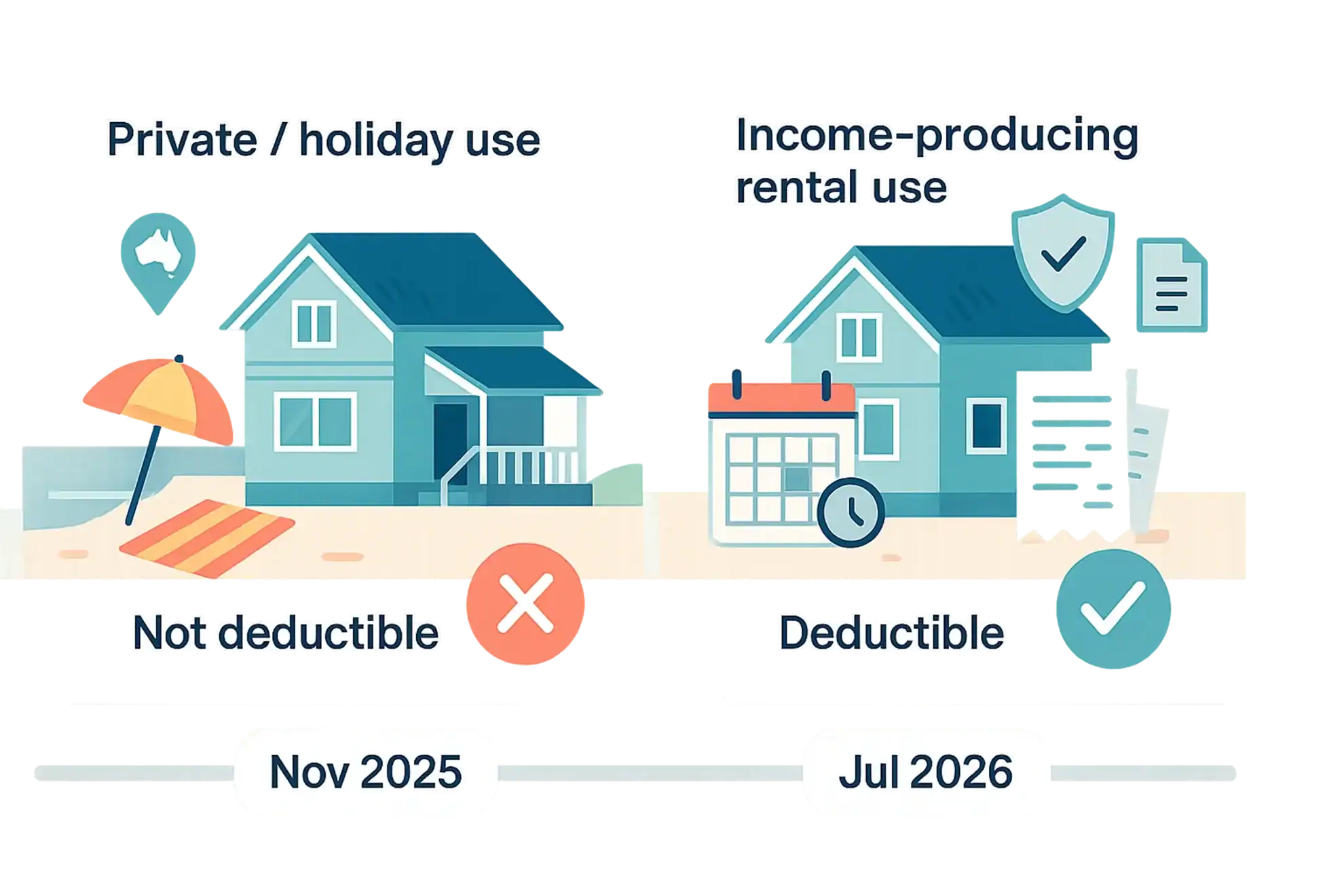

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

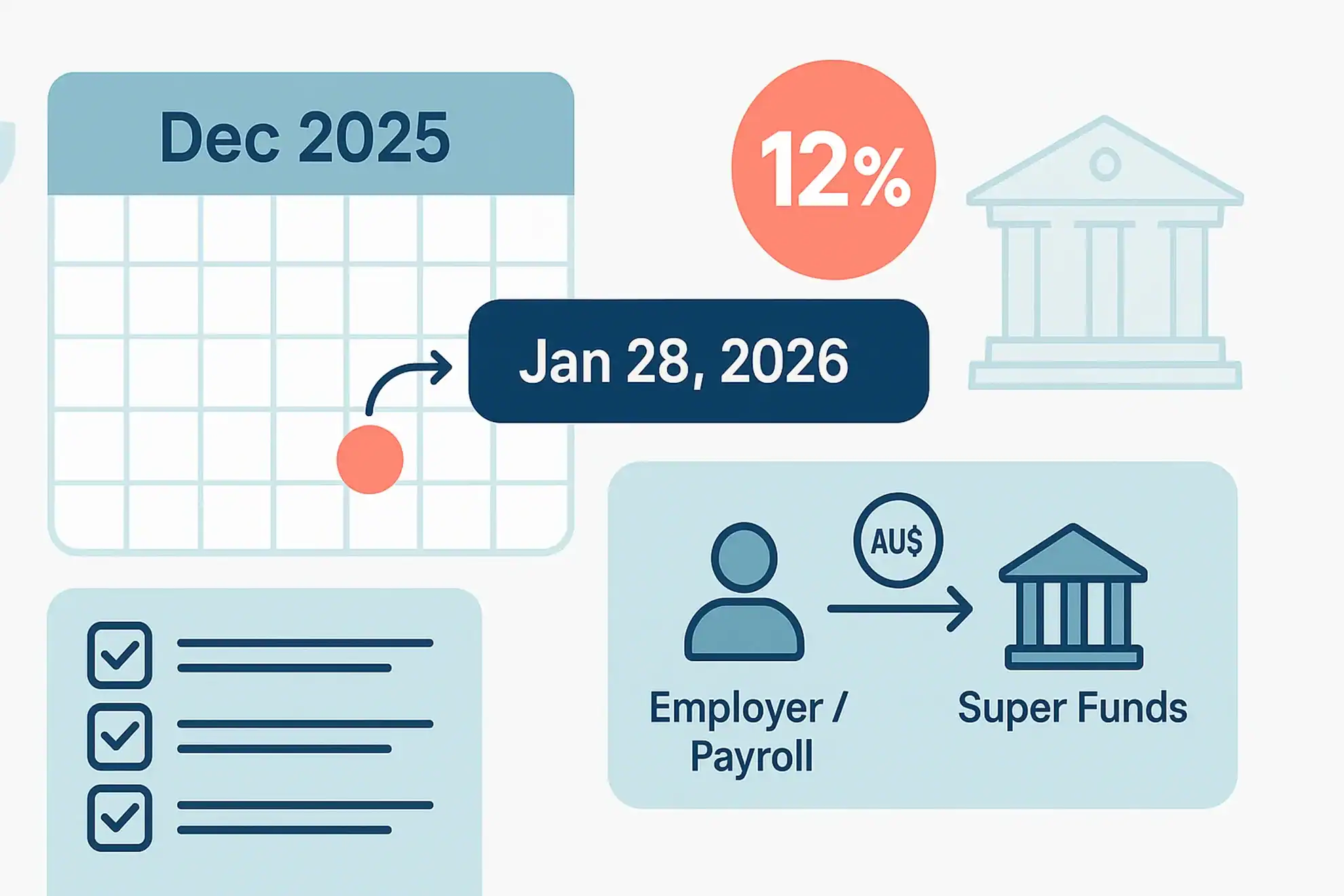

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

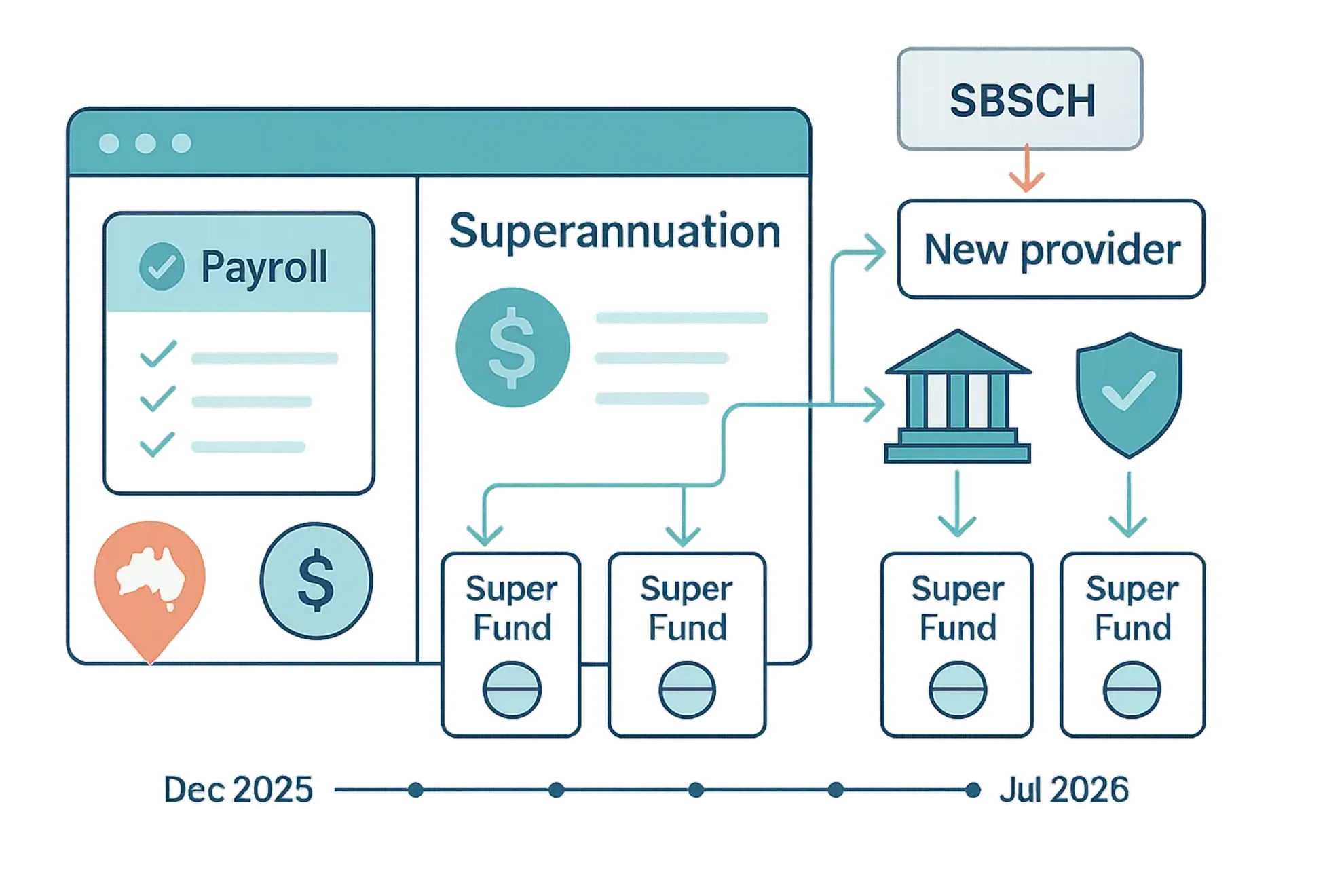

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Changing Business Structures

| | | Are you outgrowing your current business structure or is your business growing at a rate you cannot keep up with? You may need to consider changing your business structure. Here are the four main business structures. Sole trader Partnership Company Trust Each structure has different reporting requirements. So, it’s imperative you understand […]

Disclosure Of Business Tax Debts – Declaration Made

| | | Following the enactment of legislation in late 2019, the ATO can disclose certain business tax debt information to external credit reporting bureaus. This information will primarily be used when issuing external creditworthiness reports in relation to relevant businesses, effectively treating tax debts in a similar manner to other business debts. More […]

Lost or stolen TFN

If you can’t find your TFN and do not suspect misuse, phone the Australian Tax Office (ATO) on 13 28 61 between 8:00am and 8:00pm Monday to Friday and 10:00am to 4:00pm Saturday. You can also phone the ATO on Sunday between 10.00am to 4.00pm from 1 July to 31 October. If you have a […]

Fraudulent ‘Phoenix’ Activities

Fraudulent ‘phoenix’ activity occurs where a company deliberately liquidates to avoid paying creditors, taxes and employee entitlements. The perpetrators transfer the assets to a new entity, and continue operating the same or a similar business with the same ownership. Phoenix activity has impacts on the business community, employees and contractors, the government and the environment, […]

How Much Tax Do I Need To Pay?

We often receive phone calls from our Clients asking us whether they are being taxed correctly in their wages. If you are unsure whether you are being taxed correctly, the ATO has an online calculator where you can answer a series of questions relating to your wages which will determine what tax should be withheld […]

What is the Medicare Levy

Quite often we are asked about the Medicare Levy. Common questions are “What is it?”, “Why do I have to pay it” and “Is there a way I can avoid paying it”. So we’ve broken it down for you below. What is Medicare Levy? Australian Residents are entitled to Medicare benefits which is access to […]