Latest News

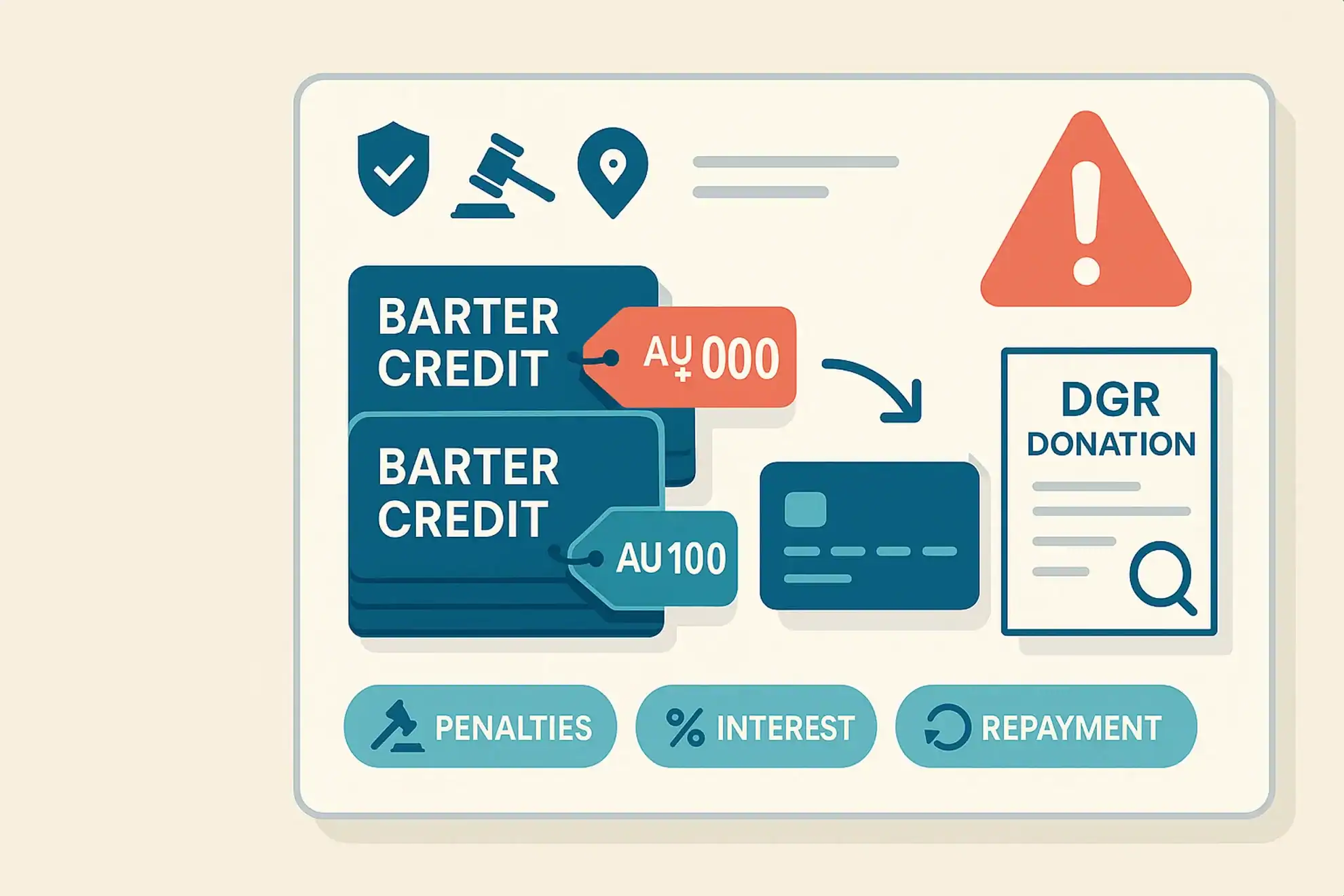

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

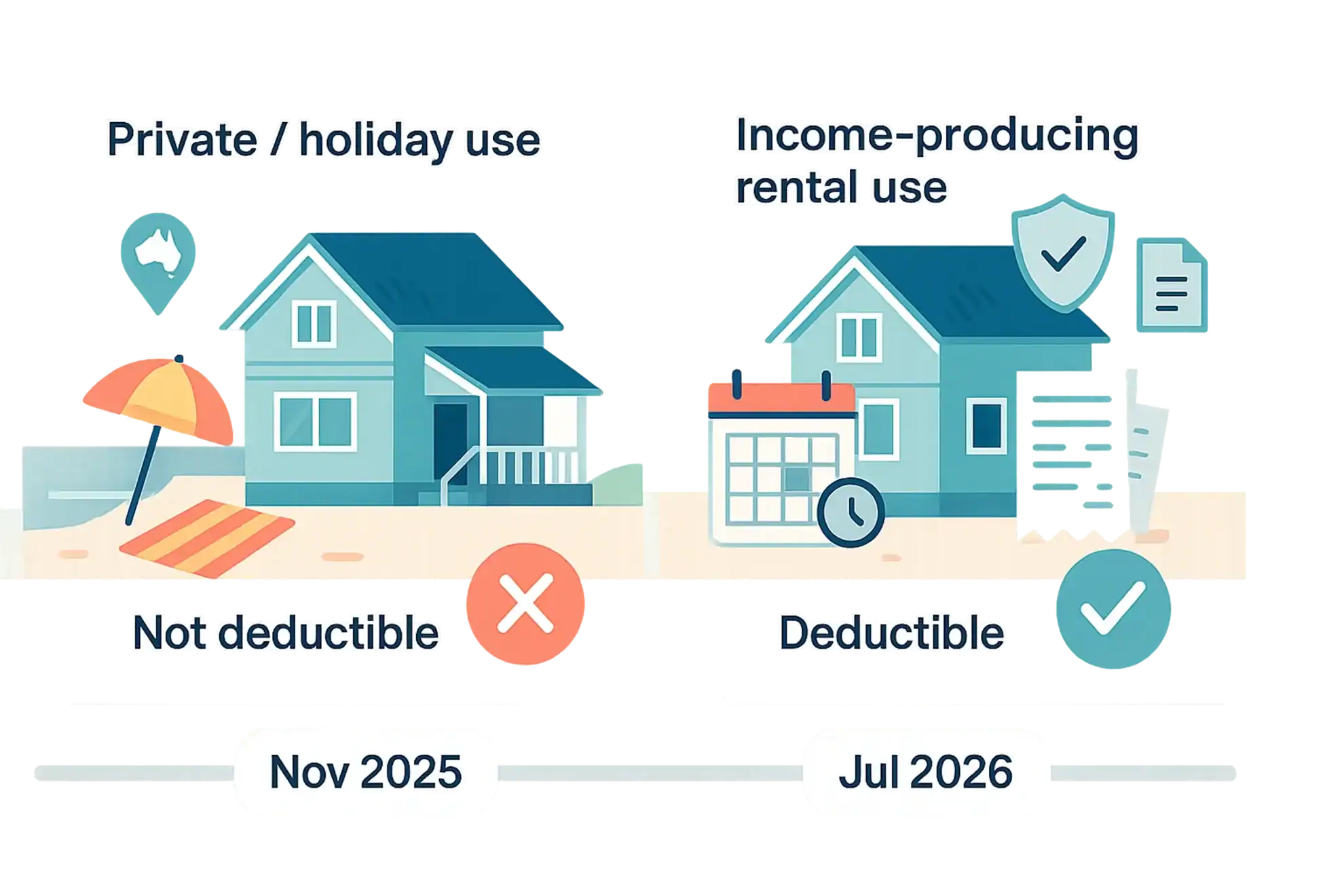

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

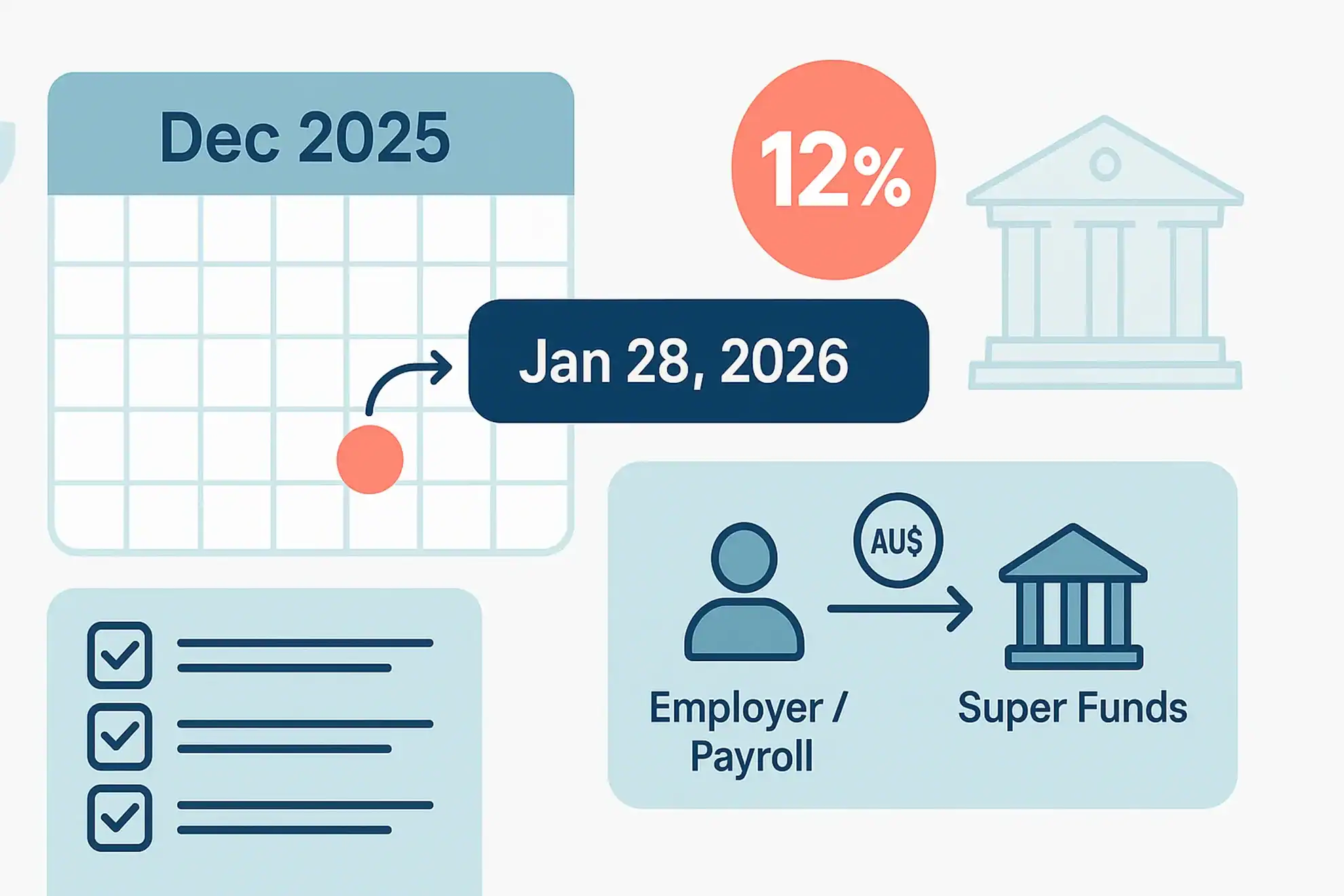

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

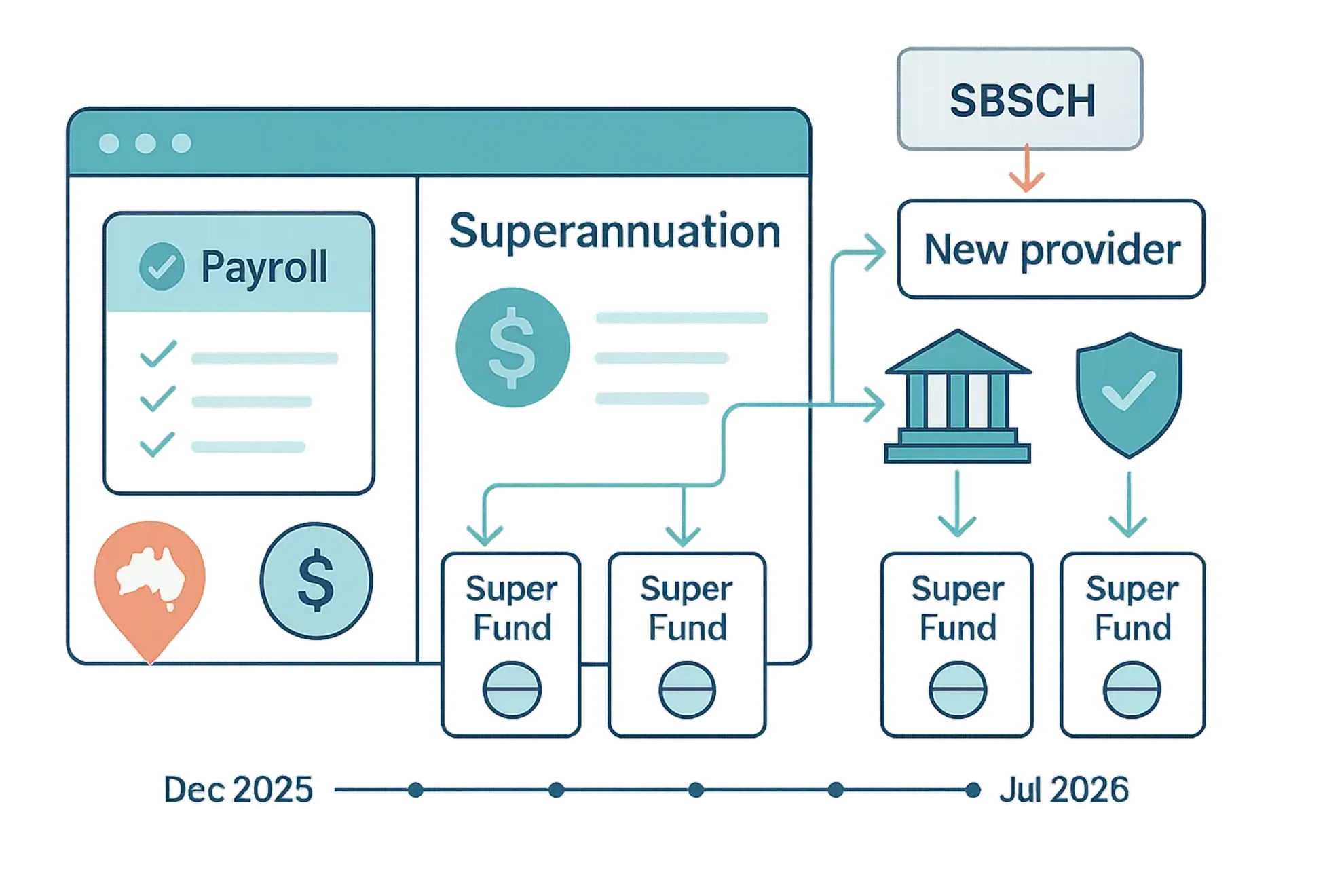

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Key Factors for Rescuing a Bad Debt Deduction

It is very often the case that unpaid debts owed to a business can have a significant impact on cash flow and the ongoing profitability of a business. In a taxation context the characterisation of a particular debt as either “doubtful” or “bad” is key as to whether or not the writing off of that […]

When Refinancing, Loan Interest Can be Deductible to a Partnership

A general law partnership is formed when two or more people (and up to, but no more than, 20 people) go into business together. Partnerships are generally set up so that all partners are equally responsible for the management of the business, but each also has liability for the debts that business may incur. As […]

Valuations and Your Self-Managed Super Fund

While there is not always the need to employ a qualified independent valuer for each valuation, there are important circumstances where it is mandated, and others where it is recommended. Where one is not used then appropriate documentation needs to be kept of how valuations were determined. Back-of-the-envelope or simply made-up valuations will not […]

Investing: Growth vs Income

Every investor goes in with dreams of a pot of gold, but there is a fundamental difference between investor types — one looks to line their pockets with investment returns along the way, and the other has the patience to wait until the end of the rainbow to reap the rewards. The distinction between investing […]

Third Party Fringe Benefits Tax Danger

Where some businesses have tripped up in the past is where the source of benefits provided is not clear cut — that is, where non-cash components of remuneration are sourced not directly from an employer, but from an associate, a related company or from a third-party provider. For fringe benefits tax (FBT) to apply, the […]

Is Your Business Prepared For Single Touch Payroll?

What is Single Touch Payroll? Single Touch Payroll is a government initiative to streamline business reporting obligations, which is due to become compulsory from 1 July 2018. When a business pays its employees, the payroll information will be sent to the ATO via the business’s payroll software. Reporting under the Single Touch Payroll (STP) system […]