Latest News

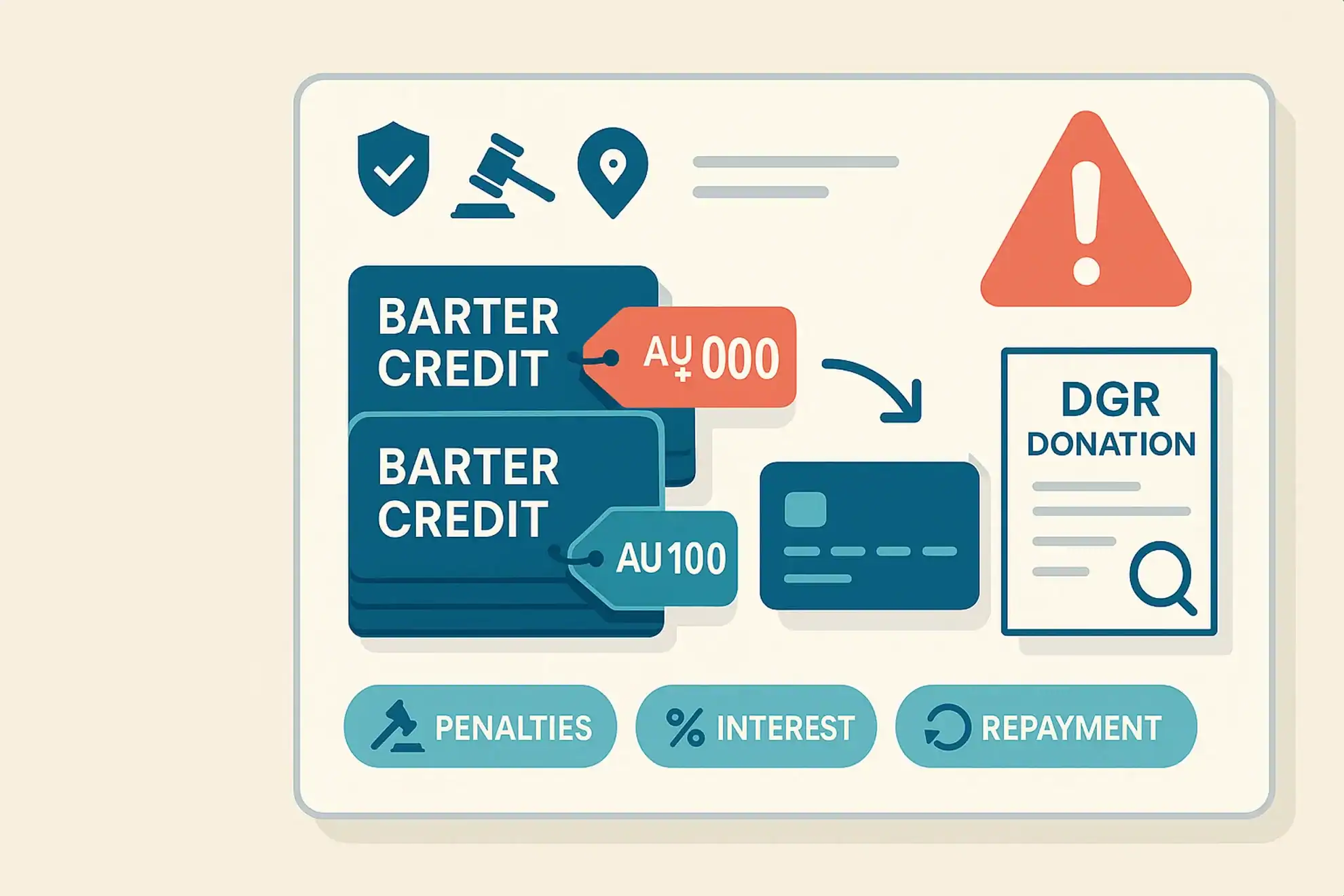

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

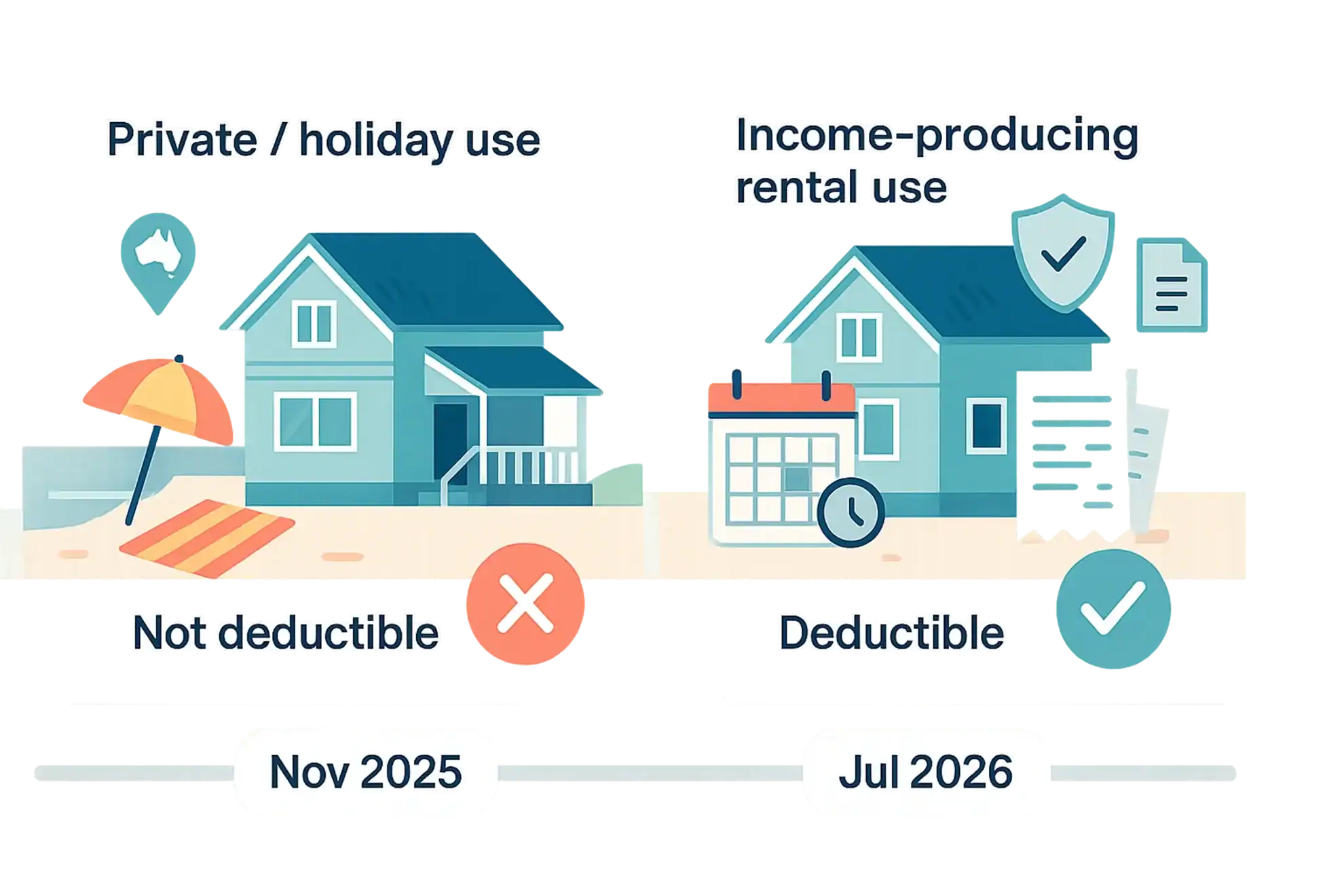

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

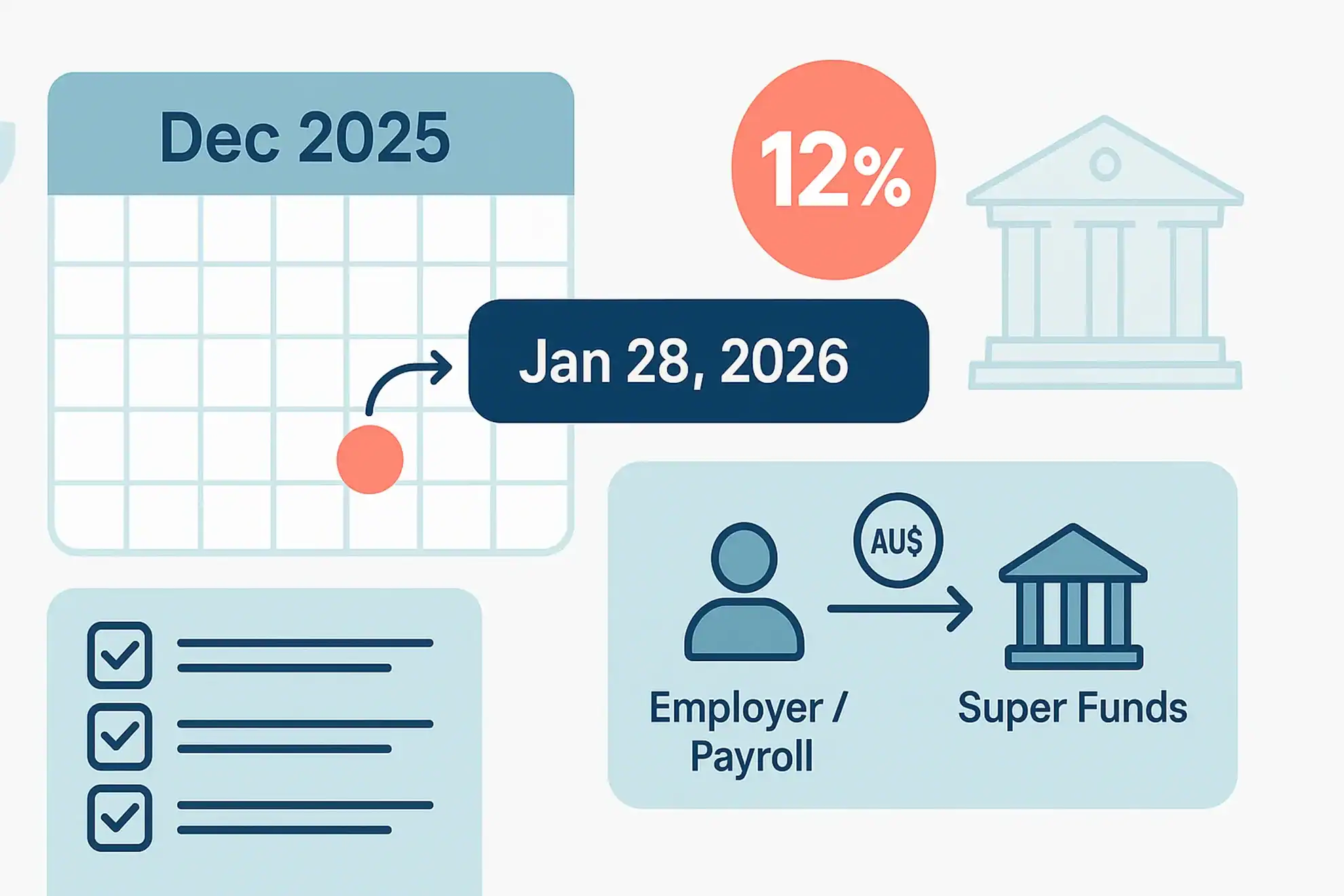

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

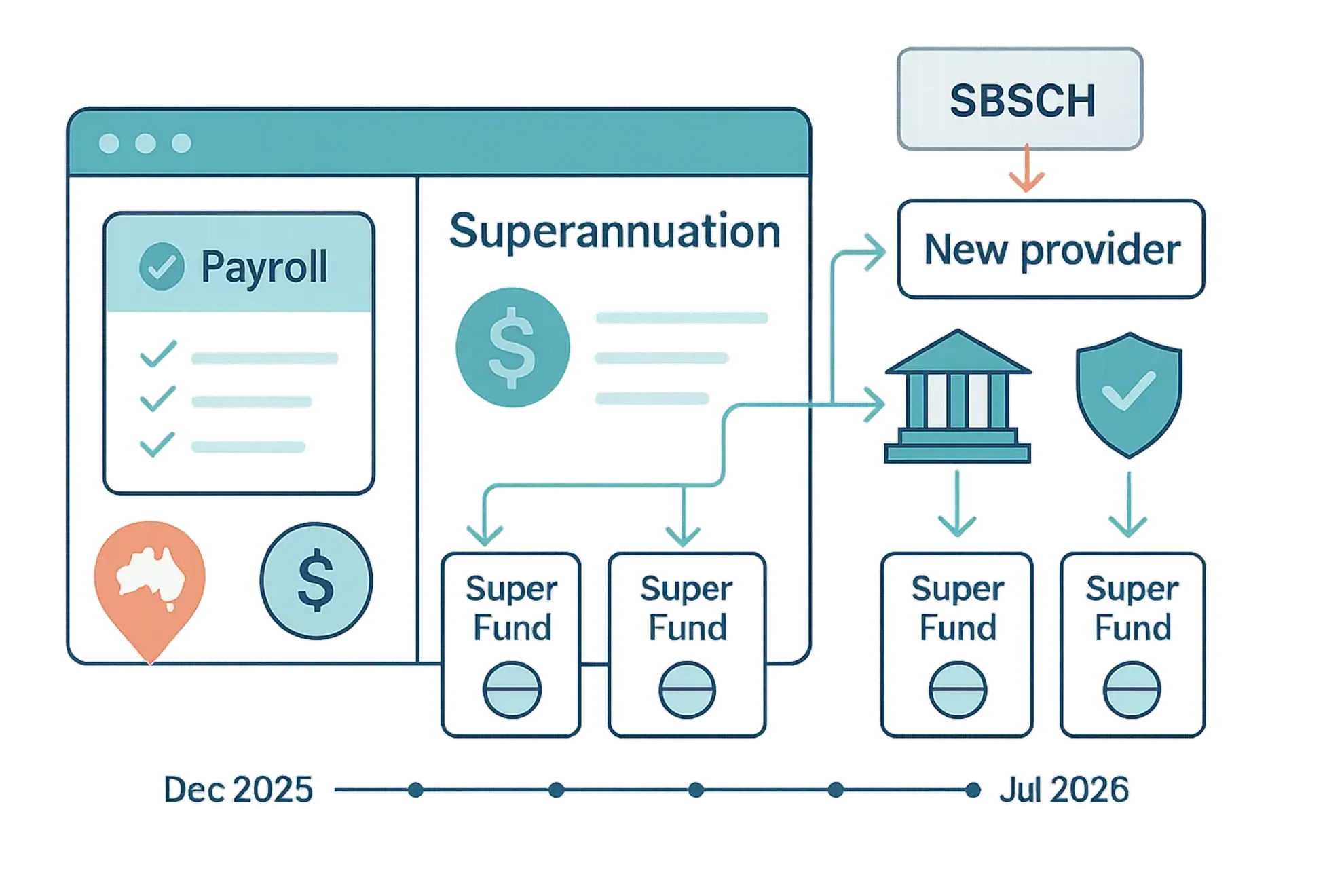

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Using The Equity In Your Home To Purchase An Investment Property

If you are already repaying your own home or another investment property, you may be able to use the equity you have built up to purchase an additional property. Let’s use an example to explain this process. Your lender is going to require that the loan amount is less than 80% of the value of […]

5 smart things to do with your tax refund.

For many people, their tax refund is treated like a mini lottery win. This tax time, consider putting your “gift” from the ATO to good use and silencing the part of you that wants to fritter it away on things that expire. 1 – Put it into your super Remember the 70-year-old you gets better […]

What is your “total superannuation balance” and why does it matter?

Recent superannuation reforms introduced a concept of “total superannuation balance”, which on the surface may give the simple impression that it is the sum of the balances of a person’s superannuation interests. However, this is not the case. What is the total balance relevant for? The total superannuation balance is relevant in determining a super […]

What the Proposed Housing-Based Super Contribution Initiatives Offer

After waiting for what seems like an eternity, the government has finally put to Parliament its draft legislation around two of its schemes. The proposed schemes, the First Home Super Saver and Contributing the proceeds of downsizing to superannuation, are both pieces of legislation that are an attempt to bring into action proposals from the […]

Life Policy Bonuses and Tax

When a life insurance policy has been held by a taxpayer for 10 years or longer, reversionary bonuses received on that policy are generally tax-free. For policies held for less than 10 years, stipulated amounts are included in the taxpayer’s assessable income, and a tax offset is available. A bonus is not assessable income if […]

Child Death Benefit Recipients and the Transfer Balance Cap

The death of a parent is hard on all those involved, however once the grieving has eased, a time comes to address financial matters. One of these issues can be what happens to any superannuation they have left. Making things harder is the fact that the new transfer balance cap (TBC) brought in as of […]