Latest News

Paying super guarantee

The ATO is reminding employers that they must pay super guarantee (‘SG’) contributions for eligible employees. Employers need to pay a minimum of 12% (the current SG rate as from 1 July 2025) of each employee’s ordinary time earnings into a complying super fund on a quarterly basis (the due date for the March 2026 […]

Taxpayer’s dog breeding activities held to be an enterprise

The Administrative Review Tribunal (‘ART’) recently held that a taxpayer had carried on an enterprise of dog breeding for GST purposes. He had lodged activity statements for the quarters ended 30 September 2018 to 31 December 2021 inclusive, claiming input tax credits (‘ITCs’) for the dog breeding activities he carried on from his home (among […]

Time limits on GST and fuel tax credit claims

Taxpayers should note that GST credits and fuel tax credits will expire if not claimed within the 4-year credit time limit (i.e., generally four years from the due date of the original BAS in which the taxpayer could have claimed them). Once credits expire, the ATO has no discretion or ability to amend the assessment […]

ATO child support data-matching program

The ATO has advised that it will acquire child support data from Services Australia for the 2025 to 2027 income years, including the following: ◆ client identification details (names, addresses, phone numbers, and dates of birth); and ◆ child support details (child support identification reference number, child support role type, and child support category). The […]

Mandating Cash Acceptance

The Government recently announced that it was delivering on its commitment “to mandate cash acceptance for essential purchases by finalising regulations that require fuel and grocery retailers to accept cash from 1 January 2026.” The changes mean that, from 1 January 2026, most food and grocery retailers must accept cash for in-person transactions of $500 […]

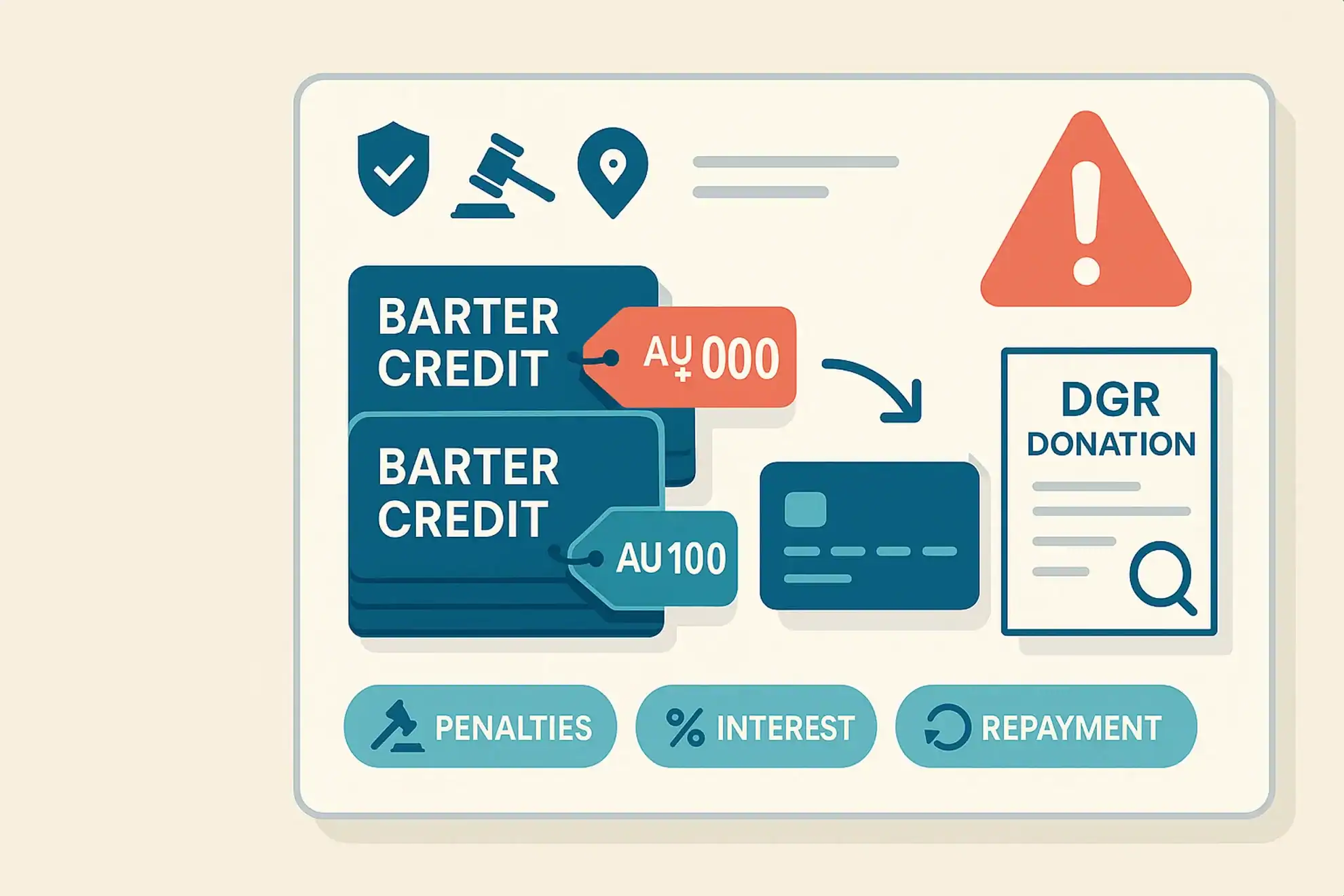

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

What’s New For Taxpayers

Before you complete your tax return for 2015, there are some changes you should be aware of in case they affect you. Mature age worker tax offset You can no longer claim the Mature age worker tax offset (MAWTO) in your tax return. Previously, to be eligible for the offset you needed to be an […]

Travel between home and work and between workplaces

While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces. If your travel was partly private and partly for work, you can only claim for the part related to your work. What you can claim You can […]

Gifts and donations

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). Deductions for gifts are claimed by the person that makes the gift (the donor). For you to claim a tax deduction for a gift, it must meet four conditions: The gift […]

Capital gains tax checklist

The following questions will help you to identify possible capital gains tax (CGT) obligations. If you answer ‘yes’ to any of these questions, CGT may apply. Some questions are intended to highlight the possibility of a capital gain or loss arising in the current year, others to alert you to the possibility of a […]

Tax on Super Contributions

The tax you pay on your super contributions generally depends on whether the contributions were made before or after you paid income tax, you exceed the super contributions cap or you are a very high-income earner. Before-tax super contributions The super contributions you make before tax (concessional) are taxed at 15%. Types of before-tax contributions […]

Zone Tax Offset – exclude ‘fly-in-fly-out’

In the 2015–16 Federal Budget, the government announced that it will exclude ‘fly-in-fly-out’ and ‘drive-in-drive-out’ (FIFO) workers from the Zone Tax Offset where their normal residence is not within a ‘zone’. Currently, to be eligible for the Zone Tax Offset, a taxpayer must reside or work in a specified remote area for more than 183 […]