Latest News

SMSF non-compliance with release authorities

Release authorities are documents issued by the ATO to super funds, authorising the release of money from a member’s super account to pay specific liabilities, including in relation to excess concessional contributions, excess non-concessional contributions, and Division 293 tax assessments. The ATO is seeing a rise in SMSFs that receive a release authority and are […]

New ATO Data-Matching Programs

The ATO acquires and uses data for pre-filling, detecting dishonest or fraudulent behaviour, and identifying areas where it can educate taxpayers to help them understand their tax obligations. When data does not match, the ATO may contact tax agents and their clients to find out why. Rental Income Data-Matching Over the coming months, the ATO […]

ATO’s focus on small business

The ATO is ‘detecting and addressing’ recurring errors in specific industries when businesses have a turnover between $1 million and $10 million. These industries include property and construction (including builders, contractors and tradies), and professional, scientific and technical services (including engineering, design, IT and consulting professionals). In these industries, the ATO continues to see recurring […]

ATO reminder: Business expenses that can (and cannot) be claimed

Taxpayers can claim a tax deduction for most business expenses, provided they meet the ATO’s three ‘golden rules’: The expense must be for business use, not for private use. If the expense is for a mix of business and private use, they can only claim the portion that is used for business. They must have […]

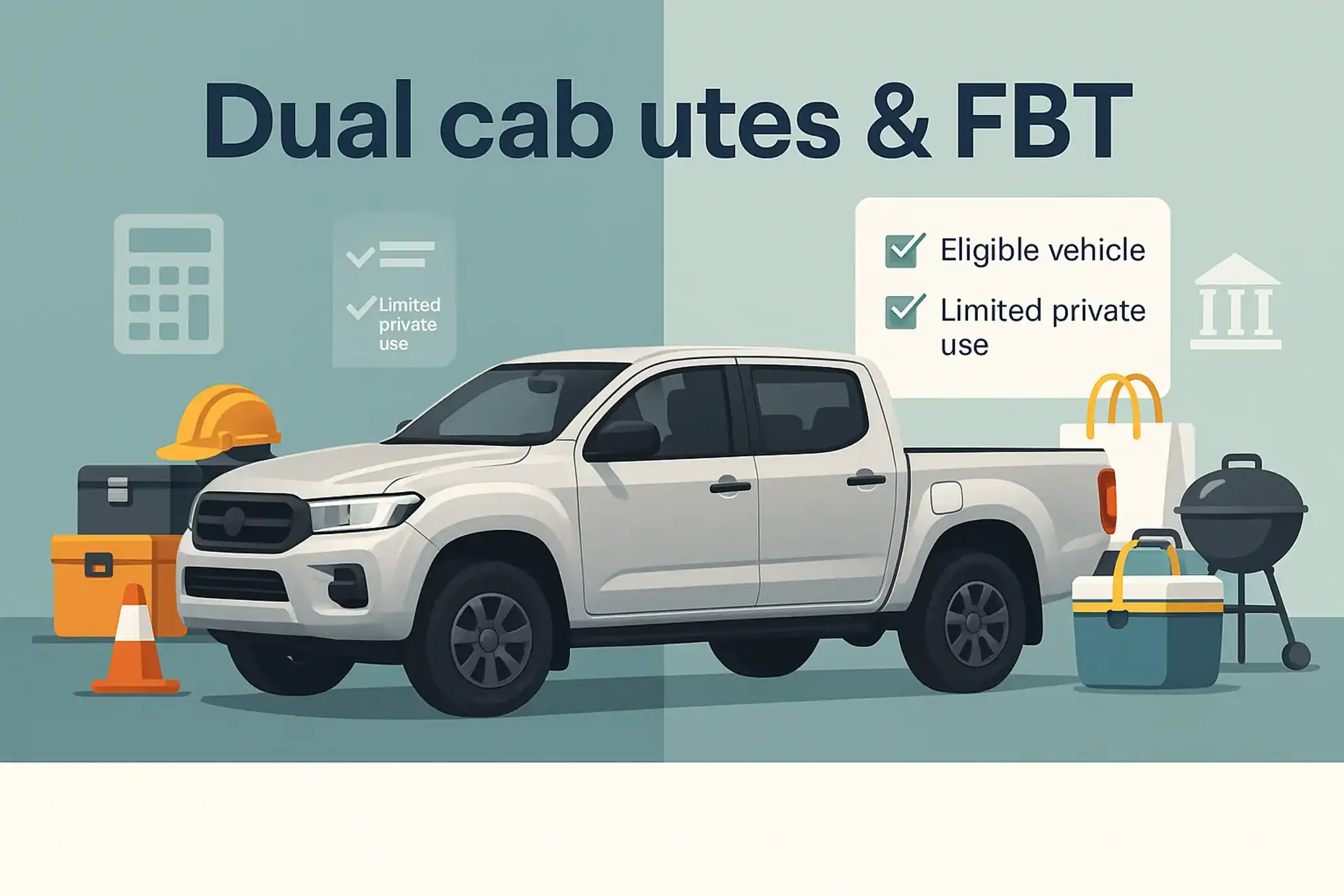

Dual cab utes and FBT

The ATO wishes to dispel the ‘common myth’ that dual cab utes are automatically exempt from fringe benefits tax (‘FBT’). If an employer provides dual cab utes to staff to complete their duties and the vehicle is available for personal use, then the benefit may be subject to FBT. By understanding how their employees use […]

ART dismisses argument that medical expenses were deductible

In a recent decision, the Administrative Review Tribunal (‘ART’) held that a taxpayer could not claim a tax deduction for medical expenses incurred by him in relation to his total and permanent disability pension. The taxpayer had been terminated from his employment due to total and permanent disablement (‘TPD’). For the 2024 income year, his […]

What’s New For Taxpayers

Before you complete your tax return for 2015, there are some changes you should be aware of in case they affect you. Mature age worker tax offset You can no longer claim the Mature age worker tax offset (MAWTO) in your tax return. Previously, to be eligible for the offset you needed to be an […]

Travel between home and work and between workplaces

While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces. If your travel was partly private and partly for work, you can only claim for the part related to your work. What you can claim You can […]

Investment Property – Claiming Repairs and Maintenance Expenses

Can you claim the cost of repairs you make before you rent out the property? You cannot claim the cost of repairing defects, damage or deterioration that existed when you obtained the property, even if you carried out these repairs to make the property suitable for renting. This is because these expenses relate to the […]

Gifts and donations

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). Deductions for gifts are claimed by the person that makes the gift (the donor). For you to claim a tax deduction for a gift, it must meet four conditions: The gift […]

Capital gains tax checklist

The following questions will help you to identify possible capital gains tax (CGT) obligations. If you answer ‘yes’ to any of these questions, CGT may apply. Some questions are intended to highlight the possibility of a capital gain or loss arising in the current year, others to alert you to the possibility of a […]

Tax on Super Contributions

The tax you pay on your super contributions generally depends on whether the contributions were made before or after you paid income tax, you exceed the super contributions cap or you are a very high-income earner. Before-tax super contributions The super contributions you make before tax (concessional) are taxed at 15%. Types of before-tax contributions […]