Latest News

GST held to apply to sales of subdivided lots

The Administrative Review Tribunal (‘ART’) recently held that some sales of subdivided farmland were subject to GST as they were made by the taxpayer in the course of carrying on an enterprise. The taxpayer owned farmland near Adelaide. He entered into an agreement with a developer, under which the developer sought rezoning and development approvals, […]

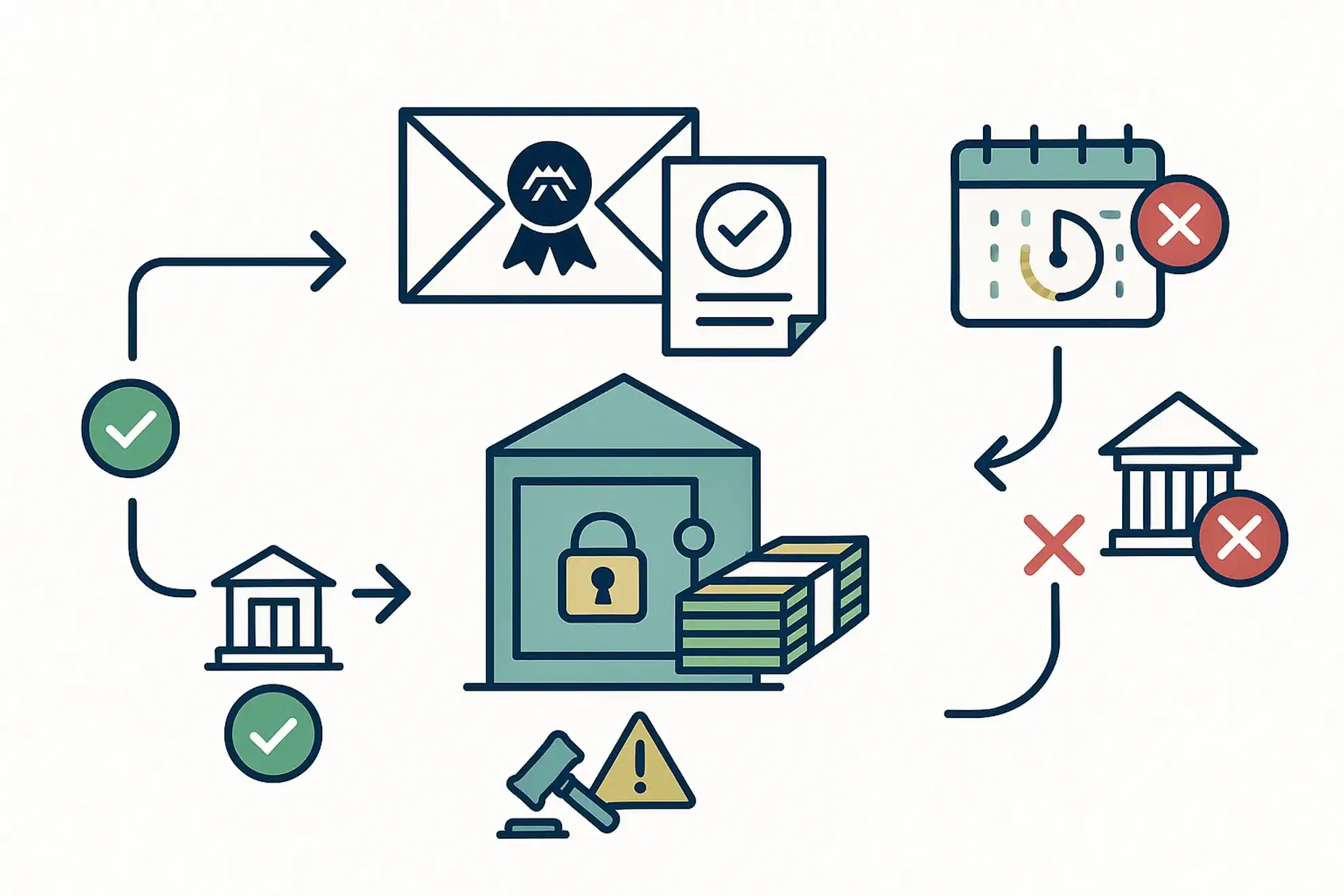

SMSF non-compliance with release authorities

Release authorities are documents issued by the ATO to super funds, authorising the release of money from a member’s super account to pay specific liabilities, including in relation to excess concessional contributions, excess non-concessional contributions, and Division 293 tax assessments. The ATO is seeing a rise in SMSFs that receive a release authority and are […]

New ATO Data-Matching Programs

The ATO acquires and uses data for pre-filling, detecting dishonest or fraudulent behaviour, and identifying areas where it can educate taxpayers to help them understand their tax obligations. When data does not match, the ATO may contact tax agents and their clients to find out why. Rental Income Data-Matching Over the coming months, the ATO […]

ATO’s focus on small business

The ATO is ‘detecting and addressing’ recurring errors in specific industries when businesses have a turnover between $1 million and $10 million. These industries include property and construction (including builders, contractors and tradies), and professional, scientific and technical services (including engineering, design, IT and consulting professionals). In these industries, the ATO continues to see recurring […]

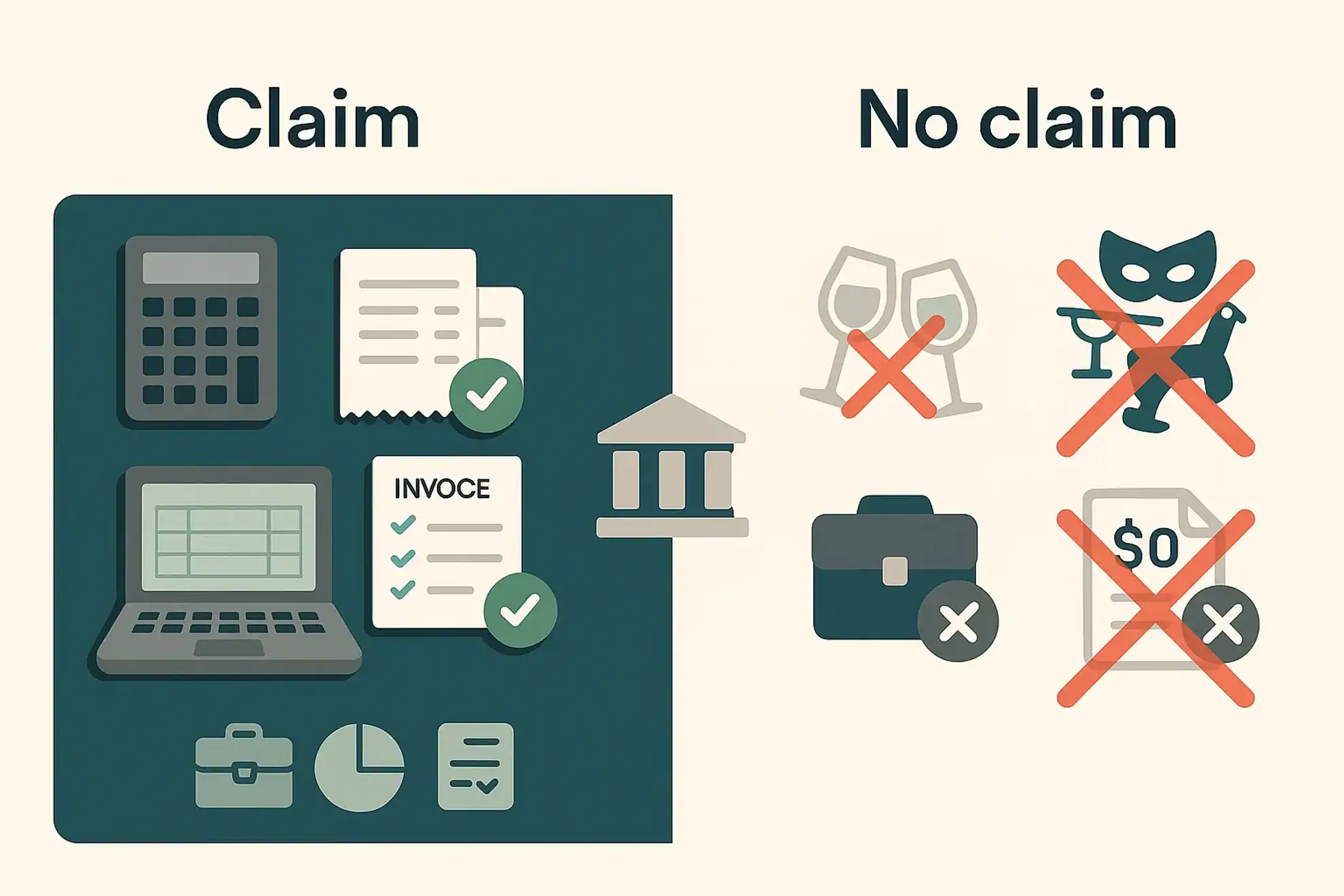

ATO reminder: Business expenses that can (and cannot) be claimed

Taxpayers can claim a tax deduction for most business expenses, provided they meet the ATO’s three ‘golden rules’: The expense must be for business use, not for private use. If the expense is for a mix of business and private use, they can only claim the portion that is used for business. They must have […]

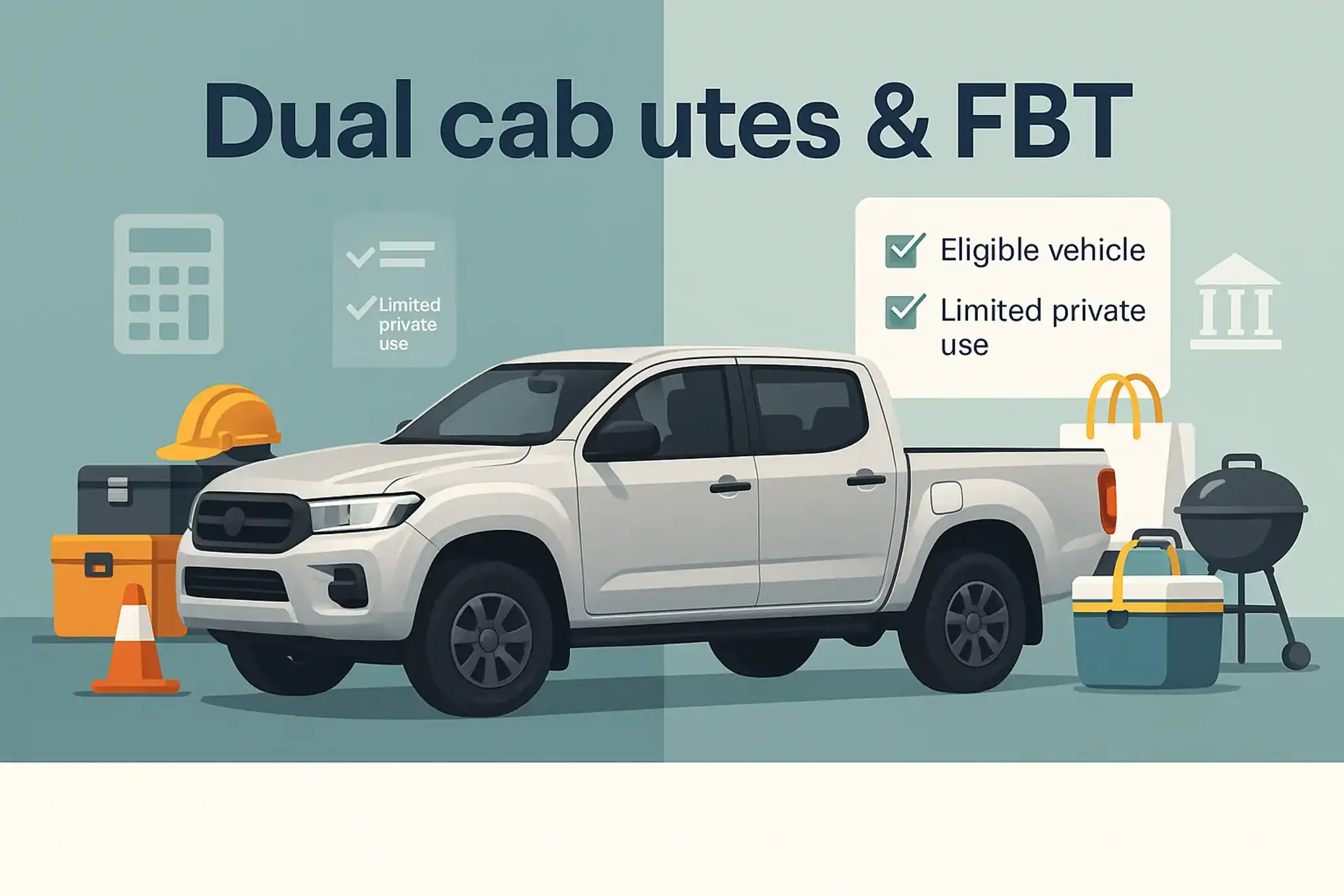

Dual cab utes and FBT

The ATO wishes to dispel the ‘common myth’ that dual cab utes are automatically exempt from fringe benefits tax (‘FBT’). If an employer provides dual cab utes to staff to complete their duties and the vehicle is available for personal use, then the benefit may be subject to FBT. By understanding how their employees use […]

Zone Tax Offset – exclude ‘fly-in-fly-out’

In the 2015–16 Federal Budget, the government announced that it will exclude ‘fly-in-fly-out’ and ‘drive-in-drive-out’ (FIFO) workers from the Zone Tax Offset where their normal residence is not within a ‘zone’. Currently, to be eligible for the Zone Tax Offset, a taxpayer must reside or work in a specified remote area for more than 183 […]

Employee Share Scheme Changes

Changes to the tax treatment of employee share schemes (ESS) took effect on 1 July 2015. These apply to Employee Share Scheme interests (shares, stapled securities and rights to acquire them) issued on or after that date. There are changes to some existing rules as well as new concessions for employees of start-up companies. The […]

Investments

Profits or returns you make on your Investments usually become part of your income for tax purposes. Many expenses relating to your Investments are tax deductible – for example, interest on money you borrow to buy shares. Australian residents for tax purposes are taxed on their worldwide income, so whether you have investments in Australia or […]

Truck Drivers: Work-Related Expenses

As tax time is fast approaching we will be outlining common work-related expenses for Truck Drivers. Short-haul or local Truck Drivers usually return home at the end of a day’s work. A long-haul Truck Drivers usually sleeps away from home in the course of driving the truck. When you can make a claim In […]

GST – Goods and Services Tax

GST (Goods and services tax ) is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia. How does the GST work Generally, businesses and other organizations registered for the Goods and Services Tax will: include GST in the price they charge for their goods and services claim credits […]

Investing in shares

Dividends (income from shares) are considered income for tax purposes. There are also other tax implications of obtaining, owning and disposing of shares, including shares in employee share schemes. You can claim deductions for costs related to the dividend income, such as management fees and interest on money you borrowed to buy the shares. Obtaining […]