Latest News

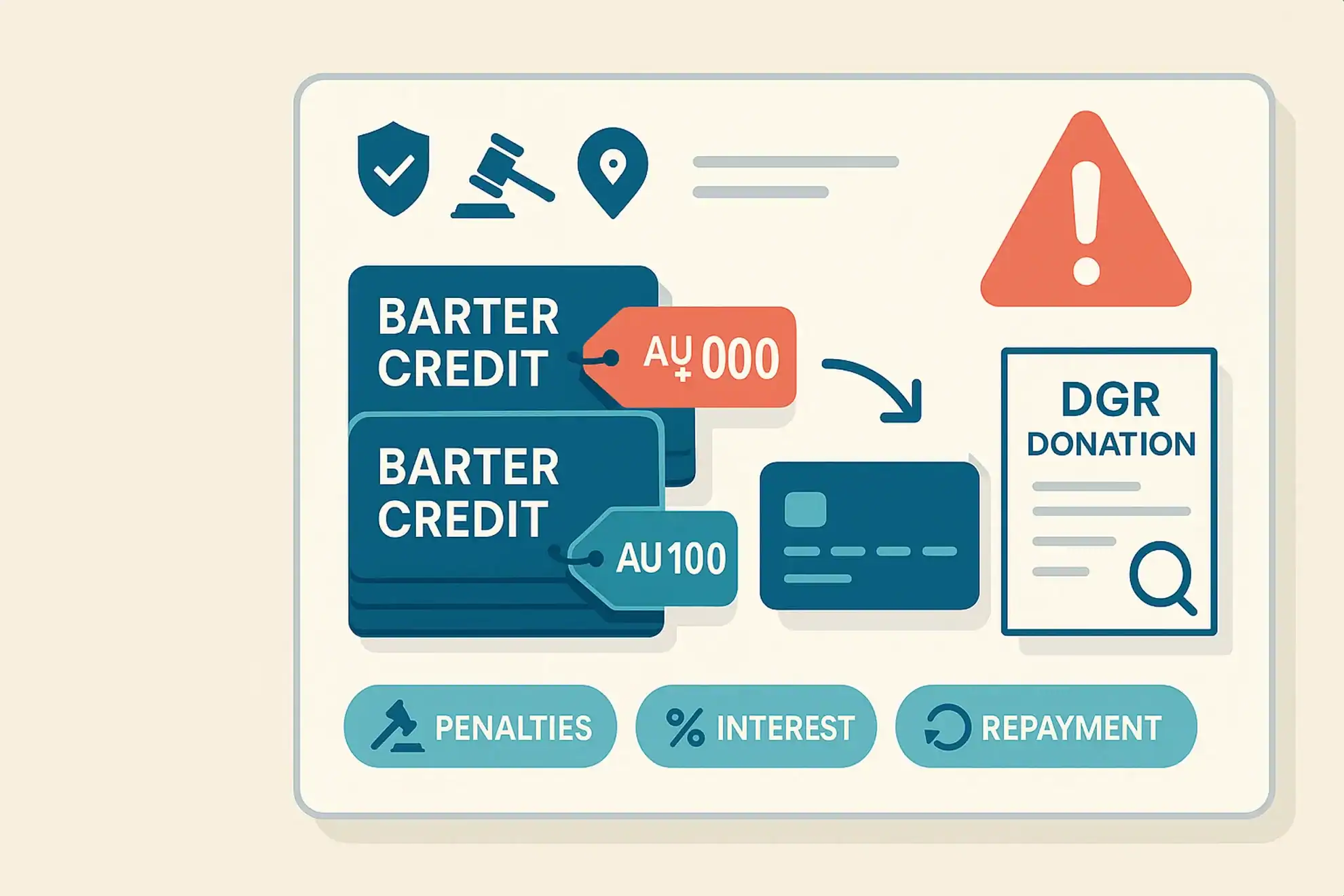

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

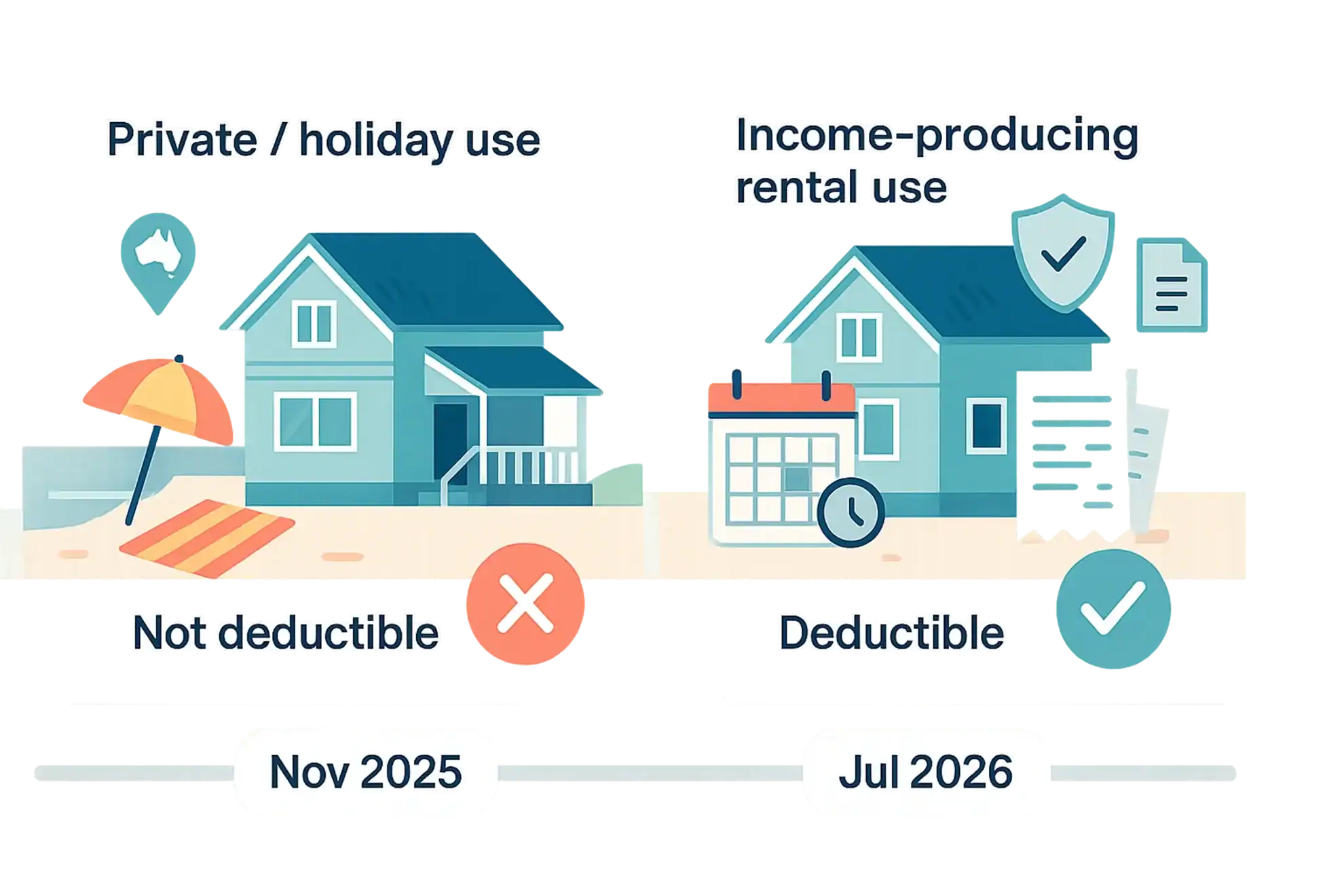

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

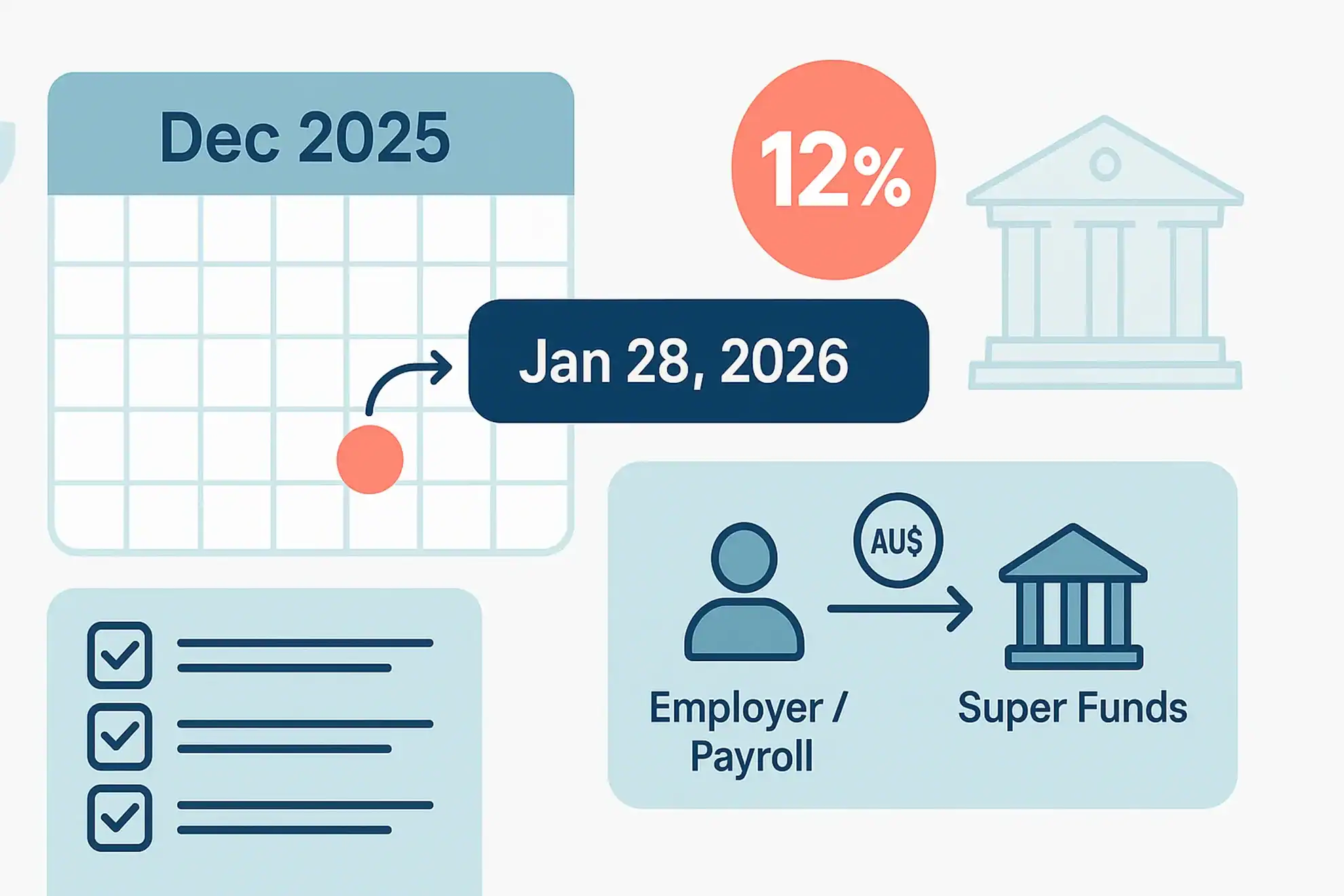

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

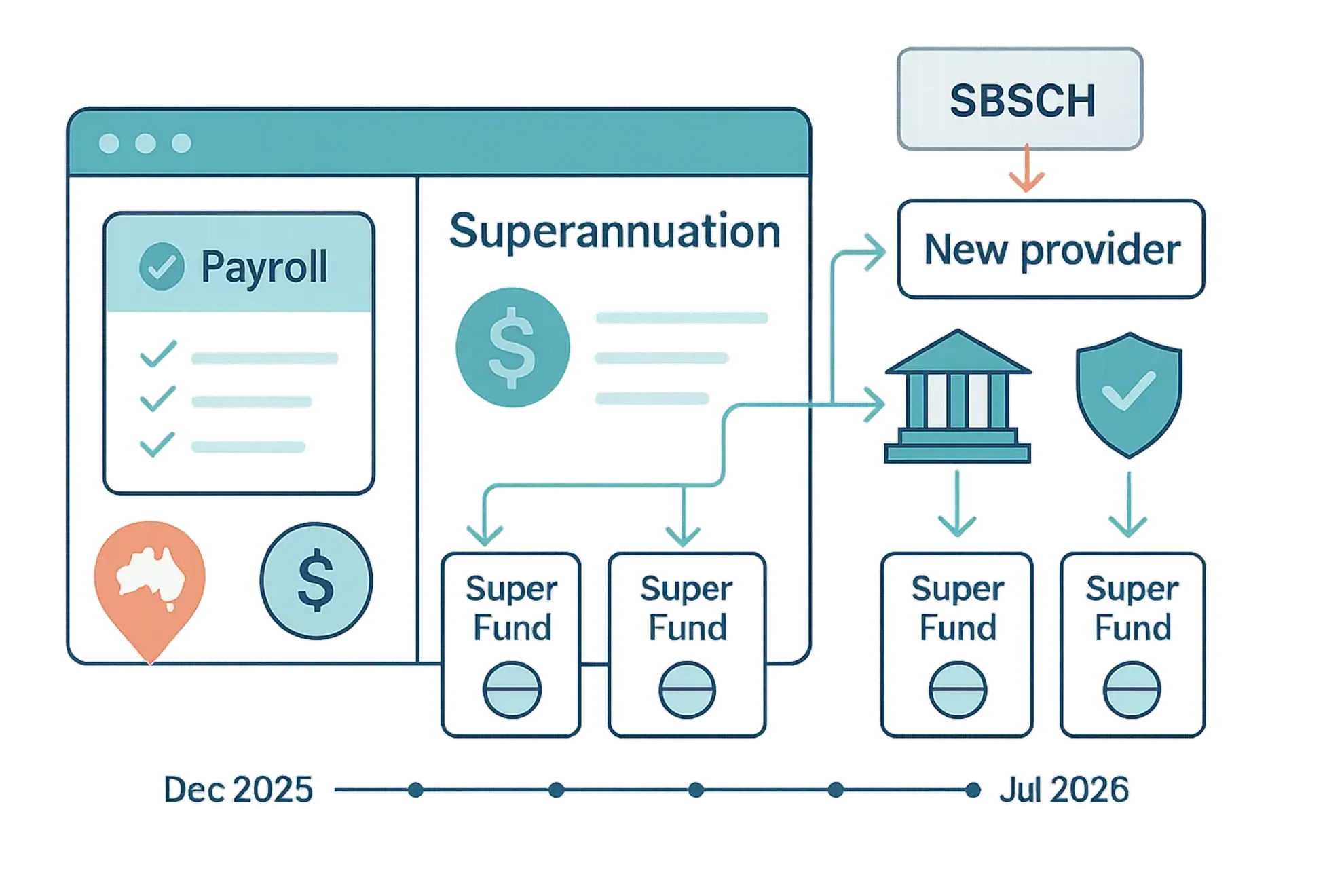

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

How to Deal with SMSF Trustee Disputes

Everyone goes through the odd rough patch in their relationships with one another and SMSF trustees are no different. However the ramifications of a dispute between trustees are likely to have more wide ranging affects than the average quarrel between friends because SMSF trustees have vested interests, established duties and legal responsibilities towards the fund, […]

Tax Tips for Entrepreneurs

Considering small business tax implications in the early stages of a start-up is important to long-term success. Generally, when starting up a business, the most immediate concern to new entrepreneurs is profitability, with taxation somewhat near the bottom of the priorities list. Financial and tax advisors recommend incorporating taxation issues into start-up thinking, especially into […]

ATO Tax return checks

The ATO has a responsibility to government and the community to make sure that everyone pays the correct amount of tax under the law. The ATO undertakes a range of integrity checks both before and after they issue refunds or payments. In some cases, the ATO may contact you to verify some details before we […]

Investment Tax Issues You Need To Be Aware Of

Investors must consider a range of tax laws dealing with income, assets and deductions. Even that term “income”, the meaning of which most of us would assume, can take on nuanced shades of meaning when considered regarding investment. For example, investment income earnings such as dividends and interest are typically considered ordinary income. Franking credits, […]

$20000 Write Off is Only Available For Small Business, Unless …

There is an under-used gem hidden within the small business simplified depreciation rules that in some circumstances can widen the opportunity to access this valuable deduction. Everyone assumes that the $20,000 instant asset write-off is exclusive to eligible small businesses. But it is possible, under certain conditions, for individuals such as employees to be able to claim […]

ATO Waves a Red Flag On Deductions For Holiday Rentals

Just when many Australians are considering getting away for a mid-winter break, the ATO is reminding taxpayers that it is paying close attention to rental properties located in popular holiday destinations around Australia. The ATO recently issued a statement saying that last year it identified a large number of mistakes with deductions for rental properties, […]