Latest News

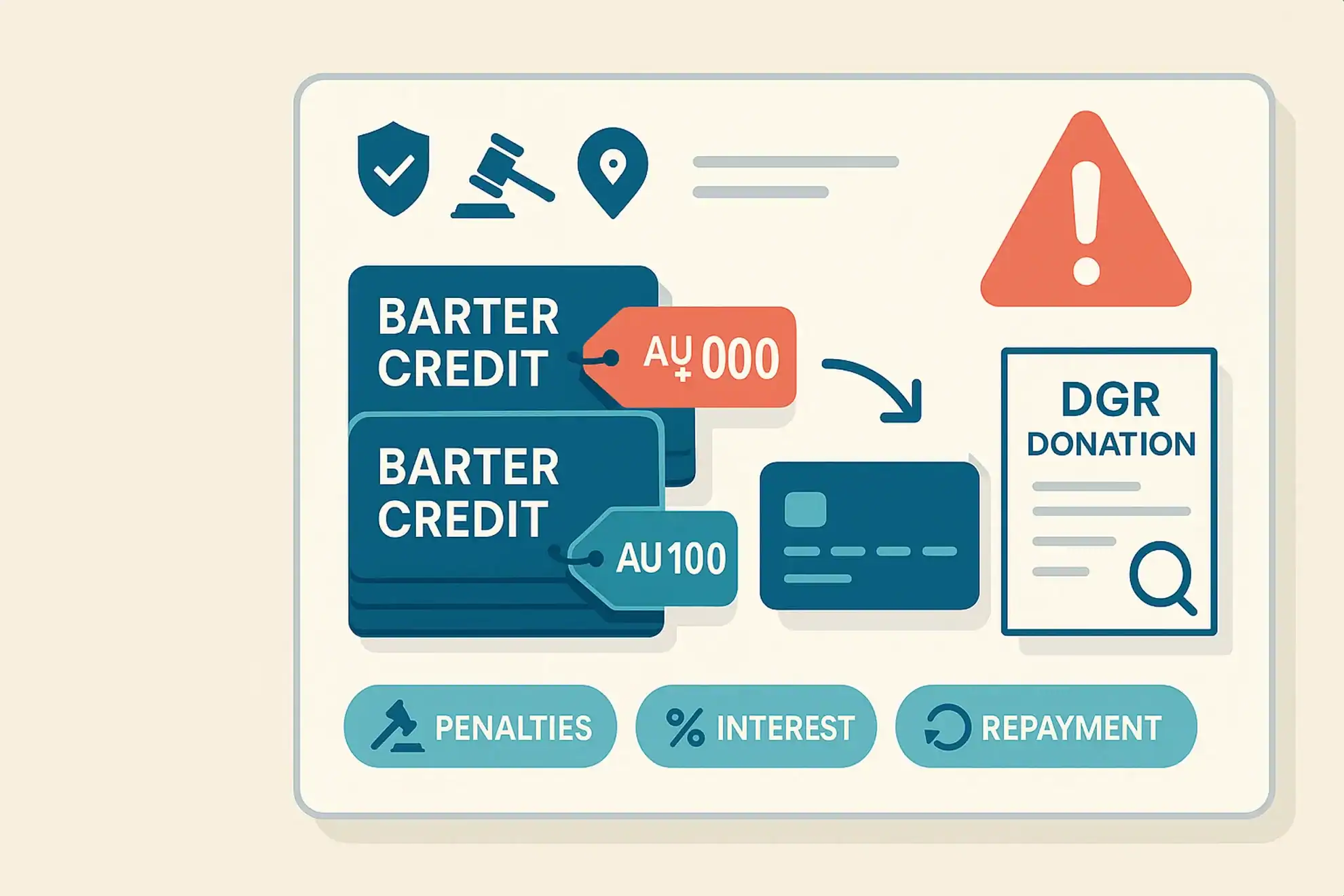

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

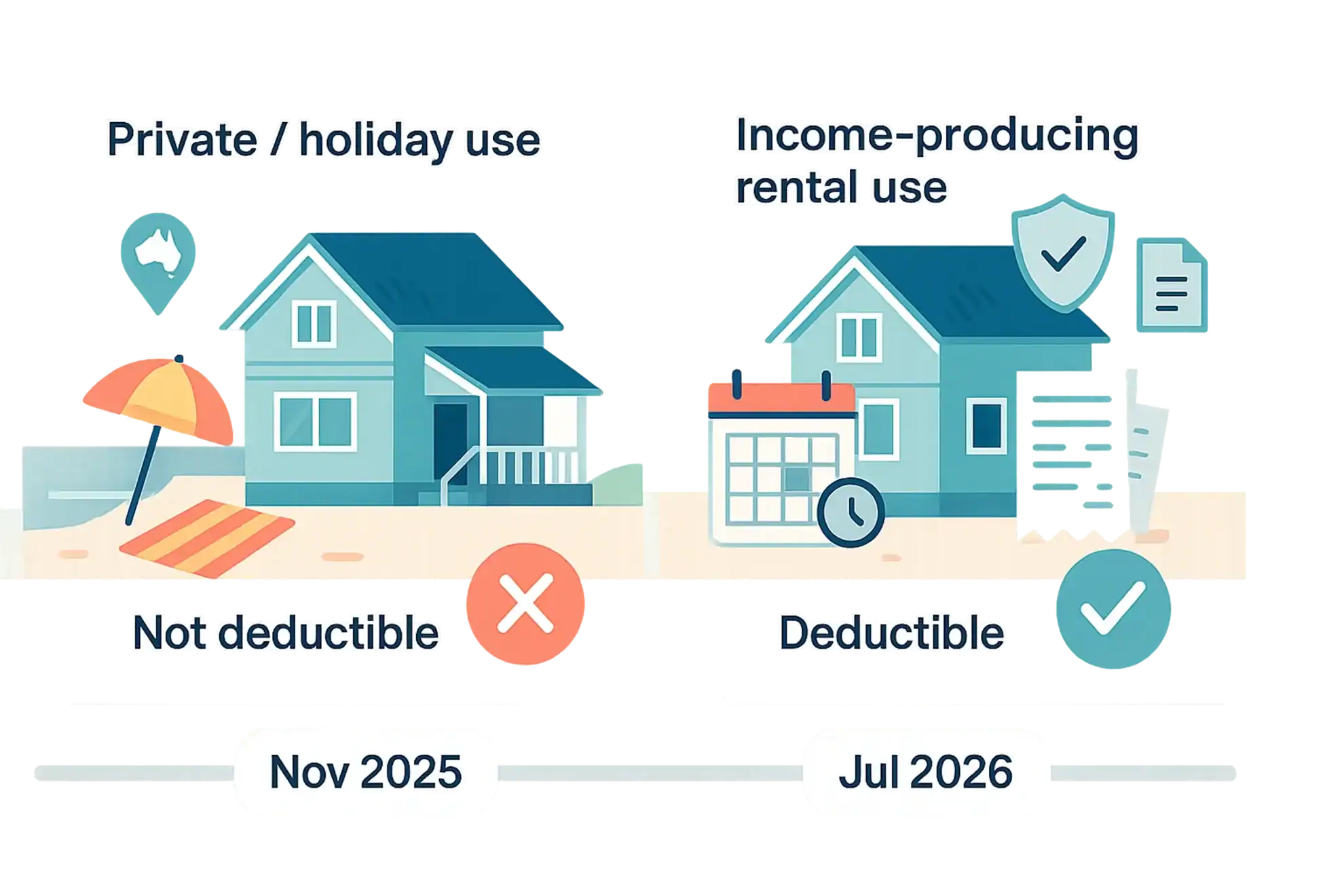

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

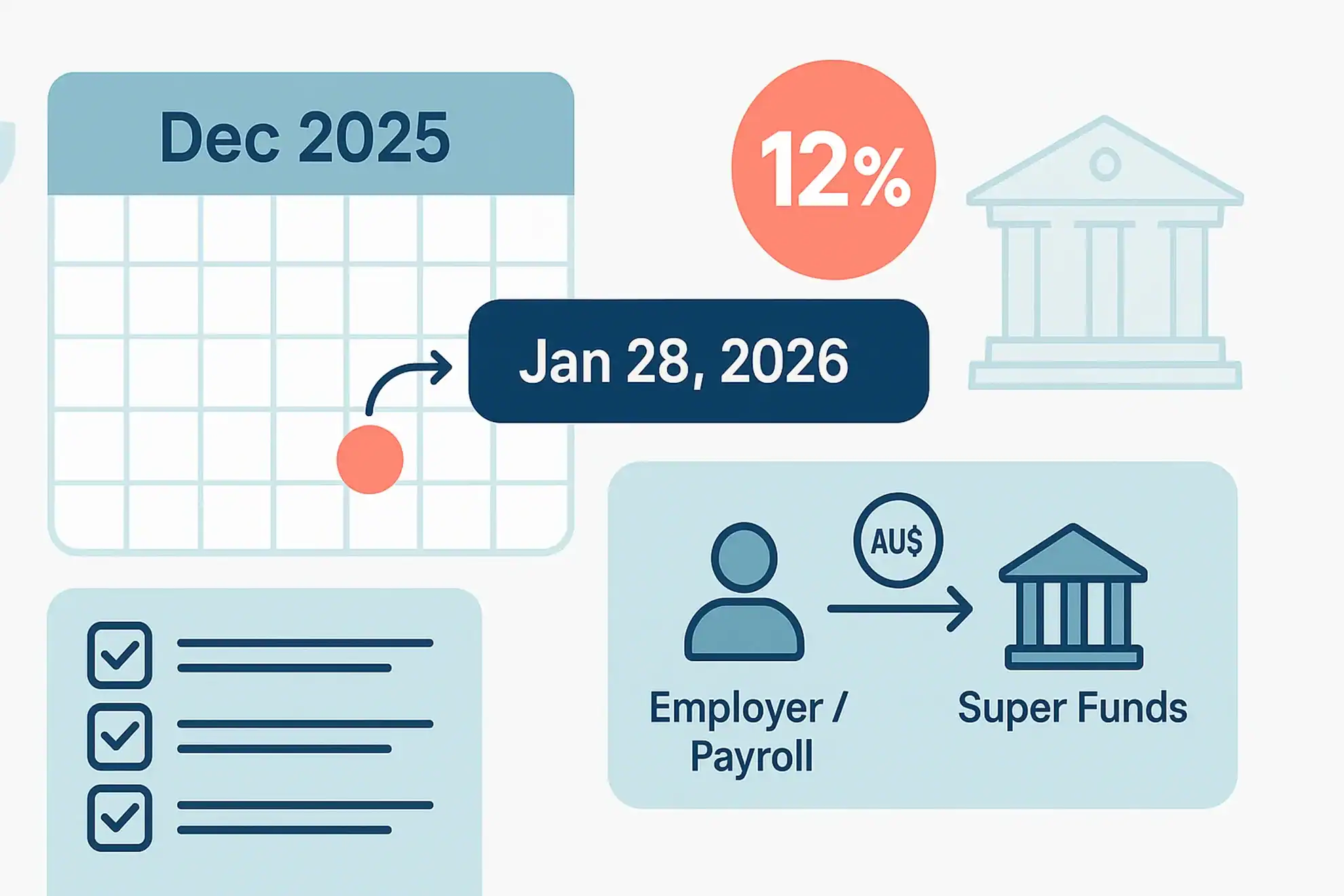

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

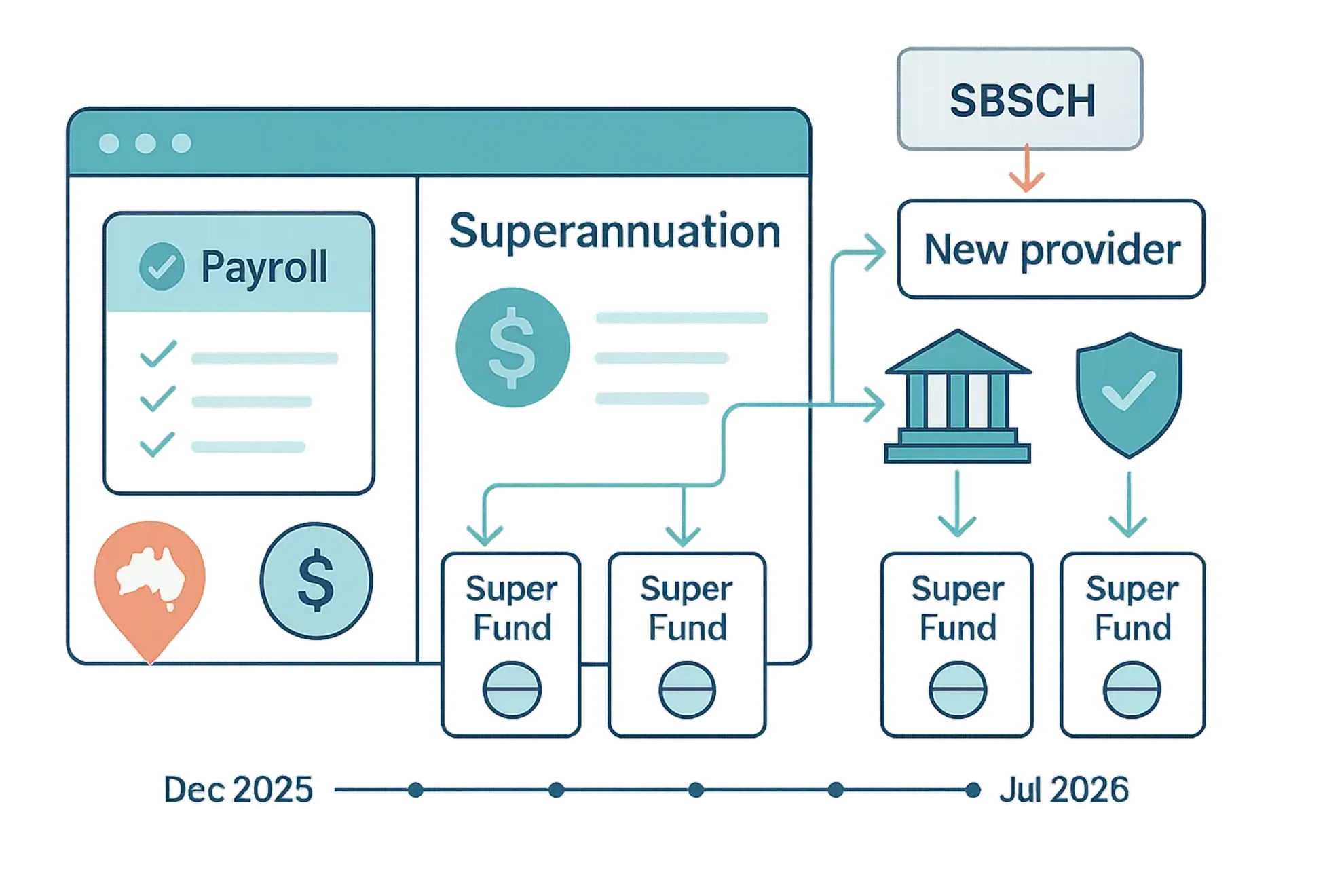

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Have You Had A Change In Creditable Purpose For GST Reporting Purposes?

Sometimes your business may end up using an asset you purchased, such as a property for example, in a way that is different to what you had originally planned. It pays to remember that if you claimed GST credits for assets that have had their intended use change from that originally planned, you need to […]

Will New Limited Recourse Borrowing Arrangments Rules Stymie Your SMSF Contribution Plans?

An “integrity” measure, which aimed to stop SMSF trustees from manipulating their total superannuation balance in order to keep below the $1.6 million threshold, may have the unintended outcome of reducing the appeal of Limited Recourse Borrowing Arrangements. Legislated changes to limited recourse borrowing arrangements (LRBAs) in regard to calculating an SMSF member’s total superannuation […]

Shares and Tax: A Stockmarket Investment Primer

Investing in the stockmarket is a lot more common than it was years ago, with ordinary Australians having experience with shares and the stockmarket either directly or through managed funds or via their superannuation fund. Recent research conducted by the Australian Securities Exchange (ASX) found that around 60% of Australians hold share investments outside of […]

Lodgement Rates and Thresholds Guide 2018 – 2019

To save you having to laboriously search for the right tax rate or relevant threshold, the essential information is right here in one place. This guide includes tax rates, offset limits and benchmarks, rebate levels, allowances and essential super as well as FBT rates and thresholds (including current gross-up factors) and student loand repayment rates. […]

Apportioning GST Annually For Business And Private Purchases

The general case regarding GST credits is that business owners can claim input tax credits relating to eligible business expenses when you lodge your business activity statement (BAS), which may be monthly or quarterly. However it is not unusual for business owners to occasionally make purchases that contain a private use component. Where expenses are […]

We have been using Taxwise for 3 years now

We have been using Taxwise for 3 years now. We love the ease of having someone come to our house to assist with our return each year. David who assists us each year has a wealth of knowledge and definitely makes tax time so much easier and stress free. We recommended Taxwise to our parents […]